- Page 1 and 2:

healthAstraZeneca Annual Reportand

- Page 3 and 4:

Financial summary$33.6bnSales down

- Page 5 and 6:

China: We announcedour decision to

- Page 7 and 8:

OverviewOperational overview7979 pr

- Page 9 and 10:

Chairman’s StatementI would like

- Page 11 and 12:

Chief Executive Officer’s ReviewA

- Page 13 and 14:

The process of getting a drug to ma

- Page 15 and 16:

OverviewnovationInnovation drives p

- Page 17 and 18:

Our Strategy and PerformanceMore pe

- Page 19 and 20:

Using the full range of innovative

- Page 21 and 22:

Our strategyMissionto make the most

- Page 23 and 24:

Our strategic priorities to 2014Our

- Page 25 and 26:

Our performance in 2011Our performa

- Page 27 and 28:

Business shapePeopleResponsible bus

- Page 29 and 30:

Strategy and PerformanceaborationIm

- Page 31 and 32:

Delivering our strategyOur strategy

- Page 33 and 34:

Development projects20112010 129342

- Page 35 and 36:

Investing in capabilitiesA core com

- Page 37 and 38:

Patent expiries for our key markete

- Page 39 and 40:

our Established Markets footprint i

- Page 41 and 42:

Product qualityWe are committed to

- Page 43 and 44:

We have a global approach, supporte

- Page 45 and 46:

ComplianceWe ensure a culture of et

- Page 47 and 48:

tegrityBusiness ReviewWe are dedica

- Page 49 and 50:

Delivering our strategyResponsible

- Page 51 and 52:

India has the fastest growing numbe

- Page 53 and 54:

ProtestsAstraZeneca acknowledges th

- Page 55 and 56:

Also in 2011, the DIHR in collabora

- Page 57 and 58:

healthcollaborationRaising breast c

- Page 59 and 60:

Pipeline by Therapy Area at 31 Dece

- Page 62 and 63:

Therapy Area ReviewIn September, we

- Page 64 and 65:

Therapy Area ReviewGastrointestinal

- Page 66 and 67:

Therapy Area ReviewInfectionTherapy

- Page 68 and 69:

Therapy Area ReviewIn the pipelineI

- Page 70 and 71:

Therapy Area ReviewOur financial pe

- Page 72 and 73:

Therapy Area ReviewOncologyTherapy

- Page 74 and 75:

Therapy Area Reviewendpoints of pro

- Page 76 and 77:

Therapy Area ReviewOur financial pe

- Page 78 and 79:

healthinnovationReducing the number

- Page 80 and 81:

Geographical ReviewUSAstraZeneca is

- Page 82 and 83:

Geographical ReviewEmerging Markets

- Page 84 and 85:

Disciplined execution of our strate

- Page 86 and 87:

Financial ReviewMeasuring performan

- Page 88 and 89:

Financial ReviewResults of operatio

- Page 90 and 91:

Financial ReviewFinancial position

- Page 92 and 93:

Financial ReviewCapitalisation and

- Page 94 and 95:

Financial ReviewResults of operatio

- Page 96 and 97:

Financial ReviewSensitivity analysi

- Page 98 and 99:

Financial Reviewover the performanc

- Page 100 and 101:

healthcollaborationFighting the ris

- Page 102 and 103:

Board of Directors and Senior Execu

- Page 104 and 105:

Board of Directors and Senior Execu

- Page 106 and 107:

Corporate Governance ReportOperatio

- Page 108 and 109:

Corporate Governance ReportThe Boar

- Page 110 and 111:

Corporate Governance ReportDuring 2

- Page 112 and 113:

Corporate Governance ReportBusiness

- Page 114 and 115:

Corporate Governance ReportPolitica

- Page 116 and 117:

Directors’ Remuneration ReportDav

- Page 118 and 119:

Directors’ Remuneration ReportVar

- Page 120 and 121:

