You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

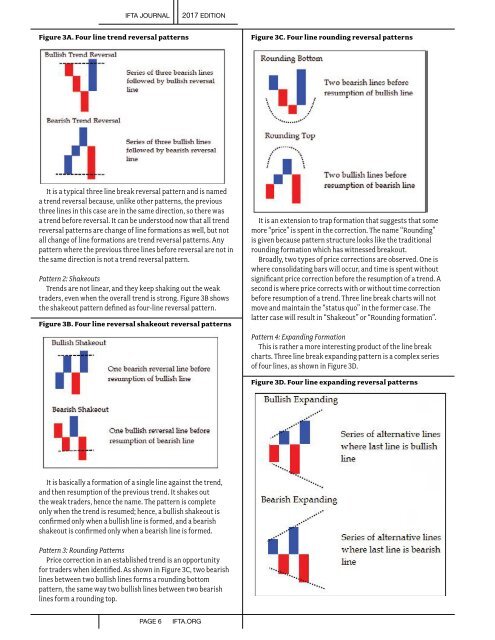

Figure 3A. Four line trend reversal patterns<br />

Figure 3C. Four line rounding reversal patterns<br />

It is a typical three line break reversal pattern and is named<br />

a trend reversal because, unlike other patterns, the previous<br />

three lines in this case are in the same direction, so there was<br />

a trend before reversal. It can be understood now that all trend<br />

reversal patterns are change of line formations as well, but not<br />

all change of line formations are trend reversal patterns. Any<br />

pattern where the previous three lines before reversal are not in<br />

the same direction is not a trend reversal pattern.<br />

Pattern 2: Shakeouts<br />

Trends are not linear, and they keep shaking out the weak<br />

traders, even when the overall trend is strong. Figure 3B shows<br />

the shakeout pattern defined as four-line reversal pattern.<br />

Figure 3B. Four line reversal shakeout reversal patterns<br />

It is an extension to trap formation that suggests that some<br />

more “price” is spent in the correction. The name “Rounding”<br />

is given because pattern structure looks like the traditional<br />

rounding formation which has witnessed breakout.<br />

Broadly, two types of price corrections are observed. One is<br />

where consolidating bars will occur, and time is spent without<br />

significant price correction before the resumption of a trend. A<br />

second is where price corrects with or without time correction<br />

before resumption of a trend. Three line break charts will not<br />

move and maintain the “status quo” in the former case. The<br />

latter case will result in “Shakeout” or “Rounding formation”.<br />

Pattern 4: Expanding Formation<br />

This is rather a more interesting product of the line break<br />

charts. Three line break expanding pattern is a complex series<br />

of four lines, as shown in Figure 3D.<br />

Figure 3D. Four line expanding reversal patterns<br />

It is basically a formation of a single line against the trend,<br />

and then resumption of the previous trend. It shakes out<br />

the weak traders, hence the name. The pattern is complete<br />

only when the trend is resumed; hence, a bullish shakeout is<br />

confirmed only when a bullish line is formed, and a bearish<br />

shakeout is confirmed only when a bearish line is formed.<br />

Pattern 3: Rounding Patterns<br />

Price correction in an established trend is an opportunity<br />

for traders when identified. As shown in Figure 3C, two bearish<br />

lines between two bullish lines forms a rounding bottom<br />

pattern, the same way two bullish lines between two bearish<br />

lines form a rounding top.<br />

PAGE 6<br />

IFTA.ORG