You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

years that includes the 20-month moving average. The moving<br />

average has been a near perfect trend indicator over the past<br />

20 years. The red arrows show the MA’s clean signals, while the<br />

blue arrows show the failed signals. We did not include the two<br />

recent failed signals. Those notwithstanding, the 20-month<br />

moving average has been an excellent indicator and certainly<br />

superior to the 10-month moving average (the equivalent of the<br />

200-day moving average).<br />

Figure 2: MSCI Emerging Markets Free Index with 20-Month Moving Average<br />

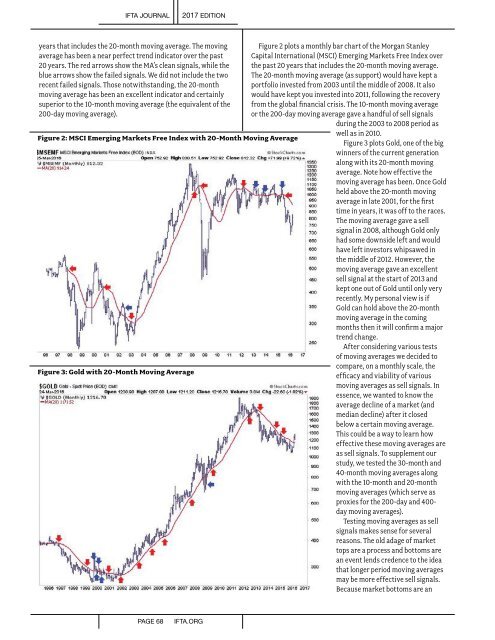

Figure 3: Gold with 20-Month Moving Average<br />

Figure 2 plots a monthly bar chart of the Morgan Stanley<br />

Capital International (MSCI) Emerging Markets Free Index over<br />

the past 20 years that includes the 20-month moving average.<br />

The 20-month moving average (as support) would have kept a<br />

portfolio invested from 2003 until the middle of 2008. It also<br />

would have kept you invested into 2011, following the recovery<br />

from the global financial crisis. The 10-month moving average<br />

or the 200-day moving average gave a handful of sell signals<br />

during the 2003 to 2008 period as<br />

well as in 2010.<br />

Figure 3 plots Gold, one of the big<br />

winners of the current generation<br />

along with its 20-month moving<br />

average. Note how effective the<br />

moving average has been. Once Gold<br />

held above the 20-month moving<br />

average in late 2001, for the first<br />

time in years, it was off to the races.<br />

The moving average gave a sell<br />

signal in 2008, although Gold only<br />

had some downside left and would<br />

have left investors whipsawed in<br />

the middle of 2012. However, the<br />

moving average gave an excellent<br />

sell signal at the start of 2013 and<br />

kept one out of Gold until only very<br />

recently. My personal view is if<br />

Gold can hold above the 20-month<br />

moving average in the coming<br />

months then it will confirm a major<br />

trend change.<br />

After considering various tests<br />

of moving averages we decided to<br />

compare, on a monthly scale, the<br />

efficacy and viability of various<br />

moving averages as sell signals. In<br />

essence, we wanted to know the<br />

average decline of a market (and<br />

median decline) after it closed<br />

below a certain moving average.<br />

This could be a way to learn how<br />

effective these moving averages are<br />

as sell signals. To supplement our<br />

study, we tested the 30-month and<br />

40-month moving averages along<br />

with the 10-month and 20-month<br />

moving averages (which serve as<br />

proxies for the 200-day and 400-<br />

day moving averages).<br />

Testing moving averages as sell<br />

signals makes sense for several<br />

reasons. The old adage of market<br />

tops are a process and bottoms are<br />

an event lends credence to the idea<br />

that longer period moving averages<br />

may be more effective sell signals.<br />

Because market bottoms are an<br />

PAGE 68<br />

IFTA.ORG