Directors’ Remuneration ReportAdd

- Page 122 and 123:

Directors’ Remuneration ReportSum

- Page 124 and 125:

Directors’ Remuneration ReportSum

- Page 126 and 127:

Directors’ Remuneration ReportIn

- Page 128 and 129:

Directors’ Remuneration ReportPer

- Page 130 and 131:

Directors’ Remuneration ReportGai

- Page 132 and 133:

RiskManagement reporting and assura

- Page 134 and 135:

RiskCommercialisation and business

- Page 136 and 137:

RiskCommercialisation and business

- Page 138 and 139:

RiskSupply chain and delivery risks

- Page 140 and 141:

RiskEconomic and financial risks co

- Page 142 and 143:

Financial StatementsPreparation of

- Page 144 and 145:

Financial StatementsConsolidated St

- Page 146 and 147: Financial StatementsConsolidated St

- Page 148 and 149: Financial StatementsGroup Accountin

- Page 150 and 151: Financial StatementsProperty, plant

- Page 152 and 153: Financial StatementsNotes to the Gr

- Page 154 and 155: Financial Statements3 Finance incom

- Page 156 and 157: Financial Statements4 Taxation cont

- Page 158 and 159: Financial Statements6 Segment infor

- Page 160 and 161: Financial Statements9 Intangible as

- Page 162 and 163: Financial Statements10 Other invest

- Page 164 and 165: Financial Statements15 Financial in

- Page 166 and 167: Financial Statements15 Financial in

- Page 168 and 169: Financial Statements18 Post-retirem

- Page 170 and 171: Financial Statements18 Post-retirem

- Page 172 and 173: Financial Statements20 Share capita

- Page 174 and 175: Financial Statements23 Financial ri

- Page 176 and 177: Financial Statements23 Financial ri

- Page 178 and 179: Financial Statements24 Employee cos

- Page 180 and 181: Financial Statements24 Employee cos

- Page 182 and 183: Financial Statements24 Employee cos

- Page 184 and 185: Financial Statements25 Commitments

- Page 186 and 187: Financial Statements25 Commitments

- Page 188 and 189: Financial Statements25 Commitments

- Page 190 and 191: Financial Statements25 Commitments

- Page 192 and 193: Financial Statements26 LeasesTotal

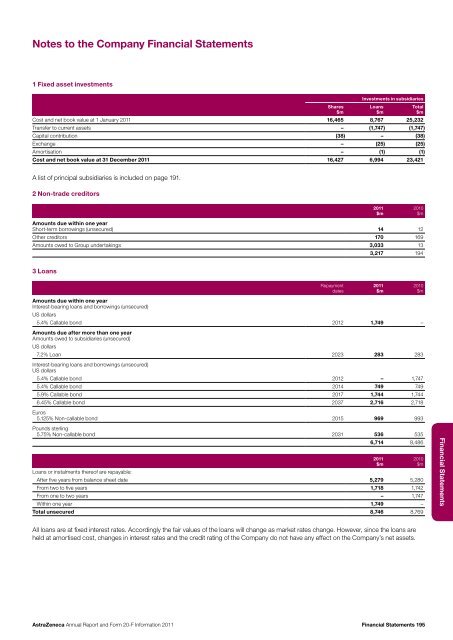

- Page 194 and 195: Financial StatementsIndependent Aud

- Page 198 and 199: Financial Statements4 ReservesShare

- Page 200 and 201: Financial StatementsGroup Financial

- Page 202 and 203: Development PipelineNCEsPhase III/R

- Page 204 and 205: Development PipelineNCEsPhases I an

- Page 206 and 207: Shareholder Information> For shares

- Page 208 and 209: Shareholder InformationDocuments on

- Page 210 and 211: Corporate InformationHistory and de

- Page 212 and 213: GlossaryThe following abbreviations

- Page 214 and 215: Index2011 performance summary 23Acc

- Page 216: Contact informationRegistered offic