to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

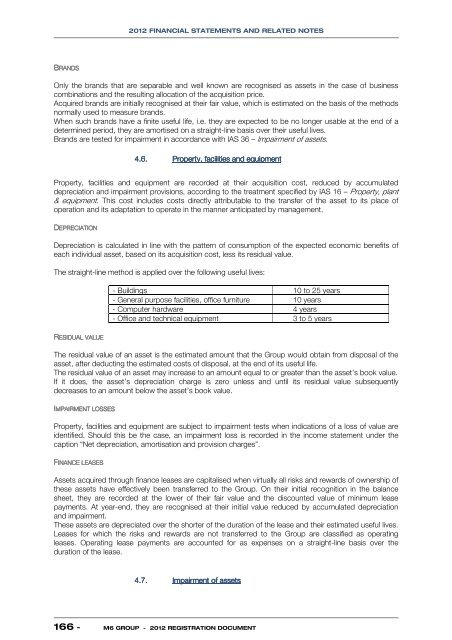

<strong>2012</strong> FINANCIAL STATEMENTS AND RELATED NOTESBRANDSOnly <strong>the</strong> brands that are separable and well known are recognised as assets in <strong>the</strong> case of businesscombinations and <strong>the</strong> resulting allocation of <strong>the</strong> acquisition price.Acquired brands are initially recognised at <strong>the</strong>ir fair value, which is estimated on <strong>the</strong> basis of <strong>the</strong> methodsnormally used <strong>to</strong> measure brands.When such brands have a finite useful life, i.e. <strong>the</strong>y are expected <strong>to</strong> be no longer usable at <strong>the</strong> end of adetermined period, <strong>the</strong>y are amortised on a straight-line basis over <strong>the</strong>ir useful lives.Brands are tested for impairment in accordance with IAS 36 – Impairment of assets.4.6. Property, facilities and equipmententProperty, facilities and equipment are recorded at <strong>the</strong>ir acquisition cost, reduced by accumulateddepreciation and impairment provisions, according <strong>to</strong> <strong>the</strong> treatment specified by IAS 16 – Property, plant& equipment. This cost includes costs directly attributable <strong>to</strong> <strong>the</strong> transfer of <strong>the</strong> asset <strong>to</strong> its place ofoperation and its adaptation <strong>to</strong> operate in <strong>the</strong> manner anticipated by management.DEPRECIATIONDepreciation is calculated in line with <strong>the</strong> pattern of consumption of <strong>the</strong> expected economic benefits ofeach individual asset, based on its acquisition cost, less its residual value.The straight-line method is applied over <strong>the</strong> following useful lives:- Buildings 10 <strong>to</strong> 25 years- General purpose facilities, office furniture 10 years- Computer hardware 4 years- Office and technical equipment 3 <strong>to</strong> 5 yearsRESIDUAL VALUEThe residual value of an asset is <strong>the</strong> estimated amount that <strong>the</strong> Group would obtain from disposal of <strong>the</strong>asset, after deducting <strong>the</strong> estimated costs of disposal, at <strong>the</strong> end of its useful life.The residual value of an asset may increase <strong>to</strong> an amount equal <strong>to</strong> or greater than <strong>the</strong> asset’s book value.If it does, <strong>the</strong> asset’s depreciation charge is zero unless and until its residual value subsequentlydecreases <strong>to</strong> an amount below <strong>the</strong> asset’s book value.IMPAIRMENT LOSSESProperty, facilities and equipment are subject <strong>to</strong> impairment tests when indications of a loss of value areidentified. Should this be <strong>the</strong> case, an impairment loss is recorded in <strong>the</strong> income statement under <strong>the</strong>caption “Net depreciation, amortisation and provision charges”.FINANCE LEASESAssets acquired through finance leases are capitalised when virtually all risks and rewards of ownership of<strong>the</strong>se assets have effectively been transferred <strong>to</strong> <strong>the</strong> Group. On <strong>the</strong>ir initial recognition in <strong>the</strong> balancesheet, <strong>the</strong>y are recorded at <strong>the</strong> lower of <strong>the</strong>ir fair value and <strong>the</strong> discounted value of minimum leasepayments. At year-end, <strong>the</strong>y are recognised at <strong>the</strong>ir initial value reduced by accumulated depreciationand impairment.These assets are depreciated over <strong>the</strong> shorter of <strong>the</strong> duration of <strong>the</strong> lease and <strong>the</strong>ir estimated useful lives.Leases for which <strong>the</strong> risks and rewards are not transferred <strong>to</strong> <strong>the</strong> Group are classified as operatingleases. Operating lease payments are accounted for as expenses on a straight-line basis over <strong>the</strong>duration of <strong>the</strong> lease.4.7. Impairment of assets166 - <strong>M6</strong> GROUP - <strong>2012</strong> REGISTRATION DOCUMENT