Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

since Jegadeesh and Titman’s study depicts and reinforces the<br />

profits of momentum over different facets in the markets.<br />

Up to Antonacci (2012), momentum has been explored<br />

from using either cross-sectional momentum or timeframe<br />

momentum. In Antonacci’s Risk Premia Harvesting Through Dual<br />

Momentum, he argues that using the two momentums in tandem<br />

with each other will enhance the returns. The results generated<br />

from the study portray exactly that, and further depict that<br />

using them in tandem makes diversification more efficient.<br />

Following Li, Xiaofei; Brooks, Chris; Miffre, Joelle (2009),<br />

trading falling stocks is more “expensive” than trading booming<br />

stocks. Through this idea, the paper “Low-Cost Momentum<br />

Strategies” attempts to define a new momentum whereby there<br />

is a relationship between the transaction costs and the volume<br />

traded; this relationship only materializes when selling, not<br />

when buying. The results reinforce the idea that “the strategies<br />

that shortlist the 10%, 20% and 50% of winners and losers with<br />

the lowest total transaction costs generate average net returns<br />

of 18.24%, 15.84%, and 12.49%, respectively.” (page 12).<br />

The Fama–French three-factor model was a method of<br />

measuring market returns, and through research, it was<br />

uncovered that value stocks outperform growth stocks. Carhart<br />

(1997) provided an extension to the model and included another<br />

factor—momentum; more specifically, monthly momentum, and<br />

ultimately suggests that the four-factor model is predominantly<br />

a more effective method of predicting market returns.<br />

Methodology<br />

Signaling<br />

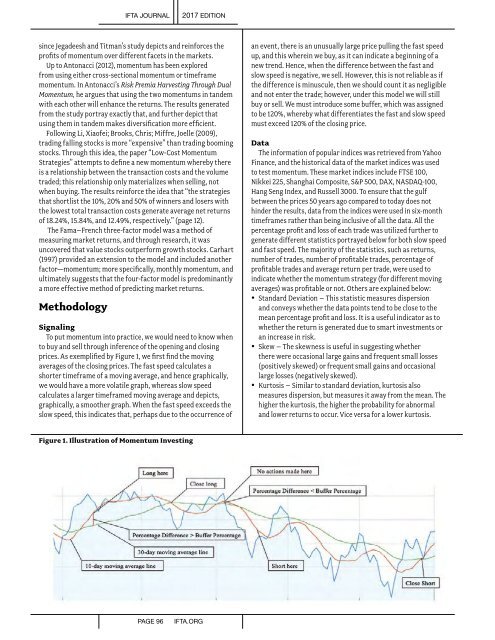

To put momentum into practice, we would need to know when<br />

to buy and sell through inference of the opening and closing<br />

prices. As exemplified by Figure 1, we first find the moving<br />

averages of the closing prices. The fast speed calculates a<br />

shorter timeframe of a moving average, and hence graphically,<br />

we would have a more volatile graph, whereas slow speed<br />

calculates a larger timeframed moving average and depicts,<br />

graphically, a smoother graph. When the fast speed exceeds the<br />

slow speed, this indicates that, perhaps due to the occurrence of<br />

an event, there is an unusually large price pulling the fast speed<br />

up, and this wherein we buy, as it can indicate a beginning of a<br />

new trend. Hence, when the difference between the fast and<br />

slow speed is negative, we sell. However, this is not reliable as if<br />

the difference is minuscule, then we should count it as negligible<br />

and not enter the trade; however, under this model we will still<br />

buy or sell. We must introduce some buffer, which was assigned<br />

to be 120%, whereby what differentiates the fast and slow speed<br />

must exceed 120% of the closing price.<br />

Data<br />

The information of popular indices was retrieved from Yahoo<br />

Finance, and the historical data of the market indices was used<br />

to test momentum. These market indices include FTSE 100,<br />

Nikkei 225, Shanghai Composite, S&P 500, DAX, NASDAQ-100,<br />

Hang Seng Index, and Russell 3000. To ensure that the gulf<br />

between the prices 50 years ago compared to today does not<br />

hinder the results, data from the indices were used in six-month<br />

timeframes rather than being inclusive of all the data. All the<br />

percentage profit and loss of each trade was utilized further to<br />

generate different statistics portrayed below for both slow speed<br />

and fast speed. The majority of the statistics, such as returns,<br />

number of trades, number of profitable trades, percentage of<br />

profitable trades and average return per trade, were used to<br />

indicate whether the momentum strategy (for different moving<br />

averages) was profitable or not. Others are explained below:<br />

• Standard Deviation – This statistic measures dispersion<br />

and conveys whether the data points tend to be close to the<br />

mean percentage profit and loss. It is a useful indicator as to<br />

whether the return is generated due to smart investments or<br />

an increase in risk.<br />

• Skew – The skewness is useful in suggesting whether<br />

there were occasional large gains and frequent small losses<br />

(positively skewed) or frequent small gains and occasional<br />

large losses (negatively skewed).<br />

• Kurtosis – Similar to standard deviation, kurtosis also<br />

measures dispersion, but measures it away from the mean. The<br />

higher the kurtosis, the higher the probability for abnormal<br />

and lower returns to occur. Vice versa for a lower kurtosis.<br />

Figure 1. Illustration of Momentum Investing<br />

PAGE 96<br />

IFTA.ORG