to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

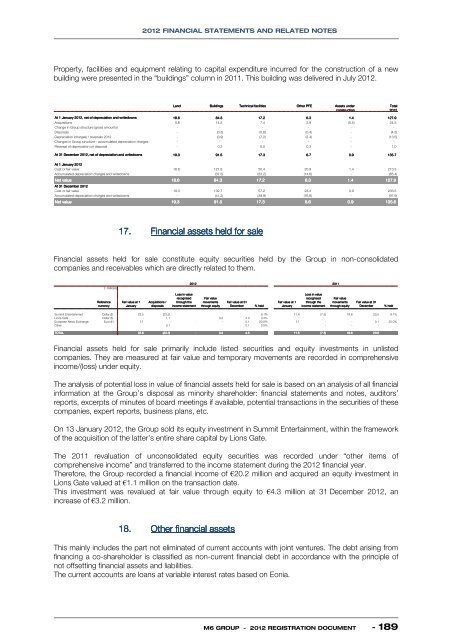

<strong>2012</strong> FINANCIAL STATEMENTS AND RELATED NOTESProperty, facilities and equipment relating <strong>to</strong> capital expenditure incurred for <strong>the</strong> construction of a newbuilding were presented in <strong>the</strong> “buildings” column in 2011. This building was delivered in July <strong>2012</strong>.LandBuildingsTechnical facilitiesO<strong>the</strong>r PFEAssets underconstructionTotal<strong>2012</strong>At 1 January <strong>2012</strong>, net of depreciation and writedowns 18.6 84.3 17.2 6.3 1.4 127.9Acquisitions 0.6 14.2 7.4 2.9 (0.5) 24.5Change in Group structure (gross amounts) - - - - - -Disposals - (3.3) (0.6) (0.4) - (4.3)Depreciation (charges) / reversals <strong>2012</strong> - (3.9) (7.2) (2.4) - (13.5)Changes in Group structure - accumulated depreciation charges - - - - - -Reversal of depreciation on disposal - 0.2 0.5 0.3 - 1.0At 31 December <strong>2012</strong>, net of depreciation and writedowns 19.3 91.5 17.3 6.7 0.9 135.7At 1 January <strong>2012</strong>Cost or fair value 18.6 121.8 50.4 20.9 1.4 213.3Accumulated depreciation charges and writedowns - (37.5) (33.2) (14.6) - (85.4)Net value 18.6 84.3 17.2 6.3 1.4 127.9At 31 December <strong>2012</strong>Cost or fair value 19.3 132.7 57.2 23.4 0.9 233.5Accumulated depreciation charges and writedowns - (41.2) (39.9) (16.8) - (97.9)Net value 19.3 91.5 17.3 6.6 0.9 135.617. Financial assets held for saleFinancial assets held for sale constitute equity securities held by <strong>the</strong> Group in non-consolidatedcompanies and receivables which are directly related <strong>to</strong> <strong>the</strong>m.(€ millions)<strong>2012</strong> 2011ReferencecurrencyFair value at 1JanuaryAcquisitions /disposalsLoss in valuerecognisedthrough <strong>the</strong>income statementFair valuemovementsthrough equityFair value at 31December% heldFair value at 1JanuaryLoss in valuerecognisedthrough <strong>the</strong>income statementFair valuemovementsthrough equityFair value at 31December% heldSummit Entertainment Dollar ($) 23.5 (23.5) - 9.1% 11.4 (7.5) 19.6 23.5 9.1%Lions Gate Dollar ($) - 1.1 4.3 0.4% -3.2European News Euro (€) 0.1 - 0.1 20.0% 0.1 Exchange - 0.1 - - 20.0%O<strong>the</strong>r 0.1 0.0% - - -0.1 TOTAL (22.3) 4.5 (7.5) 19.6 23.623.6 - 3.2 11.5 Financial assets held for sale primarily include listed securities and equity investments in unlistedcompanies. They are measured at fair value and temporary movements are recorded in comprehensiveincome/(loss) under equity.The analysis of potential loss in value of financial assets held for sale is based on an analysis of all financialinformation at <strong>the</strong> Group’s disposal as minority shareholder: financial statements and notes, audi<strong>to</strong>rs’reports, excerpts of minutes of board meetings if available, potential transactions in <strong>the</strong> securities of <strong>the</strong>secompanies, expert reports, business plans, etc.On 13 January <strong>2012</strong>, <strong>the</strong> Group sold its equity investment in Summit Entertainment, within <strong>the</strong> frameworkof <strong>the</strong> acquisition of <strong>the</strong> latter’s entire share capital by Lions Gate.The 2011 revaluation of unconsolidated equity securities was recorded under “o<strong>the</strong>r items ofcomprehensive income” and transferred <strong>to</strong> <strong>the</strong> income statement during <strong>the</strong> <strong>2012</strong> financial year.Therefore, <strong>the</strong> Group recorded a financial income of €20.2 million and acquired an equity investment inLions Gate valued at €1.1 million on <strong>the</strong> transaction date.This investment was revalued at fair value through equity <strong>to</strong> €4.3 million at 31 December <strong>2012</strong>, anincrease of €3.2 million.18. O<strong>the</strong>r financial assetsThis mainly includes <strong>the</strong> part not eliminated of current accounts with joint ventures. The debt arising fromfinancing a co-shareholder is classified as non-current financial debt in accordance with <strong>the</strong> principle ofnot offsetting financial assets and liabilities.The current accounts are loans at variable interest rates based on Eonia.<strong>M6</strong> GROUP - <strong>2012</strong> REGISTRATION DOCUMENT - 189