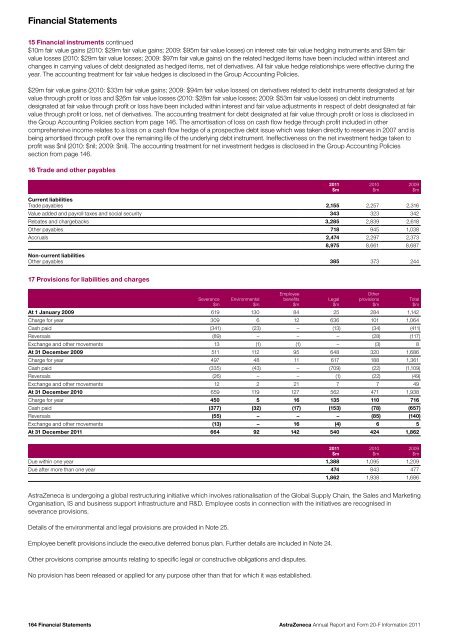

Financial Statements15 Financial instruments continued$10m fair value gains (<strong>20</strong>10: $29m fair value gains; <strong>20</strong>09: $95m fair value losses) on interest rate fair value hedging instruments <strong>and</strong> $9m fairvalue losses (<strong>20</strong>10: $29m fair value losses; <strong>20</strong>09: $97m fair value gains) on the related hedged items have been included within interest <strong>and</strong>changes in carrying values of debt designated as hedged items, net of derivatives. All fair value hedge relationships were effective during theyear. The accounting treatment for fair value hedges is disclosed in the Group Accounting Policies.$29m fair value gains (<strong>20</strong>10: $33m fair value gains; <strong>20</strong>09: $94m fair value losses) on derivatives related to debt instruments designated at fairvalue through profit or loss <strong>and</strong> $26m fair value losses (<strong>20</strong>10: $28m fair value losses; <strong>20</strong>09: $53m fair value losses) on debt instrumentsdesignated at fair value through profit or loss have been included within interest <strong>and</strong> fair value adjustments in respect of debt designated at fairvalue through profit or loss, net of derivatives. The accounting treatment for debt designated at fair value through profit or loss is disclosed inthe Group Accounting Policies section from page 146. The amortisation of loss on cash flow hedge through profit included in othercomprehensive income relates to a loss on a cash flow hedge of a prospective debt issue which was taken directly to reserves in <strong>20</strong>07 <strong>and</strong> isbeing amortised through profit over the remaining life of the underlying debt instrument. Ineffectiveness on the net investment hedge taken toprofit was $nil (<strong>20</strong>10: $nil; <strong>20</strong>09: $nil). The accounting treatment for net investment hedges is disclosed in the Group Accounting Policiessection from page 146.16 Trade <strong>and</strong> other payables<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mCurrent liabilitiesTrade payables 2,155 2,257 2,316Value added <strong>and</strong> payroll taxes <strong>and</strong> social security 343 323 342Rebates <strong>and</strong> chargebacks 3,285 2,839 2,618Other payables 718 945 1,038Accruals 2,474 2,297 2,3738,975 8,661 8,687Non-current liabilitiesOther payables 385 373 24417 Provisions for liabilities <strong>and</strong> chargesSeverance$mEnvironmental$mEmployeebenefits$mLegal$mOtherprovisions$mAt 1 January <strong>20</strong>09 619 130 84 25 284 1,142Charge for year 309 6 12 636 101 1,064Cash paid (341) (23) – (13) (34) (411)Reversals (89) – – – (28) (117)Exchange <strong>and</strong> other movements 13 (1) (1) – (3) 8At 31 December <strong>20</strong>09 511 112 95 648 3<strong>20</strong> 1,686Charge for year 497 48 11 617 188 1,361Cash paid (335) (43) – (709) (22) (1,109)Reversals (26) – – (1) (22) (49)Exchange <strong>and</strong> other movements 12 2 21 7 7 49At 31 December <strong>20</strong>10 659 119 127 562 471 1,938Charge for year 450 5 16 135 110 716Cash paid (377) (32) (17) (153) (78) (657)Reversals (55) – – – (85) (140)Exchange <strong>and</strong> other movements (13) – 16 (4) 6 5At 31 December <strong>20</strong>11 664 92 142 540 424 1,862Total$mDue within one year 1,388 1,095 1,<strong>20</strong>9Due after more than one year 474 843 4771,862 1,938 1,686<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$m<strong>AstraZeneca</strong> is undergoing a global restructuring initiative which involves rationalisation of the Global Supply Chain, the Sales <strong>and</strong> MarketingOrganisation, IS <strong>and</strong> business support infrastructure <strong>and</strong> R&D. Employee costs in connection with the initiatives are recognised inseverance provisions.Details of the environmental <strong>and</strong> legal provisions are provided in Note 25.Employee benefit provisions include the executive deferred bonus plan. Further details are included in Note 24.Other provisions comprise amounts relating to specific legal or constructive obligations <strong>and</strong> disputes.No provision has been released or applied for any purpose other than that for which it was established.164 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11

18 Post-retirement benefitsPensionsBackgroundThe Company <strong>and</strong> most of its subsidiaries offer retirement plans which cover the majority of employees in the Group. Many of these plans are‘defined contribution’, where <strong>AstraZeneca</strong>’s contribution <strong>and</strong> resulting charge is fixed at a set level or is a set percentage of employees’ pay.However, several plans, mainly in the UK, the US <strong>and</strong> Sweden, are ‘defined benefit’, where benefits are based on employees’ length of service<strong>and</strong> average final salary (typically averaged over one, three or five years). The major defined benefit plans, apart from the collectively bargainedSwedish plan (which is still open to employees born before 1979), have been closed to new entrants since <strong>20</strong>00.The major defined benefit plans are funded through legally separate, fiduciary-administered funds. The cash funding of the plans, whichmay from time to time involve special payments, is designed, in consultation with independent qualified actuaries, to ensure that the assetstogether with future contributions should be sufficient to meet future obligations. The funding is monitored rigorously by <strong>AstraZeneca</strong> <strong>and</strong>appropriate fiduciaries specifically with reference to <strong>AstraZeneca</strong>’s credit rating, market capitalisation, cash flows <strong>and</strong> the solvency of therelevant pension scheme.Financing Principles96.7% of the Group’s defined benefit obligations at 31 December <strong>20</strong>11 are in schemes within the UK, the US, Sweden or Germany. In thesecountries the pension obligations are funded with reference to the following financing principles:> > The Group has a fundamental belief in funding the benefits it promises to employees.