AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

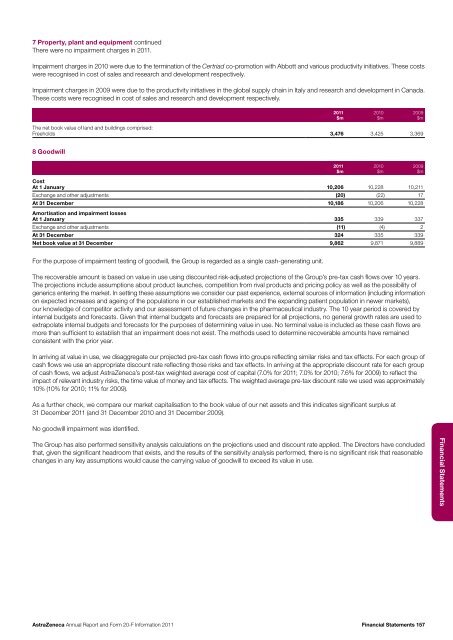

7 Property, plant <strong>and</strong> equipment continuedThere were no impairment charges in <strong>20</strong>11.Impairment charges in <strong>20</strong>10 were due to the termination of the Certriad co-promotion with Abbott <strong>and</strong> various productivity initiatives. These costswere recognised in cost of sales <strong>and</strong> research <strong>and</strong> development respectively.Impairment charges in <strong>20</strong>09 were due to the productivity initiatives in the global supply chain in Italy <strong>and</strong> research <strong>and</strong> development in Canada.These costs were recognised in cost of sales <strong>and</strong> research <strong>and</strong> development respectively.<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mThe net book value of l<strong>and</strong> <strong>and</strong> buildings comprised:Freeholds 3,476 3,425 3,3698 Goodwill<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mCostAt 1 January 10,<strong>20</strong>6 10,228 10,211Exchange <strong>and</strong> other adjustments (<strong>20</strong>) (22) 17At 31 December 10,186 10,<strong>20</strong>6 10,228Amortisation <strong>and</strong> impairment lossesAt 1 January 335 339 337Exchange <strong>and</strong> other adjustments (11) (4) 2At 31 December 324 335 339Net book value at 31 December 9,862 9,871 9,889For the purpose of impairment testing of goodwill, the Group is regarded as a single cash-generating unit.The recoverable amount is based on value in use using discounted risk-adjusted projections of the Group’s pre-tax cash flows over 10 years.The projections include assumptions about product launches, competition from rival products <strong>and</strong> pricing policy as well as the possibility ofgenerics entering the market. In setting these assumptions we consider our past experience, external sources of information (including informationon expected increases <strong>and</strong> ageing of the populations in our established markets <strong>and</strong> the exp<strong>and</strong>ing patient population in newer markets),our knowledge of competitor activity <strong>and</strong> our assessment of future changes in the pharmaceutical industry. The 10 year period is covered byinternal budgets <strong>and</strong> forecasts. Given that internal budgets <strong>and</strong> forecasts are prepared for all projections, no general growth rates are used toextrapolate internal budgets <strong>and</strong> forecasts for the purposes of determining value in use. No terminal value is included as these cash flows aremore than sufficient to establish that an impairment does not exist. The methods used to determine recoverable amounts have remainedconsistent with the prior year.In arriving at value in use, we disaggregate our projected pre-tax cash flows into groups reflecting similar risks <strong>and</strong> tax effects. For each group ofcash flows we use an appropriate discount rate reflecting those risks <strong>and</strong> tax effects. In arriving at the appropriate discount rate for each groupof cash flows, we adjust <strong>AstraZeneca</strong>’s post-tax weighted average cost of capital (7.0% for <strong>20</strong>11; 7.0% for <strong>20</strong>10; 7.6% for <strong>20</strong>09) to reflect theimpact of relevant industry risks, the time value of money <strong>and</strong> tax effects. The weighted average pre-tax discount rate we used was approximately10% (10% for <strong>20</strong>10; 11% for <strong>20</strong>09).As a further check, we compare our market capitalisation to the book value of our net assets <strong>and</strong> this indicates significant surplus at31 December <strong>20</strong>11 (<strong>and</strong> 31 December <strong>20</strong>10 <strong>and</strong> 31 December <strong>20</strong>09).No goodwill impairment was identified.The Group has also performed sensitivity analysis calculations on the projections used <strong>and</strong> discount rate applied. The Directors have concludedthat, given the significant headroom that exists, <strong>and</strong> the results of the sensitivity analysis performed, there is no significant risk that reasonablechanges in any key assumptions would cause the carrying value of goodwill to exceed its value in use.Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 157