Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

was corrected for 5-day moving average. Based on the following<br />

definitions, trend was verified seeing price transition.<br />

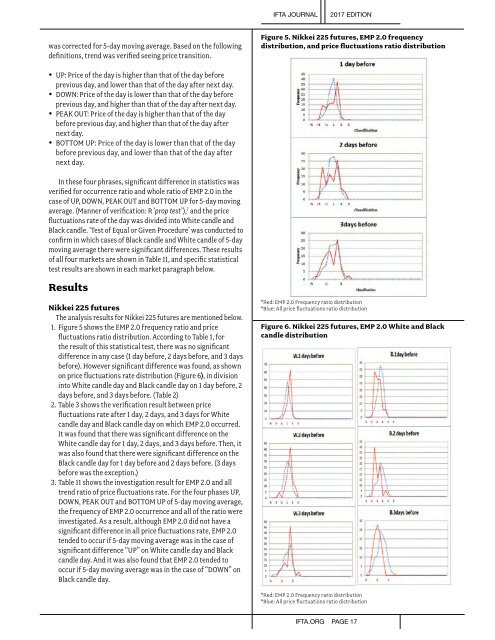

Figure 5. Nikkei 225 futures, EMP 2.0 frequency<br />

distribution, and price fluctuations ratio distribution<br />

• UP: Price of the day is higher than that of the day before<br />

previous day, and lower than that of the day after next day.<br />

• DOWN: Price of the day is lower than that of the day before<br />

previous day, and higher than that of the day after next day.<br />

• PEAK OUT: Price of the day is higher than that of the day<br />

before previous day, and higher than that of the day after<br />

next day.<br />

• BOTTOM UP: Price of the day is lower than that of the day<br />

before previous day, and lower than that of the day after<br />

next day.<br />

In these four phrases, significant difference in statistics was<br />

verified for occurrence ratio and whole ratio of EMP 2.0 in the<br />

case of UP, DOWN, PEAK OUT and BOTTOM UP for 5-day moving<br />

average. (Manner of verification: R ‘prop test’), 7 and the price<br />

fluctuations rate of the day was divided into White candle and<br />

Black candle. ‘Test of Equal or Given Procedure’ was conducted to<br />

confirm in which cases of Black candle and White candle of 5-day<br />

moving average there were significant differences. These results<br />

of all four markets are shown in Table 11, and specific statistical<br />

test results are shown in each market paragraph below.<br />

Results<br />

Nikkei 225 futures<br />

The analysis results for Nikkei 225 futures are mentioned below.<br />

1. Figure 5 shows the EMP 2.0 frequency ratio and price<br />

fluctuations ratio distribution. According to Table 1, for<br />

the result of this statistical test, there was no significant<br />

difference in any case (1 day before, 2 days before, and 3 days<br />

before). However significant difference was found, as shown<br />

on price fluctuations rate distribution (Figure 6), in division<br />

into White candle day and Black candle day on 1 day before, 2<br />

days before, and 3 days before. (Table 2)<br />

2. Table 3 shows the verification result between price<br />

fluctuations rate after 1 day, 2 days, and 3 days for White<br />

candle day and Black candle day on which EMP 2.0 occurred.<br />

It was found that there was significant difference on the<br />

White candle day for 1 day, 2 days, and 3 days before. Then, it<br />

was also found that there were significant difference on the<br />

Black candle day for 1 day before and 2 days before. (3 days<br />

before was the exception.)<br />

3. Table 11 shows the investigation result for EMP 2.0 and all<br />

trend ratio of price fluctuations rate. For the four phases UP,<br />

DOWN, PEAK OUT and BOTTOM UP of 5-day moving average,<br />

the frequency of EMP 2.0 occurrence and all of the ratio were<br />

investigated. As a result, although EMP 2.0 did not have a<br />

significant difference in all price fluctuations rate, EMP 2.0<br />

tended to occur if 5-day moving average was in the case of<br />

significant difference “UP” on White candle day and Black<br />

candle day. And it was also found that EMP 2.0 tended to<br />

occur if 5-day moving average was in the case of “DOWN” on<br />

Black candle day.<br />

*Red: EMP 2.0 Frequency ratio distribution<br />

*Blue: All price fluctuations ratio distribution<br />

Figure 6. Nikkei 225 futures, EMP 2.0 White and Black<br />

candle distribution<br />

*Red: EMP 2.0 Frequency ratio distribution<br />

*Blue: All price fluctuations ratio distribution<br />

IFTA.ORG PAGE 17