- Page 1 and 2:

2009-2010 ADOPTED OPERATING ANDCAPI

- Page 3:

This Page Intentionally Left Blank.

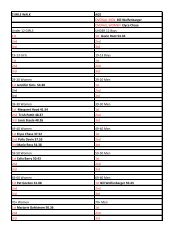

- Page 6 and 7: TABLE OF CONTENTSCITY OF HOQUIAMPRE

- Page 8 and 9: CITY OF HOQUIAMORGANIZATIONAL CHART

- Page 10 and 11: "The City of Hoquiam is poised for

- Page 12 and 13: 2007-2008 Budget Goals Scorecard &

- Page 17 and 18: also contains an outline of the app

- Page 19 and 20: Hoquiam’s Form of GovernmentHoqui

- Page 21 and 22: History of HoquiamLong before Weste

- Page 23 and 24: City Commissions and BoardsCivil Se

- Page 25 and 26: This Page Intentionally Left Blank.

- Page 27 and 28: Budget CalendarThe adoption of a bu

- Page 30 and 31: III. GOALS AND POLICIESThis section

- Page 32 and 33: POLICIESThe City Council developed

- Page 34 and 35: the highest level of service. Durin

- Page 36 and 37: 2) Sustain the current level of Cit

- Page 38 and 39: 5. Annually each department will re

- Page 40 and 41: 4.2 The Finance Department performs

- Page 42 and 43: 9.2 Change funds shall be controlle

- Page 44 and 45: IV. REVENUESThis section summarizes

- Page 46 and 47: 2. Voted Property Tax LevyAmount %

- Page 48 and 49: Sales Tax AllocationTelecommManufac

- Page 50 and 51: an amount we have determined to be

- Page 52 and 53: is $6,395 and $6,782 respectively.

- Page 54 and 55: help defray policing costs. Cities

- Page 58 and 59: Intergovernmental revenues increase

- Page 60 and 61: 7,000,000Hoquiam 2009-2010 Budget20

- Page 62 and 63: CITY OF HOQUIAMASSESSED VALUE AND L

- Page 64 and 65: City of HoquiamRevenue Forecasting

- Page 66 and 67: City of HoquiamRevenue Forecasting

- Page 68 and 69: This Page Intentionally Left Blank.

- Page 70 and 71: 2,500,000City of Hoquiam 2009-2010

- Page 72 and 73: City of Hoquiam 2009-2010 BudgetCem

- Page 74 and 75: City of Hoquiam 2009-2010 BudgetMau

- Page 76 and 77: City of Hoquiam 2009-2010 BudgetStr

- Page 78 and 79: City of Hoquiam 2009-2010 BudgetArt

- Page 80 and 81: City of Hoquiam 2009-2010 BudgetAmb

- Page 82 and 83: City of Hoquiam 2009-2010 BudgetSta

- Page 84 and 85: City of Hoquiam 2009-2010 BudgetGen

- Page 86 and 87: City of HoquiamRevenue Forecasting

- Page 88 and 89: V. FUND SUMMARY SECTIONOverviewThe

- Page 90 and 91: 2009-2010 BUDGETALL FUNDS SUMMARYFU

- Page 92 and 93: A. General Fund - #001Overview:The

- Page 94 and 95: CITY OF HOQUIAM2009-2010 OPERATING

- Page 96 and 97: CITY OF HOQUIAM2009-2010 OPERATING

- Page 98 and 99: CITY OF HOQUIAM2009-2010 OPERATING

- Page 100 and 101: CITY OF HOQUIAM2009-2010 OPERATING

- Page 102 and 103: CITY OF HOQUIAM2009-2010 OPERATING

- Page 104 and 105: CITY OF HOQUIAM2009-2010 OPERATING

- Page 106 and 107:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 108 and 109:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 110 and 111:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 112 and 113:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 114 and 115:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 116 and 117:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 118 and 119:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 120 and 121:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 122 and 123:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 124 and 125:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 126 and 127:

CITY OF HOQUIAM2009-2010 OPERATING

- Page 129 and 130:

R. Medical Dental Fund - #520Overvi

- Page 131 and 132:

S. Unemployment Compensation Fund -

- Page 133 and 134:

T. Police and Fire Pension Fund - #

- Page 135 and 136:

This Page Intentionally Left Blank.

- Page 137 and 138:

Operating Budget Expenditures and S

- Page 139 and 140:

CITY OF HOQUIAM2009-2010 Operating

- Page 141 and 142:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 143 and 144:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 145 and 146:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 147 and 148:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 149 and 150:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 151 and 152:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 153 and 154:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 155 and 156:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 157 and 158:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 159 and 160:

DEPT Name: City Hall & BuildingsDEP

- Page 161 and 162:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 163 and 164:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 165 and 166:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 167 and 168:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 169 and 170:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 171 and 172:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 173 and 174:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 175 and 176:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 177 and 178:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 179 and 180:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 181 and 182:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 183 and 184:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 185 and 186:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 187 and 188:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 189 and 190:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 191 and 192:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 193 and 194:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 195 and 196:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 197 and 198:

CITY OF HOQUIAM1008 BIENNIAL BUDGET

- Page 199 and 200:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 201 and 202:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 203 and 204:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 205 and 206:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 207 and 208:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 209 and 210:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 211 and 212:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 213 and 214:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 215 and 216:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 217 and 218:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 219 and 220:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 221 and 222:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 223 and 224:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 225 and 226:

DEPT Name: Landfill PostclosureDEPT

- Page 227 and 228:

CITY OF HOQUIAM2009-2010 BIENNIAL O

- Page 229 and 230:

CITY OF HOQUIAM2009-2010 BIENNIAL B

- Page 231 and 232:

CITY OF HOQUIAM2009-2010 CAPITAL IM

- Page 233 and 234:

CITY OF HOQUIAM2009-2010 CAPITAL BU

- Page 235 and 236:

CITY OF HOQUIAM2009-2010 CAPITAL BU

- Page 237 and 238:

CITY OF HOQUIAM2009-2010 CAPITAL BU

- Page 239 and 240:

CITY OF HOQUIAM2009-2010 CAPITAL BU

- Page 241 and 242:

2009 2010Beginning 2009-2010 2009-2

- Page 243 and 244:

CITY OF HOQUIAM2010 Remaining Debt

- Page 245 and 246:

CITY OF HOQUIAM2009-2010 BudgetDEBT

- Page 247 and 248:

FUND NUMBER: 401-25DESCRIPTION: Wat

- Page 249 and 250:

FUND NUMBER: 401-26DESCRIPTION: Sew

- Page 251 and 252:

A. Adopted Utility Rates236

- Page 253 and 254:

This Page Intentionally Left Blank.

- Page 255 and 256:

APPENDIX B2009-2010 Operating and C

- Page 257 and 258:

APPENDIX B2009-2010 Operating and C

- Page 259 and 260:

APPENDIX B2009-2010 Operating and C

- Page 261 and 262:

APPENDIX B2009-2010 Operating and C

- Page 263 and 264:

APPENDIX B2009-2010 Operating and C

- Page 265 and 266:

APPENDIX B2009-2010 Operating and C

- Page 267 and 268:

APPENDIX B2009-2010 Operating and C

- Page 269 and 270:

This Page Intentionally Left Blank.

- Page 271 and 272:

This Page Intentionally Left Blank.

- Page 273 and 274:

City of Hoquiam2009-2010 Budget Dev

- Page 275:

302 Sidewalk Construction Miscellan