to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

to download the 2012 registration document. - Groupe M6

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

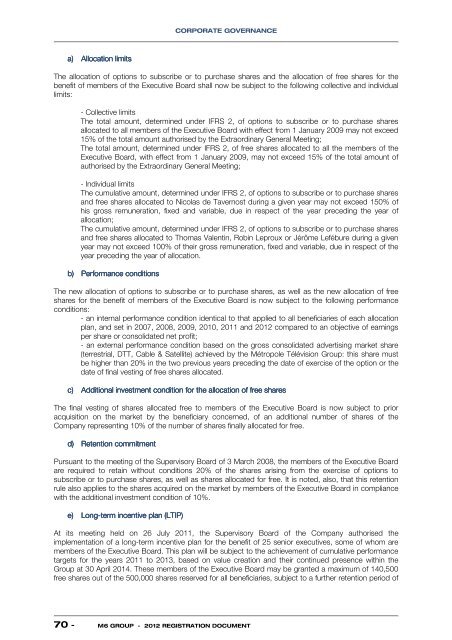

CORPORATE GOVERNANCEa) Allocation limitsThe allocation of options <strong>to</strong> subscribe or <strong>to</strong> purchase shares and <strong>the</strong> allocation of free shares for <strong>the</strong>benefit of members of <strong>the</strong> Executive Board shall now be subject <strong>to</strong> <strong>the</strong> following collective and individuallimits:- Collective limitsThe <strong>to</strong>tal amount, determined under IFRS 2, of options <strong>to</strong> subscribe or <strong>to</strong> purchase sharesallocated <strong>to</strong> all members of <strong>the</strong> Executive Board with effect from 1 January 2009 may not exceed15% of <strong>the</strong> <strong>to</strong>tal amount authorised by <strong>the</strong> Extraordinary General Meeting;The <strong>to</strong>tal amount, determined under IFRS 2, of free shares allocated <strong>to</strong> all <strong>the</strong> members of <strong>the</strong>Executive Board, with effect from 1 January 2009, may not exceed 15% of <strong>the</strong> <strong>to</strong>tal amount ofauthorised by <strong>the</strong> Extraordinary General Meeting;- Individual limitsThe cumulative amount, determined under IFRS 2, of options <strong>to</strong> subscribe or <strong>to</strong> purchase sharesand free shares allocated <strong>to</strong> Nicolas de Tavernost during a given year may not exceed 150% ofhis gross remuneration, fixed and variable, due in respect of <strong>the</strong> year preceding <strong>the</strong> year ofallocation;The cumulative amount, determined under IFRS 2, of options <strong>to</strong> subscribe or <strong>to</strong> purchase sharesand free shares allocated <strong>to</strong> Thomas Valentin, Robin Leproux or Jérôme Lefébure during a givenyear may not exceed 100% of <strong>the</strong>ir gross remuneration, fixed and variable, due in respect of <strong>the</strong>year preceding <strong>the</strong> year of allocation.b) Performance conditionsThe new allocation of options <strong>to</strong> subscribe or <strong>to</strong> purchase shares, as well as <strong>the</strong> new allocation of freeshares for <strong>the</strong> benefit of members of <strong>the</strong> Executive Board is now subject <strong>to</strong> <strong>the</strong> following performanceconditions:- an internal performance condition identical <strong>to</strong> that applied <strong>to</strong> all beneficiaries of each allocationplan, and set in 2007, 2008, 2009, 2010, 2011 and <strong>2012</strong> compared <strong>to</strong> an objective of earningsper share or consolidated net profit;- an external performance condition based on <strong>the</strong> gross consolidated advertising market share(terrestrial, DTT, Cable & Satellite) achieved by <strong>the</strong> Métropole Télévision Group: this share mustbe higher than 20% in <strong>the</strong> two previous years preceding <strong>the</strong> date of exercise of <strong>the</strong> option or <strong>the</strong>date of final vesting of free shares allocated.c) Additional investment condition for <strong>the</strong> allocation of free sharesThe final vesting of shares allocated free <strong>to</strong> members of <strong>the</strong> Executive Board is now subject <strong>to</strong> prioracquisition on <strong>the</strong> market by <strong>the</strong> beneficiary concerned, of an additional number of shares of <strong>the</strong>Company representing 10% of <strong>the</strong> number of shares finally allocated for free.d) Retention commitmentPursuant <strong>to</strong> <strong>the</strong> meeting of <strong>the</strong> Supervisory Board of 3 March 2008, <strong>the</strong> members of <strong>the</strong> Executive Boardare required <strong>to</strong> retain without conditions 20% of <strong>the</strong> shares arising from <strong>the</strong> exercise of options <strong>to</strong>subscribe or <strong>to</strong> purchase shares, as well as shares allocated for free. It is noted, also, that this retentionrule also applies <strong>to</strong> <strong>the</strong> shares acquired on <strong>the</strong> market by members of <strong>the</strong> Executive Board in compliancewith <strong>the</strong> additional investment condition of 10%.e) Long-term incentive plan (LTIP)At its meeting held on 26 July 2011, <strong>the</strong> Supervisory Board of <strong>the</strong> Company authorised <strong>the</strong>implementation of a long-term incentive plan for <strong>the</strong> benefit of 25 senior executives, some of whom aremembers of <strong>the</strong> Executive Board. This plan will be subject <strong>to</strong> <strong>the</strong> achievement of cumulative performancetargets for <strong>the</strong> years 2011 <strong>to</strong> 2013, based on value creation and <strong>the</strong>ir continued presence within <strong>the</strong>Group at 30 April 2014. These members of <strong>the</strong> Executive Board may be granted a maximum of 140,500free shares out of <strong>the</strong> 500,000 shares reserved for all beneficiaries, subject <strong>to</strong> a fur<strong>the</strong>r retention period of70 - <strong>M6</strong> GROUP - <strong>2012</strong> REGISTRATION DOCUMENT