You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

they are an essential component of almost every volatility or<br />

option pricing formula. The theory holds that stock prices move<br />

over the long and short term in a square root relationship. For<br />

example IBM made a monthly closing low of 4.52 in June, 1962 and<br />

monthly closing high of 125.69 in July, 1999. This is within a few<br />

percentage points of the square of the sum of the square root of<br />

the low price + 9 or (2.12+9)^2. GM made a low of 15 in November,<br />

1974 and a high of 95 in May, 1999. Again, a few percentage points<br />

from the square of the sum of the square root of the low + 6 or<br />

(3.87+6)^2. There are hundreds and hundreds of these examples<br />

across the stock, financial and commodity markets. Even a few<br />

minutes with a pile of stock charts and a calculator will build<br />

confidence that major highs and lows are related to each other by<br />

additions and subtractions to their square roots. The Square of<br />

Nine takes these square root relationships to a different level as<br />

you will learn in the pages ahead.”<br />

“We use the square of odd and even numbers to get not only the<br />

proof of market movements but the cause“ (W. D. Gann, The Basis<br />

of My Forecasting Method (the Geometrical Angles course), p.1. 6<br />

Square of Nine<br />

Before we continue with our illustration, it is important to<br />

know some information about W.D. Gann. He was a financial<br />

advisor and trader in the stock and commodity markets during<br />

the first half of the 20th century. In the 1920s, he developed the<br />

Square of Nine as a financial tool for trading and forecasting.<br />

Methods of using it were taught by W.D. Gann in his private<br />

financial seminars and written trading courses. In his later<br />

books, he started to use Circle of 24 and Hexagon. In the<br />

following paragraphs, the basic concepts that those charts are<br />

drawn upon are going to be explained.<br />

The reason behind the name “Square of Nine”:<br />

In Figure 12, it can be noticed that every circled cell is an odd<br />

square number and the first odd square number is 9, which<br />

is equal to 3*3 and which also comes after the first complete<br />

rotation; thus, the square is called by its cell number “Square of<br />

Nine”. 8<br />

In the upright side in the next figure (Figure 13), it can be<br />

clearly seen that all circled cells are even squares. 9<br />

Figure 12. Origin of “Square of Nine”<br />

Figure 13. Circled Cells Are Even Squares<br />

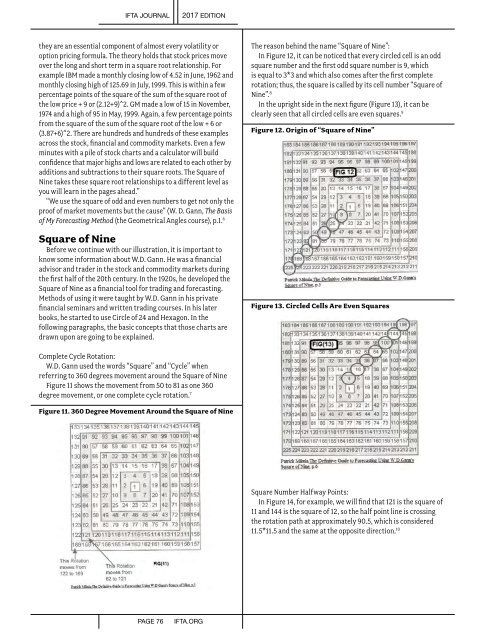

Complete Cycle Rotation:<br />

W.D. Gann used the words “Square” and “Cycle” when<br />

referring to 360 degrees movement around the Square of Nine<br />

Figure 11 shows the movement from 50 to 81 as one 360<br />

degree movement, or one complete cycle rotation. 7<br />

Figure 11. 360 Degree Movement Around the Square of Nine<br />

Square Number Halfway Points:<br />

In Figure 14, for example, we will find that 121 is the square of<br />

11 and 144 is the square of 12, so the half point line is crossing<br />

the rotation path at approximately 90.5, which is considered<br />

11.5*11.5and the same at the opposite direction. 10<br />

PAGE 76<br />

IFTA.ORG