AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

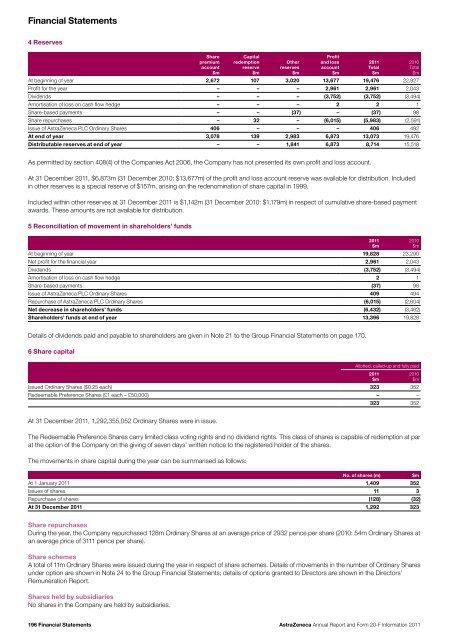

Financial Statements4 ReservesSharepremiumaccount$mCapitalredemptionreserve$mOtherreserves$mProfit<strong>and</strong> lossaccount$mAt beginning of year 2,672 107 3,0<strong>20</strong> 13,677 19,476 22,927Profit for the year – – – 2,961 2,961 2,043Dividends – – – (3,752) (3,752) (3,494)Amortisation of loss on cash flow hedge – – – 2 2 1Share-based payments – – (37) – (37) 98Share repurchases – 32 – (6,015) (5,983) (2,591)Issue of <strong>AstraZeneca</strong> PLC Ordinary Shares 406 – – – 406 492At end of year 3,078 139 2,983 6,873 13,073 19,476Distributable reserves at end of year – – 1,841 6,873 8,714 15,518<strong>20</strong>11Total$m<strong>20</strong>10Total$mAs permitted by section 408(4) of the Companies Act <strong>20</strong>06, the Company has not presented its own profit <strong>and</strong> loss account.At 31 December <strong>20</strong>11, $6,873m (31 December <strong>20</strong>10: $13,677m) of the profit <strong>and</strong> loss account reserve was available for distribution. Includedin other reserves is a special reserve of $157m, arising on the redenomination of share capital in 1999.Included within other reserves at 31 December <strong>20</strong>11 is $1,142m (31 December <strong>20</strong>10: $1,179m) in respect of cumulative share-based paymentawards. These amounts are not available for distribution.5 Reconciliation of movement in shareholders’ fundsAt beginning of year 19,828 23,290Net profit for the financial year 2,961 2,043Dividends (3,752) (3,494)Amortisation of loss on cash flow hedge 2 1Share-based payments (37) 98Issue of <strong>AstraZeneca</strong> PLC Ordinary Shares 409 494Repurchase of <strong>AstraZeneca</strong> PLC Ordinary Shares (6,015) (2,604)Net decrease in shareholders’ funds (6,432) (3,462)Shareholders’ funds at end of year 13,396 19,828<strong>20</strong>11$m<strong>20</strong>10$mDetails of dividends paid <strong>and</strong> payable to shareholders are given in Note 21 to the Group Financial Statements on page 170.6 Share capitalAllotted, called-up <strong>and</strong> fully paidIssued Ordinary Shares ($0.25 each) 323 352Redeemable Preference Shares (£1 each – £50,000) – –323 352<strong>20</strong>11$m<strong>20</strong>10$mAt 31 December <strong>20</strong>11, 1,292,355,052 Ordinary Shares were in issue.The Redeemable Preference Shares carry limited class voting rights <strong>and</strong> no dividend rights. This class of shares is capable of redemption at parat the option of the Company on the giving of seven days’ written notice to the registered holder of the shares.The movements in share capital during the year can be summarised as follows:No. of shares (m) $mAt 1 January <strong>20</strong>11 1,409 352Issues of shares 11 3Repurchase of shares (128) (32)At 31 December <strong>20</strong>11 1,292 323Share repurchasesDuring the year, the Company repurchased 128m Ordinary Shares at an average price of 2932 pence per share (<strong>20</strong>10: 54m Ordinary Shares atan average price of 3111 pence per share).Share schemesA total of 11m Ordinary Shares were issued during the year in respect of share schemes. Details of movements in the number of Ordinary Sharesunder option are shown in Note 24 to the Group Financial Statements; details of options granted to Directors are shown in the Directors’Remuneration <strong>Report</strong>.Shares held by subsidiariesNo shares in the Company are held by subsidiaries.196 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11