Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

StockCharts Technical Ranking (SCTR) System: How<br />

the SCTR Indicator Can Help Novice and Advanced<br />

Investors Rapidly Evaluate a Stock in Real Time<br />

By Gregory Allen Schnell, CMT, MFTA<br />

Gregory Allen Schnell, CMT, MFTA<br />

StockCharts.com<br />

gregs@stockcharts.com<br />

144 Lake Mead Crescent SE<br />

Calgary, AB, T2J 4A1<br />

+1 (403) 999 - 7647<br />

Abstract<br />

This paper defines the StockCharts Technical Ranking<br />

(SCTR)© indicator. The indicator has four main features. It<br />

ranks how a stock price action is performing to a large peer<br />

group in real time, assigning a value between 0–100. SCTR<br />

plots the history of the stock’s relative performance, including<br />

current value. The value does not change across different<br />

plotted time frames of hourly, daily or monthly. The SCTR<br />

provides a single value for a stock performance compared to its<br />

peers for use by technical or fundamental investing styles.<br />

Introduction<br />

This paper defines how I use the StockCharts.com Technical<br />

Ranking (SCTR)© indicator. This paper is also the first<br />

introduction of the SCTR to the global professional community<br />

of technical analysis. The indicator has been presented in<br />

workshops designed to help users of the StockCharts.com<br />

website over the years. It was recently refined in 2014. This<br />

documents one of the many interpretations and uses for the<br />

data of the plotted indicator to demonstrate the relative value.<br />

The four features of the SCTR<br />

The indicator has four main features. The SCTR ranks how a<br />

stock price action is performing relative to a defined peer group<br />

in real time. This is a larger group than just an industry group.<br />

StockCharts.com has created three groups based on Market Cap<br />

in large markets like the U.S. market. The SCTR gives a value<br />

between 0–100. A ranking of 94 would suggest the stock is<br />

behaving better than 94% of the stocks in the peer group.<br />

Secondly, when plotted as an indicator, it also shows the<br />

history of the stock’s relative performance to its group. The<br />

value of the SCTR indicator at a point in time is the same across<br />

all timeframes of minute, 10-minute, hourly, daily or monthly.<br />

The SCTR indicator has the ability to quickly outline a stock’s<br />

performance compared to its peers in one number for use by<br />

technical or fundamental investing styles. It can educate new<br />

or experienced investors by calculating a value for the relative<br />

quality of price movement even though they all have a different<br />

price. The SCTR quickly disseminates which stocks have better<br />

price action than others. Once the indicator is explained,<br />

investors can quickly evaluate a stock’s relative price action<br />

compared to other stocks in the group in a tabular or chart<br />

format. Apple currently has an SCTR of 31.5, and this paper will<br />

supply information on understanding that value.<br />

The last benefit of the SCTR is that it helps investors<br />

eventually get a portfolio of very fast-moving stocks and<br />

provides a simple exit plan to retain the gains. When you are in<br />

very strong SCTR stocks and each one is trending very quickly,<br />

your portfolio can capture dynamic, outsized gains, and the<br />

indicator leads you to these stocks every day.<br />

Materials and Methods<br />

Calculating an SCTR<br />

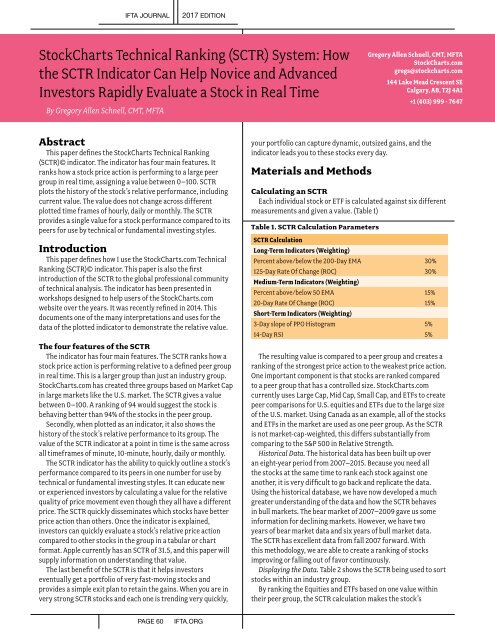

Each individual stock or ETF is calculated against six different<br />

measurements and given a value. (Table 1)<br />

Table 1. SCTR Calculation Parameters<br />

SCTR Calculation<br />

Long-Term Indicators (Weighting)<br />

Percent above/below the 200-Day EMA 30%<br />

125-Day Rate Of Change (ROC) 30%<br />

Medium-Term Indicators (Weighting)<br />

Percent above/below 50 EMA 15%<br />

20-Day Rate Of Change (ROC) 15%<br />

Short-Term Indicators (Weighting)<br />

3-Day slope of PPO Histogram 5%<br />

14-Day RSI 5%<br />

The resulting value is compared to a peer group and creates a<br />

ranking of the strongest price action to the weakest price action.<br />

One important component is that stocks are ranked compared<br />

to a peer group that has a controlled size. StockCharts.com<br />

currently uses Large Cap, Mid Cap, Small Cap, and ETFs to create<br />

peer comparisons for U.S. equities and ETFs due to the large size<br />

of the U.S. market. Using Canada as an example, all of the stocks<br />

and ETFs in the market are used as one peer group. As the SCTR<br />

is not market-cap-weighted, this differs substantially from<br />

comparing to the S&P 500 in Relative Strength.<br />

Historical Data. The historical data has been built up over<br />

an eight-year period from 2007–2015. Because you need all<br />

the stocks at the same time to rank each stock against one<br />

another, it is very difficult to go back and replicate the data.<br />

Using the historical database, we have now developed a much<br />

greater understanding of the data and how the SCTR behaves<br />

in bull markets. The bear market of 2007–2009 gave us some<br />

information for declining markets. However, we have two<br />

years of bear market data and six years of bull market data.<br />

The SCTR has excellent data from fall 2007 forward. With<br />

this methodology, we are able to create a ranking of stocks<br />

improving or falling out of favor continuously.<br />

Displaying the Data. Table 2 shows the SCTR being used to sort<br />

stocks within an industry group.<br />

By ranking the Equities and ETFs based on one value within<br />

their peer group, the SCTR calculation makes the stock’s<br />

PAGE 60<br />

IFTA.ORG