> > The Group considers its pension arrangements in the context of its broader capital structure. In general it does not believe in committingexcessive capital for funding while it has better uses of capital within the business nor does it wish to generate surpluses.> > The pension funds are not part of the Group’s core business. The Group believes in taking some rewarded risks with the investmentsunderlying the funding, subject to a medium to long-term plan to reduce those risks if opportunities arise.> > The Group recognises that deciding to hold certain investments may cause volatility in the funding position. The Group would not wishto amend its contribution level for relatively small deviations from its preferred funding level, because it is expected that there will beshort-term volatility, but it is prepared to react appropriately to more significant deviations.> > In the event that local regulations require an additional level of financing, the Group would consider the use of alternative methods of providingthis that do not require immediate cash funding but help mitigate exposure of the pension arrangement to the credit risk of the Group.These principles are appropriate to <strong>AstraZeneca</strong>’s business at the present date; should circumstances change they may require review.<strong>AstraZeneca</strong> has developed a funding framework to implement these principles. This determines the cash contributions payable to the pensionfunds, but does not affect the IAS 19 liabilities. To reduce the risk of committing excess capital to pension funds, liability valuations are basedon the expected return on the actual pension assets, rather than a corporate bond yield. At present this puts a different value on the liabilitiesthan IAS 19.UKWith regard to the Group’s UK defined benefit fund, the above principles are modified in light of the UK regulatory requirements <strong>and</strong> resultingdiscussions with the Pension Fund Trustee. The most recent full actuarial valuation was carried out at 31 March <strong>20</strong>10.Under the agreed funding principles for the UK, cash contributions will be paid to the UK Pension Fund to target a level of assets in excess ofthe current expected cost of providing benefits. In addition, <strong>AstraZeneca</strong> will make contributions to an escrow account which will be held outsideof the UK Pension Fund. The escrow account assets will be payable to the fund in agreed circumstances, for example, in the event of <strong>AstraZeneca</strong><strong>and</strong> the Pension Fund Trustee agreeing on a change to the current long-term investment strategy.The market value of the fund’s assets at the valuation date was £3,129m ($4,832m equivalent), representing 79% of the fund’s actuariallyassessed liabilities (Technical Provisions). The Company has agreed to fund the shortfall by making payments of £72.5m ($112m) a year until31 December <strong>20</strong>11 <strong>and</strong> then lump sum payments totalling £715m ($1,103m) before 30 June <strong>20</strong>13. The first of these lump sum payments of£180m ($278m) was paid into the UK Pension Fund in December <strong>20</strong>11 from existing investments held in escrow for the Pension Fund. A further£300m ($463m) was paid into the UK Pension Fund during January <strong>20</strong>12 with the balance payable by 30 June <strong>20</strong>13. This is in addition to thecontributions required to meet the ongoing benefits accruing in the region of £24m ($37m) per annum. In <strong>20</strong>11, £132m ($213m) was paid intothe escrow account <strong>and</strong> a further £230m ($355m) was paid in during January <strong>20</strong>12. At 31 December <strong>20</strong>11, £192m ($296m) of escrow fundassets are included within other investments (see Note 10).Under the agreed funding principles used to set the Technical Provisions, the key assumptions as at 31 March <strong>20</strong>10 are as follows: long-termUK price inflation set at 3.8% per annum, salary increases at 0% per annum (as a result of pensionable pay levels being frozen in <strong>20</strong>10), pensionincreases at 3.55% per annum <strong>and</strong> investment returns at 5.9% per annum.During the first half of <strong>20</strong>10, following consultation with its UK employees’ representatives, <strong>AstraZeneca</strong> introduced a freeze on pensionablepay at 30 June <strong>20</strong>10 levels for defined benefit members of the UK Pension Fund. The defined benefit fund remains open to existing members<strong>and</strong> employees who choose to leave the defined benefit fund will retain a deferred pension in addition to being offered membership in a newGroup Self Invested Personal Pension Plan.Financial StatementsThe amendment to the UK defined benefit fund to freeze pensionable pay at 30 June <strong>20</strong>10 levels represents an accounting curtailment of certainpension obligations. The majority of members opted to remain in the defined benefit fund <strong>and</strong> continue benefit accrual with frozen pensionablepay. In accordance with IAS 19, the scheme obligations were revalued by the scheme actuaries immediately prior to the change <strong>and</strong> assumptionsreviewed at that date. The resulting credit of $693m was recognised in comprehensive income in <strong>20</strong>10.<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 165