AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

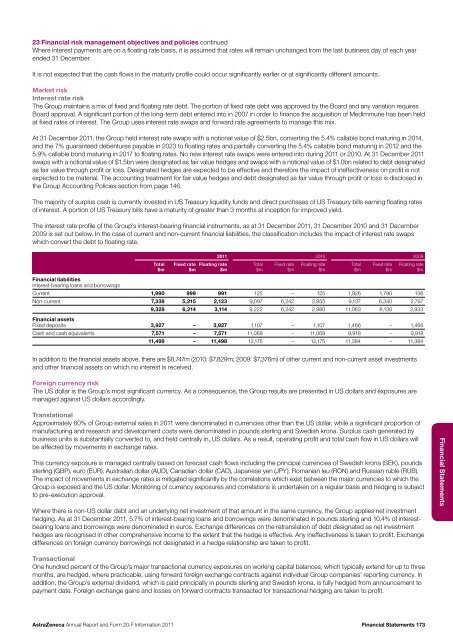

23 Financial risk management objectives <strong>and</strong> policies continuedWhere interest payments are on a floating rate basis, it is assumed that rates will remain unchanged from the last business day of each yearended 31 December.It is not expected that the cash flows in the maturity profile could occur significantly earlier or at significantly different amounts.Market riskInterest rate riskThe Group maintains a mix of fixed <strong>and</strong> floating rate debt. The portion of fixed rate debt was approved by the Board <strong>and</strong> any variation requiresBoard approval. A significant portion of the long-term debt entered into in <strong>20</strong>07 in order to finance the acquisition of MedImmune has been heldat fixed rates of interest. The Group uses interest rate swaps <strong>and</strong> forward rate agreements to manage this mix.At 31 December <strong>20</strong>11, the Group held interest rate swaps with a notional value of $2.5bn, converting the 5.4% callable bond maturing in <strong>20</strong>14,<strong>and</strong> the 7% guaranteed debentures payable in <strong>20</strong>23 to floating rates <strong>and</strong> partially converting the 5.4% callable bond maturing in <strong>20</strong>12 <strong>and</strong> the5.9% callable bond maturing in <strong>20</strong>17 to floating rates. No new interest rate swaps were entered into during <strong>20</strong>11 or <strong>20</strong>10. At 31 December <strong>20</strong>11swaps with a notional value of $1.5bn were designated as fair value hedges <strong>and</strong> swaps with a notional value of $1.0bn related to debt designatedas fair value through profit or loss. Designated hedges are expected to be effective <strong>and</strong> therefore the impact of ineffectiveness on profit is notexpected to be material. The accounting treatment for fair value hedges <strong>and</strong> debt designated as fair value through profit or loss is disclosed inthe Group Accounting Policies section from page 146.The majority of surplus cash is currently invested in US Treasury liquidity funds <strong>and</strong> direct purchases of US Treasury bills earning floating ratesof interest. A portion of US Treasury bills have a maturity of greater than 3 months at inception for improved yield.The interest rate profile of the Group’s interest-bearing financial instruments, as at 31 December <strong>20</strong>11, 31 December <strong>20</strong>10 <strong>and</strong> 31 December<strong>20</strong>09 is set out below. In the case of current <strong>and</strong> non-current financial liabilities, the classification includes the impact of interest rate swapswhich convert the debt to floating rate.Total$mFixed rate Floating rate$m$m<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Total$mFixed rate$mFloating rate$mTotal$mFixed rate$mFloating rate$mFinancial liabilitiesInterest-bearing loans <strong>and</strong> borrowingsCurrent 1,990 999 991 125 – 125 1,926 1,790 136Non-current 7,338 5,215 2,123 9,097 6,242 2,855 9,137 6,340 2,7979,328 6,214 3,114 9,222 6,242 2,980 11,063 8,130 2,933Financial assetsFixed deposits 3,927 – 3,927 1,107 – 1,107 1,466 – 1,466Cash <strong>and</strong> cash equivalents 7,571 – 7,571 11,068 – 11,068 9,918 – 9,91811,498 – 11,498 12,175 – 12,175 11,384 – 11,384In addition to the financial assets above, there are $8,747m (<strong>20</strong>10: $7,829m; <strong>20</strong>09: $7,376m) of other current <strong>and</strong> non-current asset investments<strong>and</strong> other financial assets on which no interest is received.Foreign currency riskThe US dollar is the Group’s most significant currency. As a consequence, the Group results are presented in US dollars <strong>and</strong> exposures aremanaged against US dollars accordingly.TranslationalApproximately 60% of Group external sales in <strong>20</strong>11 were denominated in currencies other than the US dollar, while a significant proportion ofmanufacturing <strong>and</strong> research <strong>and</strong> development costs were denominated in pounds sterling <strong>and</strong> Swedish krona. Surplus cash generated bybusiness units is substantially converted to, <strong>and</strong> held centrally in, US dollars. As a result, operating profit <strong>and</strong> total cash flow in US dollars willbe affected by movements in exchange rates.This currency exposure is managed centrally based on forecast cash flows including the principal currencies of Swedish krona (SEK), poundssterling (GBP), euro (EUR), Australian dollar (AUD), Canadian dollar (CAD), Japanese yen (JPY), Romanian leu (RON) <strong>and</strong> Russian ruble (RUB).The impact of movements in exchange rates is mitigated significantly by the correlations which exist between the major currencies to which theGroup is exposed <strong>and</strong> the US dollar. Monitoring of currency exposures <strong>and</strong> correlations is undertaken on a regular basis <strong>and</strong> hedging is subjectto pre-execution approval.Where there is non-US dollar debt <strong>and</strong> an underlying net investment of that amount in the same currency, the Group applies net investmenthedging. As at 31 December <strong>20</strong>11, 5.7% of interest-bearing loans <strong>and</strong> borrowings were denominated in pounds sterling <strong>and</strong> 10.4% of interestbearingloans <strong>and</strong> borrowings were denominated in euros. Exchange differences on the retranslation of debt designated as net investmenthedges are recognised in other comprehensive income to the extent that the hedge is effective. Any ineffectiveness is taken to profit. Exchangedifferences on foreign currency borrowings not designated in a hedge relationship are taken to profit.Financial StatementsTransactionalOne hundred percent of the Group’s major transactional currency exposures on working capital balances, which typically extend for up to threemonths, are hedged, where practicable, using forward foreign exchange contracts against individual Group companies’ reporting currency. Inaddition, the Group’s external dividend, which is paid principally in pounds sterling <strong>and</strong> Swedish krona, is fully hedged from announcement topayment date. Foreign exchange gains <strong>and</strong> losses on forward contracts transacted for transactional hedging are taken to profit.<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 173