AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

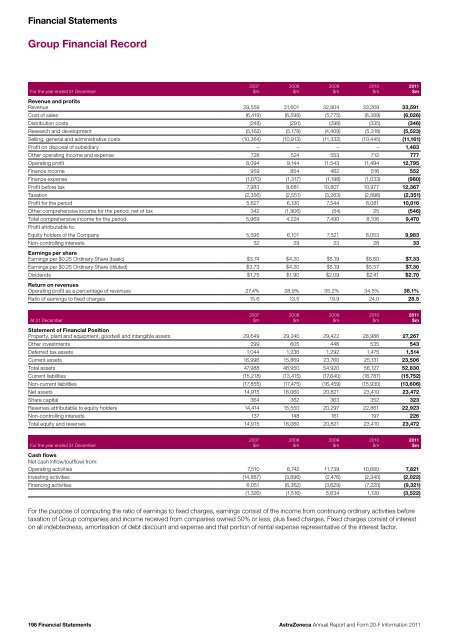

Financial StatementsGroup Financial RecordFor the year ended 31 December<strong>20</strong>07$m<strong>20</strong>08$m<strong>20</strong>09$m<strong>20</strong>10$m<strong>20</strong>11$mRevenue <strong>and</strong> profitsRevenue 29,559 31,601 32,804 33,269 33,591Cost of sales (6,419) (6,598) (5,775) (6,389) (6,026)Distribution costs (248) (291) (298) (335) (346)Research <strong>and</strong> development (5,162) (5,179) (4,409) (5,318) (5,523)Selling, general <strong>and</strong> administrative costs (10,364) (10,913) (11,332) (10,445) (11,161)Profit on disposal of subsidiary – – – – 1,483Other operating income <strong>and</strong> expense 728 524 553 712 777Operating profit 8,094 9,144 11,543 11,494 12,795Finance income 959 854 462 516 552Finance expense (1,070) (1,317) (1,198) (1,033) (980)Profit before tax 7,983 8,681 10,807 10,977 12,367Taxation (2,356) (2,551) (3,263) (2,896) (2,351)Profit for the period 5,627 6,130 7,544 8,081 10,016Other comprehensive income for the period, net of tax 342 (1,906) (54) 25 (546)Total comprehensive income for the period 5,969 4,224 7,490 8,106 9,470Profit attributable to:Equity holders of the Company 5,595 6,101 7,521 8,053 9,983Non-controlling interests 32 29 23 28 33Earnings per shareEarnings per $0.25 Ordinary Share (basic) $3.74 $4.<strong>20</strong> $5.19 $5.60 $7.33Earnings per $0.25 Ordinary Share (diluted) $3.73 $4.<strong>20</strong> $5.19 $5.57 $7.30Dividends $1.75 $1.90 $2.09 $2.41 $2.70Return on revenuesOperating profit as a percentage of revenues 27.4% 28.9% 35.2% 34.5% 38.1%Ratio of earnings to fixed charges 15.6 13.5 19.9 24.0 28.5At 31 December<strong>20</strong>07$m<strong>20</strong>08$m<strong>20</strong>09$m<strong>20</strong>10$m<strong>20</strong>11$mStatement of Financial PositionProperty, plant <strong>and</strong> equipment, goodwill <strong>and</strong> intangible assets 29,649 29,240 29,422 28,986 27,267Other investments 299 605 446 535 543Deferred tax assets 1,044 1,236 1,292 1,475 1,514Current assets 16,996 15,869 23,760 25,131 23,506Total assets 47,988 46,950 54,9<strong>20</strong> 56,127 52,830Current liabilities (15,218) (13,415) (17,640) (16,787) (15,752)Non-current liabilities (17,855) (17,475) (16,459) (15,930) (13,606)Net assets 14,915 16,060 <strong>20</strong>,821 23,410 23,472Share capital 364 362 363 352 323Reserves attributable to equity holders 14,414 15,550 <strong>20</strong>,297 22,861 22,923Non-controlling interests 137 148 161 197 226Total equity <strong>and</strong> reserves 14,915 16,060 <strong>20</strong>,821 23,410 23,472For the year ended 31 December<strong>20</strong>07$m<strong>20</strong>08$m<strong>20</strong>09$m<strong>20</strong>10$m<strong>20</strong>11$mCash flowsNet cash inflow/(outflow) from:Operating activities 7,510 8,742 11,739 10,680 7,821Investing activities (14,887) (3,896) (2,476) (2,340) (2,022)Financing activities 6,051 (6,362) (3,629) (7,2<strong>20</strong>) (9,321)(1,326) (1,516) 5,634 1,1<strong>20</strong> (3,522)For the purpose of computing the ratio of earnings to fixed charges, earnings consist of the income from continuing ordinary activities beforetaxation of Group companies <strong>and</strong> income received from companies owned 50% or less, plus fixed charges. Fixed charges consist of intereston all indebtedness, amortisation of debt discount <strong>and</strong> expense <strong>and</strong> that portion of rental expense representative of the interest factor.198 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11