2009-10 Adopted Budget - City of Hoquiam

2009-10 Adopted Budget - City of Hoquiam

2009-10 Adopted Budget - City of Hoquiam

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

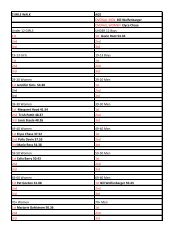

APPENDIX B<strong>2009</strong>-20<strong>10</strong> Operating and Capital <strong>Budget</strong>Glossary <strong>of</strong> TermsLEVY LID: A statutory restriction on the annual increase in the amount <strong>of</strong> property tax agiven public jurisdiction can assess on regular or excess levies, without approval bypopular vote.LGIP: The local government investment pool is a repository run by the WashingtonState Treasurer's Office.LIABILITY: Debt or other legal obligations arising out <strong>of</strong> transactions in the past whichmust be liquidated, renewed or refunded at some future date.LOCAL IMPROVEMENT DISTRICT (LID): A defined set <strong>of</strong> properties established by<strong>City</strong> Council action within which the <strong>City</strong> provides for specified infrastructureimprovements in return for the ability to assess the individual properties a sufficientannual amount to finance the costs <strong>of</strong> such improvements. Such improvements areusually financed through the issuance <strong>of</strong> LID Bonds. Local Improvement District 95-1and 98-01 <strong>of</strong> the <strong>City</strong> constitute such LID’s (see the Debt Service section <strong>of</strong> this budgetdocument).MATURITIES: The dates on which the principal or stated values <strong>of</strong> investments or debtobligations mature and may be reclaimed.MILLIAGE RATE: The property tax rate which is based on the valuation <strong>of</strong> property. Atax rate <strong>of</strong> one mill produces one dollar <strong>of</strong> taxes on each $1,000 <strong>of</strong> property valuation.Washington state law limits the milliage rate on any property to 1% <strong>of</strong> assessed value,or <strong>10</strong> mills, for all purposes without popular approval through a vote <strong>of</strong> the people.MITIGATION FEES: Contributions made by developers toward future improvements <strong>of</strong>city facilities resulting from the additional demand on the <strong>City</strong>’s facilities generated fromthe development.MODIFIED ACCRUAL BASIS: The basis <strong>of</strong> accounting under which expenditures, otherthan accrued interest on general long-term debt, are recorded at the time liabilities areincurred and revenues are recorded when received in cash except for material and/oravailable revenues, which should be accrued to reflect properly the taxes levied andrevenue earned.NET REVENUE: The revenue <strong>of</strong> a system, business or fund less the cost <strong>of</strong>maintenance and operation <strong>of</strong> that system, business <strong>of</strong> fund.NOTES TO THE FINANCIAL STATEMENTS: The Summary <strong>of</strong> Significant AccountingPolicies (SSAP) and other disclosures required for a fair presentation <strong>of</strong> the financialstatements <strong>of</strong> government in conformity with Generally Accepted Accounting Principles(GAAP) and not included on the face <strong>of</strong> the financial statements themselves. The notesto the financial statements are an integral part <strong>of</strong> the General Purpose FinancialStatement (GPFS).OBJECT (Sub-object): As used in expenditure classification, this term applies to thetype <strong>of</strong> item purchased or the service obtained (as distinguished from the resultsobtained from expenditures).248