AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

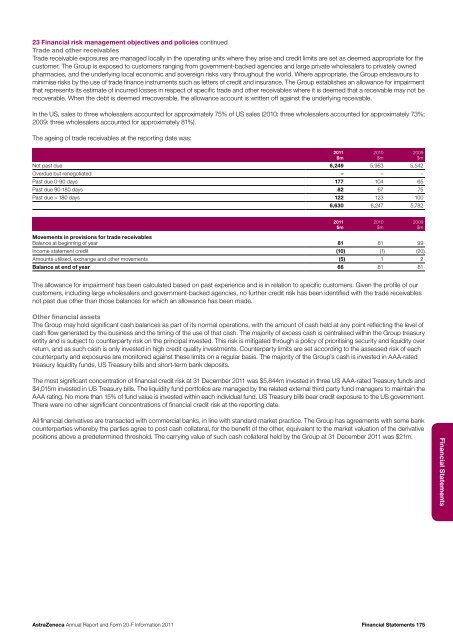

23 Financial risk management objectives <strong>and</strong> policies continuedTrade <strong>and</strong> other receivablesTrade receivable exposures are managed locally in the operating units where they arise <strong>and</strong> credit limits are set as deemed appropriate for thecustomer. The Group is exposed to customers ranging from government-backed agencies <strong>and</strong> large private wholesalers to privately ownedpharmacies, <strong>and</strong> the underlying local economic <strong>and</strong> sovereign risks vary throughout the world. Where appropriate, the Group endeavours tominimise risks by the use of trade finance instruments such as letters of credit <strong>and</strong> insurance. The Group establishes an allowance for impairmentthat represents its estimate of incurred losses in respect of specific trade <strong>and</strong> other receivables where it is deemed that a receivable may not berecoverable. When the debt is deemed irrecoverable, the allowance account is written off against the underlying receivable.In the US, sales to three wholesalers accounted for approximately 75% of US sales (<strong>20</strong>10: three wholesalers accounted for approximately 73%;<strong>20</strong>09: three wholesalers accounted for approximately 81%).The ageing of trade receivables at the reporting date was:Not past due 6,249 5,953 5,542Overdue but renegotiated – – –Past due 0-90 days 177 104 65Past due 90-180 days 82 67 75Past due > 180 days 122 123 1006,630 6,247 5,782<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$m<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mMovements in provisions for trade receivablesBalance at beginning of year 81 81 99Income statement credit (10) (1) (<strong>20</strong>)Amounts utilised, exchange <strong>and</strong> other movements (5) 1 2Balance at end of year 66 81 81The allowance for impairment has been calculated based on past experience <strong>and</strong> is in relation to specific customers. Given the profile of ourcustomers, including large wholesalers <strong>and</strong> government-backed agencies, no further credit risk has been identified with the trade receivablesnot past due other than those balances for which an allowance has been made.Other financial assetsThe Group may hold significant cash balances as part of its normal operations, with the amount of cash held at any point reflecting the level ofcash flow generated by the business <strong>and</strong> the timing of the use of that cash. The majority of excess cash is centralised within the Group treasuryentity <strong>and</strong> is subject to counterparty risk on the principal invested. This risk is mitigated through a policy of prioritising security <strong>and</strong> liquidity overreturn, <strong>and</strong> as such cash is only invested in high credit quality investments. Counterparty limits are set according to the assessed risk of eachcounterparty <strong>and</strong> exposures are monitored against these limits on a regular basis. The majority of the Group’s cash is invested in AAA-ratedtreasury liquidity funds, US Treasury bills <strong>and</strong> short-term bank deposits.The most significant concentration of financial credit risk at 31 December <strong>20</strong>11 was $5,844m invested in three US AAA-rated Treasury funds <strong>and</strong>$4,015m invested in US Treasury bills. The liquidity fund portfolios are managed by the related external third party fund managers to maintain theAAA rating. No more than 15% of fund value is invested within each individual fund. US Treasury bills bear credit exposure to the US government.There were no other significant concentrations of financial credit risk at the reporting date.All financial derivatives are transacted with commercial banks, in line with st<strong>and</strong>ard market practice. The Group has agreements with some bankcounterparties whereby the parties agree to post cash collateral, for the benefit of the other, equivalent to the market valuation of the derivativepositions above a predetermined threshold. The carrying value of such cash collateral held by the Group at 31 December <strong>20</strong>11 was $21m.Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 175