AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

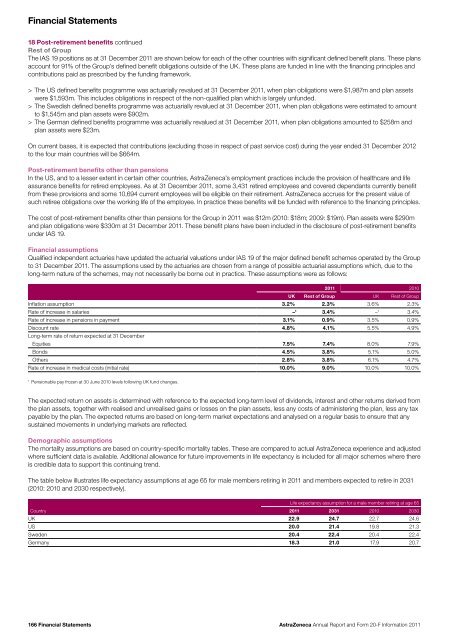

Financial Statements18 Post-retirement benefits continuedRest of GroupThe IAS 19 positions as at 31 December <strong>20</strong>11 are shown below for each of the other countries with significant defined benefit plans. These plansaccount for 91% of the Group’s defined benefit obligations outside of the UK. These plans are funded in line with the financing principles <strong>and</strong>contributions paid as prescribed by the funding framework.> > The US defined benefits programme was actuarially revalued at 31 December <strong>20</strong>11, when plan obligations were $1,987m <strong>and</strong> plan assetswere $1,593m. This includes obligations in respect of the non-qualified plan which is largely unfunded.> > The Swedish defined benefits programme was actuarially revalued at 31 December <strong>20</strong>11, when plan obligations were estimated to amountto $1,545m <strong>and</strong> plan assets were $902m.> > The German defined benefits programme was actuarially revalued at 31 December <strong>20</strong>11, when plan obligations amounted to $258m <strong>and</strong>plan assets were $23m.On current bases, it is expected that contributions (excluding those in respect of past service cost) during the year ended 31 December <strong>20</strong>12to the four main countries will be $664m.Post-retirement benefits other than pensionsIn the US, <strong>and</strong> to a lesser extent in certain other countries, <strong>AstraZeneca</strong>’s employment practices include the provision of healthcare <strong>and</strong> lifeassurance benefits for retired employees. As at 31 December <strong>20</strong>11, some 3,431 retired employees <strong>and</strong> covered dependants currently benefitfrom these provisions <strong>and</strong> some 10,694 current employees will be eligible on their retirement. <strong>AstraZeneca</strong> accrues for the present value ofsuch retiree obligations over the working life of the employee. In practice these benefits will be funded with reference to the financing principles.The cost of post-retirement benefits other than pensions for the Group in <strong>20</strong>11 was $12m (<strong>20</strong>10: $18m; <strong>20</strong>09: $19m). Plan assets were $290m<strong>and</strong> plan obligations were $330m at 31 December <strong>20</strong>11. These benefit plans have been included in the disclosure of post-retirement benefitsunder IAS 19.Financial assumptionsQualified independent actuaries have updated the actuarial valuations under IAS 19 of the major defined benefit schemes operated by the Groupto 31 December <strong>20</strong>11. The assumptions used by the actuaries are chosen from a range of possible actuarial assumptions which, due to thelong-term nature of the schemes, may not necessarily be borne out in practice. These assumptions were as follows:<strong>20</strong>11 <strong>20</strong>10UK Rest of Group UK Rest of GroupInflation assumption 3.2% 2.3% 3.6% 2.3%Rate of increase in salaries – 1 3.4% – 1 3.4%Rate of increase in pensions in payment 3.1% 0.9% 3.5% 0.9%Discount rate 4.8% 4.1% 5.5% 4.9%Long-term rate of return expected at 31 DecemberEquities 7.5% 7.4% 8.0% 7.9%Bonds 4.5% 3.8% 5.1% 5.0%Others 2.8% 3.8% 6.1% 4.7%Rate of increase in medical costs (initial rate) 10.0% 9.0% 10.0% 10.0%1Pensionable pay frozen at 30 June <strong>20</strong>10 levels following UK fund changes.The expected return on assets is determined with reference to the expected long-term level of dividends, interest <strong>and</strong> other returns derived fromthe plan assets, together with realised <strong>and</strong> unrealised gains or losses on the plan assets, less any costs of administering the plan, less any taxpayable by the plan. The expected returns are based on long-term market expectations <strong>and</strong> analysed on a regular basis to ensure that anysustained movements in underlying markets are reflected.Demographic assumptionsThe mortality assumptions are based on country-specific mortality tables. These are compared to actual <strong>AstraZeneca</strong> experience <strong>and</strong> adjustedwhere sufficient data is available. Additional allowance for future improvements in life expectancy is included for all major schemes where thereis credible data to support this continuing trend.The table below illustrates life expectancy assumptions at age 65 for male members retiring in <strong>20</strong>11 <strong>and</strong> members expected to retire in <strong>20</strong>31(<strong>20</strong>10: <strong>20</strong>10 <strong>and</strong> <strong>20</strong>30 respectively).Life expectancy assumption for a male member retiring at age 65Country <strong>20</strong>11 <strong>20</strong>31 <strong>20</strong>10 <strong>20</strong>30UK 22.9 24.7 22.7 24.6US <strong>20</strong>.0 21.4 19.8 21.3Sweden <strong>20</strong>.4 22.4 <strong>20</strong>.4 22.4Germany 18.3 21.0 17.9 <strong>20</strong>.7166 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11