Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IFTA JOURNAL<br />

2017 EDITION<br />

Figure 11. The average percent invested by the RSI (14)<br />

model by number of trades with relative performance<br />

compared to buy and hold for two secular bull markets<br />

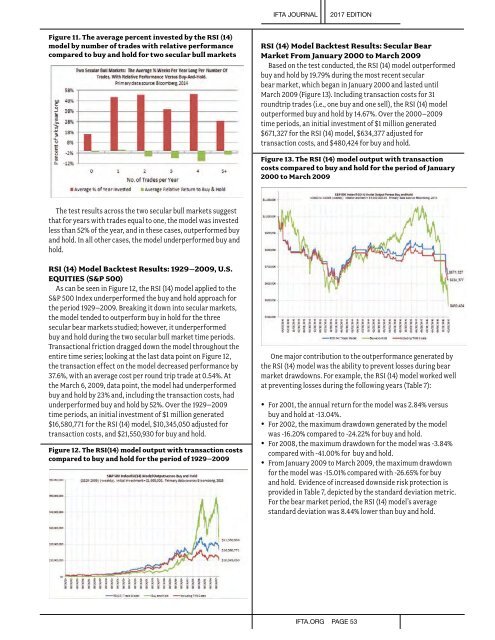

RSI (14) Model Backtest Results: Secular Bear<br />

Market From January 2000 to March 2009<br />

Based on the test conducted, the RSI (14) model outperformed<br />

buy and hold by 19.79% during the most recent secular<br />

bear market, which began in January 2000 and lasted until<br />

March 2009 (Figure 13). Including transaction costs for 31<br />

roundtrip trades (i.e., one buy and one sell), the RSI (14) model<br />

outperformed buy and hold by 14.67%. Over the 2000–2009<br />

time periods, an initial investment of $1 million generated<br />

$671,327 for the RSI (14) model, $634,377 adjusted for<br />

transaction costs, and $480,424 for buy and hold.<br />

Figure 13. The RSI (14) model output with transaction<br />

costs compared to buy and hold for the period of January<br />

2000 to March 2009<br />

The test results across the two secular bull markets suggest<br />

that for years with trades equal to one, the model was invested<br />

less than 52% of the year, and in these cases, outperformed buy<br />

and hold. In all other cases, the model underperformed buy and<br />

hold.<br />

RSI (14) Model Backtest Results: 1929–2009, U.S.<br />

EQUITIES (S&P 500)<br />

As can be seen in Figure 12, the RSI (14) model applied to the<br />

S&P 500 Index underperformed the buy and hold approach for<br />

the period 1929–2009. Breaking it down into secular markets,<br />

the model tended to outperform buy in hold for the three<br />

secular bear markets studied; however, it underperformed<br />

buy and hold during the two secular bull market time periods.<br />

Transactional friction dragged down the model throughout the<br />

entire time series; looking at the last data point on Figure 12,<br />

the transaction effect on the model decreased performance by<br />

37.6%, with an average cost per round trip trade at 0.54%. At<br />

the March 6, 2009, data point, the model had underperformed<br />

buy and hold by 23% and, including the transaction costs, had<br />

underperformed buy and hold by 52%. Over the 1929–2009<br />

time periods, an initial investment of $1 million generated<br />

$16,580,771 for the RSI (14) model, $10,345,050 adjusted for<br />

transaction costs, and $21,550,930 for buy and hold.<br />

Figure 12. The RSI(14) model output with transaction costs<br />

compared to buy and hold for the period of 1929–2009<br />

One major contribution to the outperformance generated by<br />

the RSI (14) model was the ability to prevent losses during bear<br />

market drawdowns. For example, the RSI (14) model worked well<br />

at preventing losses during the following years (Table 7):<br />

• For 2001, the annual return for the model was 2.84% versus<br />

buy and hold at -13.04%. <br />

• For 2002, the maximum drawdown generated by the model<br />

was -16.20% compared to -24.22% for buy and hold. <br />

• For 2008, the maximum drawdown for the model was -3.84%<br />

compared with -41.00% for buy and hold. <br />

• From January 2009 to March 2009, the maximum drawdown<br />

for the model was -15.01% compared with -26.65% for buy<br />

and hold. Evidence of increased downside risk protection is<br />

provided in Table 7, depicted by the standard deviation metric.<br />

For the bear market period, the RSI (14) model’s average<br />

standard deviation was 8.44% lower than buy and hold. <br />

IFTA.ORG PAGE 53