AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

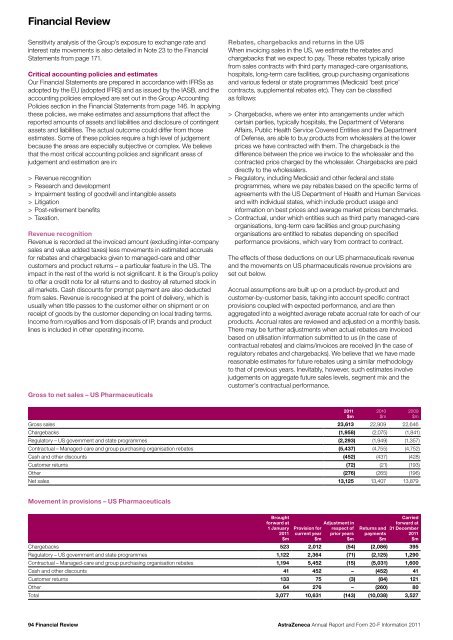

Financial ReviewSensitivity analysis of the Group’s exposure to exchange rate <strong>and</strong>interest rate movements is also detailed in Note 23 to the FinancialStatements from page 171.Critical accounting policies <strong>and</strong> estimatesOur Financial Statements are prepared in accordance with IFRSs asadopted by the EU (adopted IFRS) <strong>and</strong> as issued by the IASB, <strong>and</strong> theaccounting policies employed are set out in the Group AccountingPolicies section in the Financial Statements from page 146. In applyingthese policies, we make estimates <strong>and</strong> assumptions that affect thereported amounts of assets <strong>and</strong> liabilities <strong>and</strong> disclosure of contingentassets <strong>and</strong> liabilities. The actual outcome could differ from thoseestimates. Some of these policies require a high level of judgementbecause the areas are especially subjective or complex. We believethat the most critical accounting policies <strong>and</strong> significant areas ofjudgement <strong>and</strong> estimation are in:> Revenue recognition> Research <strong>and</strong> development> Impairment testing of goodwill <strong>and</strong> intangible assets> Litigation> Post-retirement benefits> Taxation.Revenue recognitionRevenue is recorded at the invoiced amount (excluding inter-companysales <strong>and</strong> value added taxes) less movements in estimated accrualsfor rebates <strong>and</strong> chargebacks given to managed-care <strong>and</strong> othercustomers <strong>and</strong> product returns – a particular feature in the US. Theimpact in the rest of the world is not significant. It is the Group’s policyto offer a credit note for all returns <strong>and</strong> to destroy all returned stock inall markets. Cash discounts for prompt payment are also deductedfrom sales. Revenue is recognised at the point of delivery, which isusually when title passes to the customer either on shipment or onreceipt of goods by the customer depending on local trading terms.Income from royalties <strong>and</strong> from disposals of IP, br<strong>and</strong>s <strong>and</strong> productlines is included in other operating income.Gross to net sales – US PharmaceuticalsRebates, chargebacks <strong>and</strong> returns in the USWhen invoicing sales in the US, we estimate the rebates <strong>and</strong>chargebacks that we expect to pay. These rebates typically arisefrom sales contracts with third party managed-care organisations,hospitals, long-term care facilities, group purchasing organisations<strong>and</strong> various federal or state programmes (Medicaid ‘best price’contracts, supplemental rebates etc). They can be classifiedas follows:> Chargebacks, where we enter into arrangements under whichcertain parties, typically hospitals, the Department of VeteransAffairs, Public Health Service Covered Entities <strong>and</strong> the Departmentof Defense, are able to buy products from wholesalers at the lowerprices we have contracted with them. The chargeback is thedifference between the price we invoice to the wholesaler <strong>and</strong> thecontracted price charged by the wholesaler. Chargebacks are paiddirectly to the wholesalers.> Regulatory, including Medicaid <strong>and</strong> other federal <strong>and</strong> stateprogrammes, where we pay rebates based on the specific terms ofagreements with the US Department of Health <strong>and</strong> Human Services<strong>and</strong> with individual states, which include product usage <strong>and</strong>information on best prices <strong>and</strong> average market prices benchmarks.> Contractual, under which entities such as third party managed-careorganisations, long-term care facilities <strong>and</strong> group purchasingorganisations are entitled to rebates depending on specifiedperformance provisions, which vary from contract to contract.The effects of these deductions on our US pharmaceuticals revenue<strong>and</strong> the movements on US pharmaceuticals revenue provisions areset out below.Accrual assumptions are built up on a product-by-product <strong>and</strong>customer-by-customer basis, taking into account specific contractprovisions coupled with expected performance, <strong>and</strong> are thenaggregated into a weighted average rebate accrual rate for each of ourproducts. Accrual rates are reviewed <strong>and</strong> adjusted on a monthly basis.There may be further adjustments when actual rebates are invoicedbased on utilisation information submitted to us (in the case ofcontractual rebates) <strong>and</strong> claims/invoices are received (in the case ofregulatory rebates <strong>and</strong> chargebacks). We believe that we have madereasonable estimates for future rebates using a similar methodologyto that of previous years. Inevitably, however, such estimates involvejudgements on aggregate future sales levels, segment mix <strong>and</strong> thecustomer’s contractual performance.Gross sales 23,613 22,909 22,646Chargebacks (1,958) (2,075) (1,841)Regulatory – US government <strong>and</strong> state programmes (2,293) (1,949) (1,357)Contractual – Managed-care <strong>and</strong> group purchasing organisation rebates (5,437) (4,755) (4,752)Cash <strong>and</strong> other discounts (452) (437) (428)Customer returns (72) (21) (193)Other (276) (265) (196)Net sales 13,125 13,407 13,879<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mMovement in provisions – US PharmaceuticalsBroughtforward at1 January<strong>20</strong>11$mProvision forcurrent year$mAdjustment inrespect ofprior years$mReturns <strong>and</strong>payments$mCarriedforward at31 December<strong>20</strong>11$mChargebacks 523 2,012 (54) (2,086) 395Regulatory – US government <strong>and</strong> state programmes 1,122 2,364 (71) (2,125) 1,290Contractual – Managed-care <strong>and</strong> group purchasing organisation rebates 1,194 5,452 (15) (5,031) 1,600Cash <strong>and</strong> other discounts 41 452 – (452) 41Customer returns 133 75 (3) (84) 121Other 64 276 – (260) 80Total 3,077 10,631 (143) (10,038) 3,52794 Financial Review<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11