to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

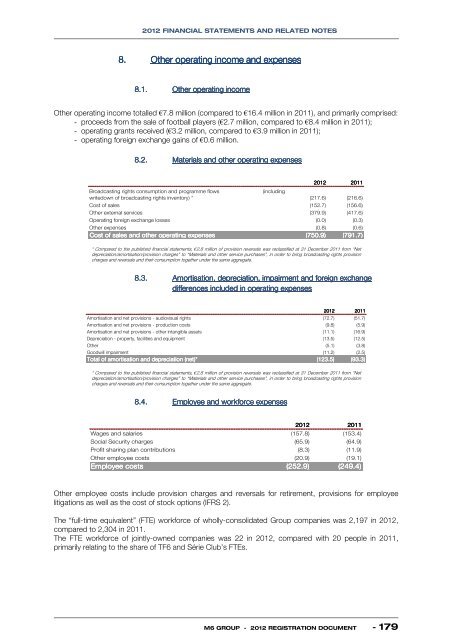

<strong>2012</strong> FINANCIAL STATEMENTS AND RELATED NOTES8. O<strong>the</strong>r operating income and expenses8.1. O<strong>the</strong>r operating incomeO<strong>the</strong>r operating income <strong>to</strong>talled €7.8 million (compared <strong>to</strong> €16.4 million in 2011), and primarily comprised:- proceeds from <strong>the</strong> sale of football players (€2.7 million, compared <strong>to</strong> €8.4 million in 2011);- operating grants received (€3.2 million, compared <strong>to</strong> €3.9 million in 2011);- operating foreign exchange gains of €0.6 million.8.2. Materials and o<strong>the</strong>r operating expenses<strong>2012</strong> 2011Broadcasting rights consumption and programme flows(includingwritedown of broadcasting rights inven<strong>to</strong>ry) *(217.6) (216.6)Cost of sales (152.7) (156.6)O<strong>the</strong>r external services (379.9) (417.6)Operating foreign exchange losses (0.0) (0.3)O<strong>the</strong>r expenses (0.8) (0.6)Cost of sales and o<strong>the</strong>r operating expenses (750.9) (791.7)* Compared <strong>to</strong> <strong>the</strong> published financial statements, €2.8 million of provision reversals was reclassified at 31 December 2011 from “Netdepreciation/amortisation/provision charges” <strong>to</strong> “Materials and o<strong>the</strong>r service purchases”, in order <strong>to</strong> bring broadcasting rights provisioncharges and reversals and <strong>the</strong>ir consumption <strong>to</strong>ge<strong>the</strong>r under <strong>the</strong> same aggregate.8.3. Amortisation, depreciation, impairment and foreign exchangedifferences included in operating expenses<strong>2012</strong> 2011Amortisation and net provisions - audiovisual rights (72.7) (51.7)Amortisation and net provisions - production costs (9.8) (5.9)Amortisation and net provisions - o<strong>the</strong>r intangible assets (11.1) (16.9)Depreciation - property, facilities and equipment (13.5) (12.5)O<strong>the</strong>r (5.1) (3.8)Goodwill impairment (11.2) (2.5)Total of amortisation and depreciation (net)* (123.5) (93.3)* Compared <strong>to</strong> <strong>the</strong> published financial statements, €2.8 million of provision reversals was reclassified at 31 December 2011 from “Netdepreciation/amortisation/provision charges” <strong>to</strong> “Materials and o<strong>the</strong>r service purchases”, in order <strong>to</strong> bring broadcasting rights provisioncharges and reversals and <strong>the</strong>ir consumption <strong>to</strong>ge<strong>the</strong>r under <strong>the</strong> same aggregate.8.4. Employee and workforce expenses<strong>2012</strong> 2011Wages and salaries (157.8) (153.4)Social Security charges (65.9) (64.9)Profit sharing plan contributions (8.3) (11.9)O<strong>the</strong>r employee costs (20.9) (19.1)Employee costs (252.9) (249.4)O<strong>the</strong>r employee costs include provision charges and reversals for retirement, provisions for employeelitigations as well as <strong>the</strong> cost of s<strong>to</strong>ck options (IFRS 2).The “full-time equivalent” (FTE) workforce of wholly-consolidated Group companies was 2,197 in <strong>2012</strong>,compared <strong>to</strong> 2,304 in 2011.The FTE workforce of jointly-owned companies was 22 in <strong>2012</strong>, compared with 20 people in 2011,primarily relating <strong>to</strong> <strong>the</strong> share of TF6 and Série Club’s FTEs.<strong>M6</strong> GROUP - <strong>2012</strong> REGISTRATION DOCUMENT - 179