- Page 4:

DisclaimerThis report is an English

- Page 8:

M6 GROUP PRESENTATION1. M6 Group pr

- Page 13 and 14:

M6 GROUP PRESENTATION1.4.2. 2012 fi

- Page 15 and 16:

M6 GROUP PRESENTATION• Another am

- Page 17 and 18:

M6 GROUP PRESENTATIONIn total, the

- Page 19 and 20:

M6 GROUP PRESENTATIONIndividual Wat

- Page 21 and 22:

M6 GROUP PRESENTATION Historic chan

- Page 23 and 24:

M6 GROUP PRESENTATIONThe top ten M6

- Page 25 and 26:

M6 GROUP PRESENTATIONChange in the

- Page 27 and 28:

M6 GROUP PRESENTATIONshown-before s

- Page 29 and 30:

M6 GROUP PRESENTATIONIn order to co

- Page 31 and 32:

M6 GROUP PRESENTATIONSND was the le

- Page 33 and 34:

M6 GROUP PRESENTATIONa) Business pr

- Page 35 and 36:

M6 GROUP PRESENTATIONExcerpt of Top

- Page 37 and 38:

M6 GROUP PRESENTATIONMistergooddeal

- Page 39 and 40:

M6 GROUP PRESENTATIONwill be built

- Page 41 and 42:

M6 GROUP PRESENTATIONSTATUTORY ALLO

- Page 43 and 44:

M6 GROUP PRESENTATIONHowever, a Gen

- Page 45 and 46:

M6 GROUP PRESENTATIONAs a network w

- Page 47 and 48:

M6 GROUP PRESENTATIONb) Provisions

- Page 49 and 50:

M6 GROUP PRESENTATIONThe amendment

- Page 51 and 52:

CORPORATE GOVERNANCECORPORATE GOVER

- Page 53 and 54:

CORPORATE GOVERNANCEMembers of the

- Page 55 and 56:

CORPORATE GOVERNANCE- Chairman of t

- Page 57 and 58:

CORPORATE GOVERNANCE- Manager of P7

- Page 59 and 60:

CORPORATE GOVERNANCEAppointments an

- Page 61 and 62:

CORPORATE GOVERNANCEDelphine ARNAUL

- Page 63 and 64:

CORPORATE GOVERNANCEThe missions an

- Page 65 and 66:

CORPORATE GOVERNANCE- Director of C

- Page 67 and 68:

CORPORATE GOVERNANCEcharge of imple

- Page 69 and 70:

CORPORATE GOVERNANCEJérôme Leféb

- Page 71 and 72:

CORPORATE GOVERNANCEa) Basis of com

- Page 73 and 74:

CORPORATE GOVERNANCEtwo years of ad

- Page 75 and 76:

CORPORATE GOVERNANCEb) Free shares

- Page 77 and 78:

CORPORATE GOVERNANCERobin LEPROUX 2

- Page 79 and 80:

CORPORATE GOVERNANCE- no family con

- Page 81 and 82:

CORPORATE GOVERNANCEEight of these

- Page 83 and 84:

CORPORATE GOVERNANCEMinutes are pre

- Page 85 and 86:

CORPORATE GOVERNANCEonce a year and

- Page 87 and 88:

CORPORATE GOVERNANCE• matters rel

- Page 89 and 90:

CORPORATE GOVERNANCE- Excluding Rob

- Page 91 and 92:

CORPORATE GOVERNANCE5.1.3 Allocatio

- Page 93 and 94:

CORPORATE GOVERNANCE- an Ethics Cha

- Page 95 and 96:

CORPORATE GOVERNANCEAt the balance

- Page 97 and 98:

CORPORATE GOVERNANCEbecoming famili

- Page 99 and 100:

CORPORATE GOVERNANCESHARE CAPITAL33

- Page 101 and 102:

SHARE CAPITALStock market performan

- Page 103 and 104:

SHARE CAPITAL3.4. Cash dividend pol

- Page 105 and 106:

SHARE CAPITAL- At least one third o

- Page 107 and 108:

SHARE CAPITALChange in the number o

- Page 109 and 110:

SHARE CAPITALTreasury shares alloca

- Page 111 and 112:

SHARE CAPITALDate of General Meetin

- Page 113 and 114:

SHARE CAPITALDate of General Meetin

- Page 115 and 116:

SHARE CAPITALControlled companies h

- Page 117 and 118:

SHARE CAPITAL3.10.4.4. Identificati

- Page 119 and 120:

RISK FACTORS AND MANAGEMENTRISK FAC

- Page 121 and 122:

RISK FACTORS AND MANAGEMENT4.1.2. D

- Page 123 and 124:

