Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

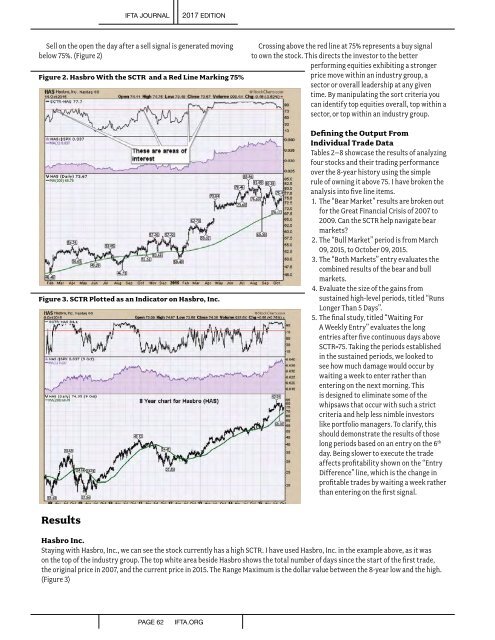

Sell on the open the day after a sell signal is generated moving<br />

below 75%. (Figure 2)<br />

Figure 2. Hasbro With the SCTR and a Red Line Marking 75%<br />

Figure 3. SCTR Plotted as an Indicator on Hasbro, Inc.<br />

Crossing above the red line at 75% represents a buy signal<br />

to own the stock. This directs the investor to the better<br />

performing equities exhibiting a stronger<br />

price move within an industry group, a<br />

sector or overall leadership at any given<br />

time. By manipulating the sort criteria you<br />

can identify top equities overall, top within a<br />

sector, or top within an industry group.<br />

Defining the Output From<br />

Individual Trade Data<br />

Tables 2–8 showcase the results of analyzing<br />

four stocks and their trading performance<br />

over the 8-year history using the simple<br />

rule of owning it above 75. I have broken the<br />

analysis into five line items.<br />

1. The “Bear Market” results are broken out<br />

for the Great Financial Crisis of 2007 to<br />

2009. Can the SCTR help navigate bear<br />

markets?<br />

2. The “Bull Market” period is from March<br />

09, 2015, to October 09, 2015.<br />

3. The “Both Markets” entry evaluates the<br />

combined results of the bear and bull<br />

markets.<br />

4. Evaluate the size of the gains from<br />

sustained high-level periods, titled “Runs<br />

Longer Than 5 Days”.<br />

5. The final study, titled “Waiting For<br />

A Weekly Entry” evaluates the long<br />

entries after five continuous days above<br />

SCTR=75. Taking the periods established<br />

in the sustained periods, we looked to<br />

see how much damage would occur by<br />

waiting a week to enter rather than<br />

entering on the next morning. This<br />

is designed to eliminate some of the<br />

whipsaws that occur with such a strict<br />

criteria and help less nimble investors<br />

like portfolio managers. To clarify, this<br />

should demonstrate the results of those<br />

long periods based on an entry on the 6 th<br />

day. Being slower to execute the trade<br />

affects profitability shown on the “Entry<br />

Difference” line, which is the change in<br />

profitable trades by waiting a week rather<br />

than entering on the first signal.<br />

Results<br />

Hasbro Inc.<br />

Staying with Hasbro, Inc., we can see the stock currently has a high SCTR. I have used Hasbro, Inc. in the example above, as it was<br />

on the top of the industry group. The top white area beside Hasbro shows the total number of days since the start of the first trade,<br />

the original price in 2007, and the current price in 2015. The Range Maximum is the dollar value between the 8-year low and the high.<br />

(Figure 3)<br />

PAGE 62<br />

IFTA.ORG