Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

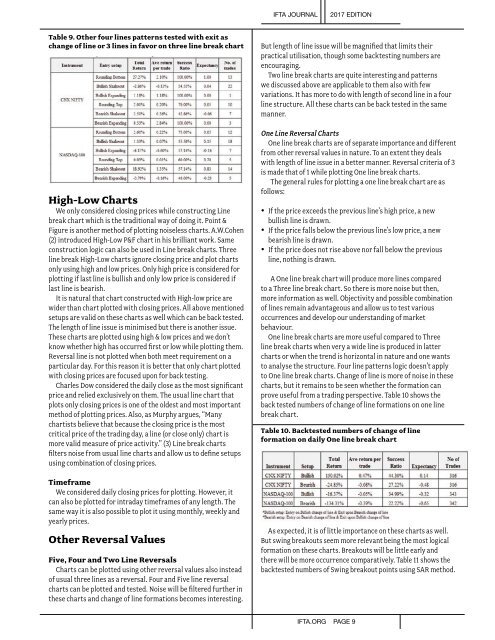

Table 9. Other four lines patterns tested with exit as<br />

change of line or 3 lines in favor on three line break chart<br />

High-Low Charts<br />

We only considered closing prices while constructing Line<br />

break chart which is the traditional way of doing it. Point &<br />

Figure is another method of plotting noiseless charts. A.W.Cohen<br />

(2) introduced High-Low P&F chart in his brilliant work. Same<br />

construction logic can also be used in Line break charts. Three<br />

line break High-Low charts ignore closing price and plot charts<br />

only using high and low prices. Only high price is considered for<br />

plotting if last line is bullish and only low price is considered if<br />

last line is bearish.<br />

It is natural that chart constructed with High-low price are<br />

wider than chart plotted with closing prices. All above mentioned<br />

setups are valid on these charts as well which can be back tested.<br />

The length of line issue is minimised but there is another issue.<br />

These charts are plotted using high & low prices and we don’t<br />

know whether high has occurred first or low while plotting them.<br />

Reversal line is not plotted when both meet requirement on a<br />

particular day. For this reason it is better that only chart plotted<br />

with closing prices are focused upon for back testing.<br />

Charles Dow considered the daily close as the most significant<br />

price and relied exclusively on them. The usual line chart that<br />

plots only closing prices is one of the oldest and most important<br />

method of plotting prices. Also, as Murphy argues, “Many<br />

chartists believe that because the closing price is the most<br />

critical price of the trading day, a line (or close only) chart is<br />

more valid measure of price activity.” (3) Line break charts<br />

filters noise from usual line charts and allow us to define setups<br />

using combination of closing prices.<br />

Timeframe<br />

We considered daily closing prices for plotting. However, it<br />

can also be plotted for intraday timeframes of any length. The<br />

same way it is also possible to plot it using monthly, weekly and<br />

yearly prices.<br />

Other Reversal Values<br />

Five, Four and Two Line Reversals<br />

Charts can be plotted using other reversal values also instead<br />

of usual three lines as a reversal. Four and Five line reversal<br />

charts can be plotted and tested. Noise will be filtered further in<br />

these charts and change of line formations becomes interesting.<br />

But length of line issue will be magnified that limits their<br />

practical utilisation, though some backtesting numbers are<br />

encouraging.<br />

Two line break charts are quite interesting and patterns<br />

we discussed above are applicable to them also with few<br />

variations. It has more to do with length of second line in a four<br />

line structure. All these charts can be back tested in the same<br />

manner.<br />

One Line Reversal Charts<br />

One line break charts are of separate importance and different<br />

from other reversal values in nature. To an extent they deals<br />

with length of line issue in a better manner. Reversal criteria of 3<br />

is made that of 1 while plotting One line break charts.<br />

The general rules for plotting a one line break chart are as<br />

follows:<br />

• If the price exceeds the previous line’s high price, a new<br />

bullish line is drawn.<br />

• If the price falls below the previous line’s low price, a new<br />

bearish line is drawn.<br />

• If the price does not rise above nor fall below the previous<br />

line, nothing is drawn.<br />

A One line break chart will produce more lines compared<br />

to a Three line break chart. So there is more noise but then,<br />

more information as well. Objectivity and possible combination<br />

of lines remain advantageous and allow us to test various<br />

occurrences and develop our understanding of market<br />

behaviour.<br />

One line break charts are more useful compared to Three<br />

line break charts when very a wide line is produced in latter<br />

charts or when the trend is horizontal in nature and one wants<br />

to analyse the structure. Four line patterns logic doesn’t apply<br />

to One line break charts. Change of line is more of noise in these<br />

charts, but it remains to be seen whether the formation can<br />

prove useful from a trading perspective. Table 10 shows the<br />

back tested numbers of change of line formations on one line<br />

break chart.<br />

Table 10. Backtested numbers of change of line<br />

formation on daily One line break chart<br />

As expected, it is of little importance on these charts as well.<br />

But swing breakouts seem more relevant being the most logical<br />

formation on these charts. Breakouts will be little early and<br />

there will be more occurrence comparatively. Table 11 shows the<br />

backtested numbers of Swing breakout points using SAR method.<br />

IFTA.ORG PAGE 9