Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

The Significance of the 400-Day Moving Average as a<br />

Sell Signal as Compared to Other Moving Averages<br />

By Jordan Roy-Byrne, CMT, MFTA<br />

Jordan Roy-Byrne, CMT, MFTA<br />

Jordan@TheDailyGold.com<br />

5101 25 th Ave NE, #C135<br />

Seattle, WA 98105<br />

(206) 973-7843<br />

Abstract<br />

This paper compares the efficacy and viability of four moving<br />

averages as sell signals. Using monthly equivalents (10-month<br />

moving average for the 200-day moving average and 20-month<br />

moving average for the 400-day moving average) we compiled<br />

data as to how a market performed after it closed below those<br />

monthly moving averages. We specifically recorded how far<br />

the market declined from the break of the moving average<br />

to its next low. We recorded all instances and summarized<br />

our findings with an average decline and median decline. We<br />

applied this study to eight different markets: S&P 500, Emerging<br />

Markets, Nasdaq, Nikkei Hong Kong, Commodities (CCI), Gold<br />

and Oil. The results as to which moving averages produced the<br />

best sell signals varied between markets and asset classes.<br />

However, for the entire study, the 20-month and 30-month<br />

moving average sell signals produced the best results. The<br />

20-month moving average sell signal was best for the S&P 500<br />

and Emerging Markets. The 10-month moving average and<br />

median sell signal (proxy for 200-day moving average) shows<br />

very little viability and efficacy in comparison to the longer<br />

period moving averages.<br />

Introduction<br />

The study of moving averages is a key component of technical<br />

analysis. Both novice and professional practitioners of technical<br />

analysis use a variety of and combination of moving averages in<br />

their trading and investing. Advanced practitioners will often<br />

use a combination of exponential (recent data weighted more<br />

heavily) moving averages and simple (all data weighted equally)<br />

moving averages. Basic moving average analysis starts with the<br />

simple 50- and 200-day moving averages.<br />

Conventional wisdom is that the 200-day moving average is<br />

the most important moving average. It is a huge focus of basic<br />

moving average analysis and is always discussed publicly when<br />

the stock market starts to roll over. Famed trader and fund<br />

manager Paul Tudor Jones spoke about this in a rare interview<br />

over 15 years ago:<br />

My metric for everything I look at is the 200-day<br />

moving average of closing prices. I’ve seen too many<br />

things go to zero, stocks and commodities. The whole<br />

trick in investing is: “How do I keep from losing<br />

everything?” If you use the 200-day moving average<br />

rule, then you get out. You play defense and you get out.<br />

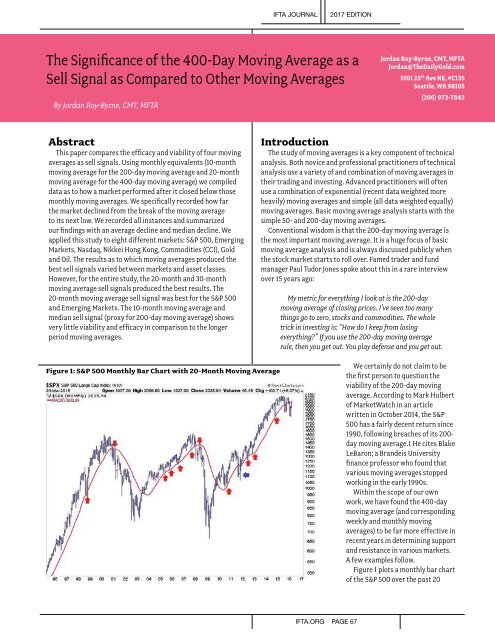

Figure 1: S&P 500 Monthly Bar Chart with 20-Month Moving Average<br />

We certainly do not claim to be<br />

the first person to question the<br />

viability of the 200-day moving<br />

average. According to Mark Hulbert<br />

of MarketWatch in an article<br />

written in October 2014, the S&P<br />

500 has a fairly decent return since<br />

1990, following breaches of its 200-<br />

day moving average.1 He cites Blake<br />

LeBaron; a Brandeis University<br />

finance professor who found that<br />

various moving averages stopped<br />

working in the early 1990s.<br />

Within the scope of our own<br />

work, we have found the 400-day<br />

moving average (and corresponding<br />

weekly and monthly moving<br />

averages) to be far more effective in<br />

recent years in determining support<br />

and resistance in various markets.<br />

A few examples follow.<br />

Figure 1 plots a monthly bar chart<br />

of the S&P 500 over the past 20<br />

IFTA.ORG PAGE 67