Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

Table 2. Results of Hasbro, Inc. (HAS) When SCTR Is<br />

Greater Than 75<br />

Price<br />

in 2007<br />

Price<br />

in 2015<br />

Range<br />

Maximum<br />

Hasbro # Days<br />

Hasbro 1,977 $21.73 $74.44 $66.80<br />

# Days<br />

Total<br />

Days<br />

% of<br />

Time in<br />

Market<br />

# of<br />

Trades<br />

Percent<br />

Profitable<br />

Cumulative<br />

Gain<br />

Bear Market 202 320 63% 13 62% $3.87<br />

Bull Market 442 1657 27% 33 45% $21.55<br />

Both<br />

Markets<br />

644 1977 33% 46 50% $25.42<br />

Runs Longer<br />

Than 5 Days<br />

566 10 80% $29.86<br />

Waiting for a<br />

Weekly Entry<br />

526 10 60% $22.95<br />

Entry<br />

Difference<br />

-20% -23%<br />

The Average Gain for Hasbro depending on the primary trend is<br />

shown in Table 3.<br />

Table 3. Results of Hasbro, Inc. (HAS) Average Gain/Trade<br />

Hasbro Bear Market Bull Market<br />

Average Loss $(0.52) $(0.65)<br />

Average Gain $0.88 $2.22<br />

Apple, Inc.<br />

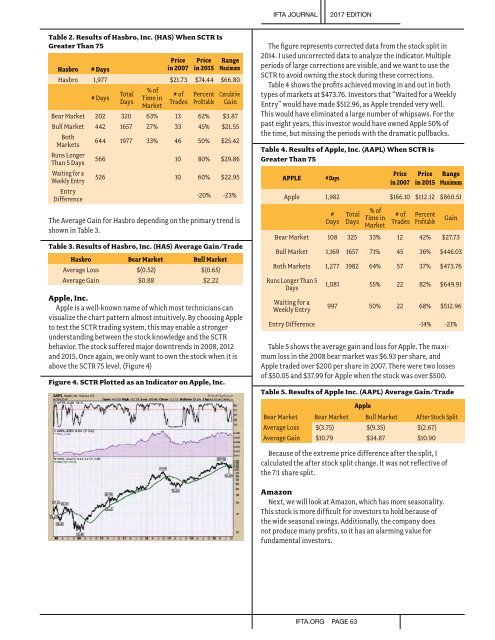

Apple is a well-known name of which most technicians can<br />

visualize the chart pattern almost intuitively. By choosing Apple<br />

to test the SCTR trading system, this may enable a stronger<br />

understanding between the stock knowledge and the SCTR<br />

behavior. The stock suffered major downtrends in 2008, 2012<br />

and 2015. Once again, we only want to own the stock when it is<br />

above the SCTR 75 level. (Figure 4)<br />

Figure 4. SCTR Plotted as an Indicator on Apple, Inc.<br />

The figure represents corrected data from the stock split in<br />

2014. I used uncorrected data to analyze the indicator. Multiple<br />

periods of large corrections are visible, and we want to use the<br />

SCTR to avoid owning the stock during these corrections.<br />

Table 4 shows the profits achieved moving in and out in both<br />

types of markets at $473.76. Investors that “Waited for a Weekly<br />

Entry” would have made $512.96, as Apple trended very well.<br />

This would have eliminated a large number of whipsaws. For the<br />

past eight years, this investor would have owned Apple 50% of<br />

the time, but missing the periods with the dramatic pullbacks.<br />

Table 4. Results of Apple, Inc. (AAPL) When SCTR Is<br />

Greater Than 75<br />

APPLE # Days<br />

Price<br />

in 2007<br />

Price<br />

in 2015<br />

Range<br />

Maximum<br />

Apple 1,982 $166.10 $112.12 $860.51<br />

#<br />

Days<br />

Total<br />

Days<br />

% of<br />

Time in<br />

Market<br />

# of<br />

Trades<br />

Percent<br />

Profitable<br />

Gain<br />

Bear Market 108 325 33% 12 42% $27.73<br />

Bull Market 1,169 1657 71% 45 36% $446.03<br />

Both Markets 1,277 1982 64% 57 37% $473.76<br />

Runs Longer Than 5<br />

Days<br />

Waiting for a<br />

Weekly Entry<br />

1,081 55% 22 82% $649.91<br />

997 50% 22 68% $512.96<br />

Entry Difference -14% -21%<br />

Table 5 shows the average gain and loss for Apple. The maximum<br />

loss in the 2008 bear market was $6.93 per share, and<br />

Apple traded over $200 per share in 2007. There were two losses<br />

of $50.05 and $37.99 for Apple when the stock was over $500.<br />

Table 5. Results of Apple Inc. (AAPL) Average Gain/Trade<br />

Apple<br />

Bear Market Bear Market Bull Market After Stock Split<br />

Average Loss $(3.75) $(9.35) $(2.67)<br />

Average Gain $10.79 $34.87 $10.90<br />

Because of the extreme price difference after the split, I<br />

calculated the after stock split change. It was not reflective of<br />

the 7:1 share split.<br />

Amazon<br />

Next, we will look at Amazon, which has more seasonality.<br />

This stock is more difficult for investors to hold because of<br />

the wide seasonal swings. Additionally, the company does<br />

not produce many profits, so it has an alarming value for<br />

fundamental investors.<br />

IFTA.ORG PAGE 63