RISK FACTORS AND MANAGEMENT4.1.5. P

- Page 125 and 126:

RISK FACTORS AND MANAGEMENTIt is po

- Page 127 and 128:

RISK FACTORS AND MANAGEMENT4.5.3. R

- Page 129 and 130:

RISK FACTORS AND MANAGEMENTc) Exclu

- Page 131 and 132:

RISK FACTORS AND MANAGEMENT• the

- Page 133 and 134: RISK FACTORS AND MANAGEMENT4.7. Ind

- Page 135 and 136: 2012 FINANCIAL REPORT2012 FINANCIAL

- Page 137 and 138: 2012 FINANCIAL REPORT5.1.1.2. Conso

- Page 139 and 140: 2012 FINANCIAL REPORT5.1.2.2. M6 TV

- Page 141 and 142: 2012 FINANCIAL REPORTAdvertising an

- Page 143 and 144: 2012 FINANCIAL REPORT- the disposal

- Page 145 and 146: 2012 FINANCIAL REPORTthe reliabilit

- Page 147 and 148: 2012 FINANCIAL REPORTIt sets and de

- Page 149 and 150: 2012 FINANCIAL REPORTParent company

- Page 151 and 152: 2012 FINANCIAL REPORT5.4.3. Diversi

- Page 153 and 154: 2012 FINANCIAL REPORT2012 FINANCIAL

- Page 155 and 156: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 157 and 158: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 159 and 160: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 161 and 162: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 163 and 164: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 165 and 166: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 167 and 168: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 169 and 170: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 171 and 172: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 173 and 174: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 175 and 176: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 177 and 178: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 179 and 180: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 181 and 182: 2012 FINANCIAL STATEMENTS AND RELAT

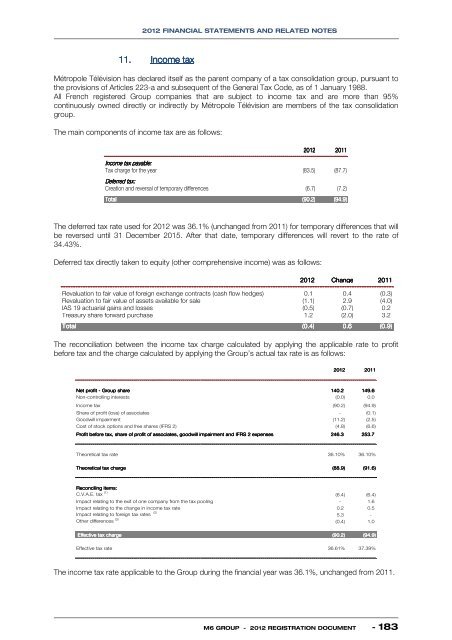

- Page 183: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 187 and 188: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 189 and 190: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 191 and 192: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 193 and 194: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 195 and 196: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 197 and 198: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 199 and 200: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 201 and 202: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 203 and 204: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 205 and 206: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 207 and 208: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 209 and 210: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 211 and 212: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 213 and 214: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 215 and 216: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 217 and 218: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 219 and 220: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 221 and 222: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 223 and 224: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 225 and 226: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 227 and 228: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 229 and 230: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 231 and 232: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 233 and 234: 2012 FINANCIAL STATEMENTS AND RELAT

- Page 235 and 236:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 237 and 238:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 239 and 240:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 241 and 242:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 243 and 244:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 245 and 246:

2012 FINANCIAL STATEMENTS AND RELAT

- Page 247 and 248:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 249 and 250:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 251 and 252:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 253 and 254:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 255 and 256:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 257 and 258:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 259 and 260:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 261 and 262:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 263 and 264:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 265 and 266:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 267 and 268:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 269 and 270:

SUSTAINABLE DEVELOPMENT AND CORPORA

- Page 271 and 272:

COMBINED GENERAL MEETING OF 13 MAY

- Page 273 and 274:

COMBINED GENERAL MEETING8.2. Report

- Page 275 and 276:

COMBINED GENERAL MEETING8.3. Report

- Page 277 and 278:

COMBINED GENERAL MEETINGIn ordinary

- Page 279 and 280:

COMBINED GENERAL MEETING- ensure ad

- Page 281 and 282:

COMBINED GENERAL MEETINGOTHER INFOR

- Page 283 and 284:

OTHER INFORMATION9.4. Person respon

- Page 285 and 286:

OTHER INFORMATION14. ADMINISTRATIVE

- Page 287 and 288:

OTHER INFORMATIONiv.Reports of the

- Page 290:

288 - M6 GROUP - 2012 REGISTRATION