2009-10 Adopted Budget - City of Hoquiam

2009-10 Adopted Budget - City of Hoquiam

2009-10 Adopted Budget - City of Hoquiam

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

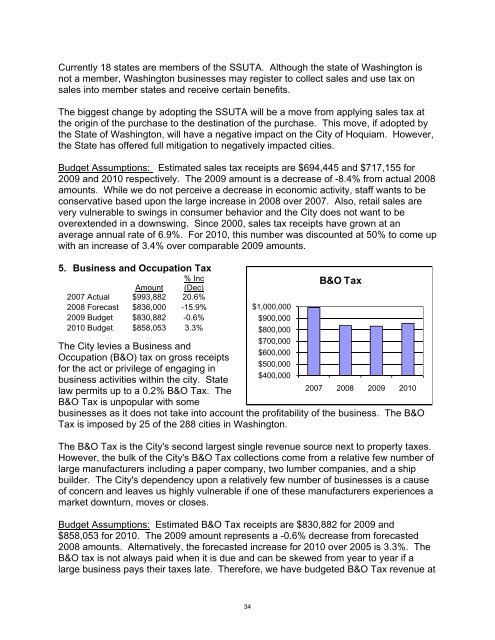

Currently 18 states are members <strong>of</strong> the SSUTA. Although the state <strong>of</strong> Washington isnot a member, Washington businesses may register to collect sales and use tax onsales into member states and receive certain benefits.The biggest change by adopting the SSUTA will be a move from applying sales tax atthe origin <strong>of</strong> the purchase to the destination <strong>of</strong> the purchase. This move, if adopted bythe State <strong>of</strong> Washington, will have a negative impact on the <strong>City</strong> <strong>of</strong> <strong>Hoquiam</strong>. However,the State has <strong>of</strong>fered full mitigation to negatively impacted cities.<strong>Budget</strong> Assumptions: Estimated sales tax receipts are $694,445 and $717,155 for<strong>2009</strong> and 20<strong>10</strong> respectively. The <strong>2009</strong> amount is a decrease <strong>of</strong> -8.4% from actual 2008amounts. While we do not perceive a decrease in economic activity, staff wants to beconservative based upon the large increase in 2008 over 2007. Also, retail sales arevery vulnerable to swings in consumer behavior and the <strong>City</strong> does not want to beoverextended in a downswing. Since 2000, sales tax receipts have grown at anaverage annual rate <strong>of</strong> 6.9%. For 20<strong>10</strong>, this number was discounted at 50% to come upwith an increase <strong>of</strong> 3.4% over comparable <strong>2009</strong> amounts.5. Business and Occupation Tax% IncAmount (Dec)2007 Actual $993,882 20.6%2008 Forecast $836,000 -15.9%<strong>2009</strong> <strong>Budget</strong> $830,882 -0.6%20<strong>10</strong> <strong>Budget</strong> $858,053 3.3%The <strong>City</strong> levies a Business andOccupation (B&O) tax on gross receiptsfor the act or privilege <strong>of</strong> engaging inbusiness activities within the city. Statelaw permits up to a 0.2% B&O Tax. TheB&O Tax is unpopular with some$1,000,000$900,000$800,000$700,000$600,000$500,000$400,000B&O Tax2007 2008 <strong>2009</strong> 20<strong>10</strong>businesses as it does not take into account the pr<strong>of</strong>itability <strong>of</strong> the business. The B&OTax is imposed by 25 <strong>of</strong> the 288 cities in Washington.The B&O Tax is the <strong>City</strong>'s second largest single revenue source next to property taxes.However, the bulk <strong>of</strong> the <strong>City</strong>'s B&O Tax collections come from a relative few number <strong>of</strong>large manufacturers including a paper company, two lumber companies, and a shipbuilder. The <strong>City</strong>'s dependency upon a relatively few number <strong>of</strong> businesses is a cause<strong>of</strong> concern and leaves us highly vulnerable if one <strong>of</strong> these manufacturers experiences amarket downturn, moves or closes.<strong>Budget</strong> Assumptions: Estimated B&O Tax receipts are $830,882 for <strong>2009</strong> and$858,053 for 20<strong>10</strong>. The <strong>2009</strong> amount represents a -0.6% decrease from forecasted2008 amounts. Alternatively, the forecasted increase for 20<strong>10</strong> over 2005 is 3.3%. TheB&O tax is not always paid when it is due and can be skewed from year to year if alarge business pays their taxes late. Therefore, we have budgeted B&O Tax revenue at34