You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

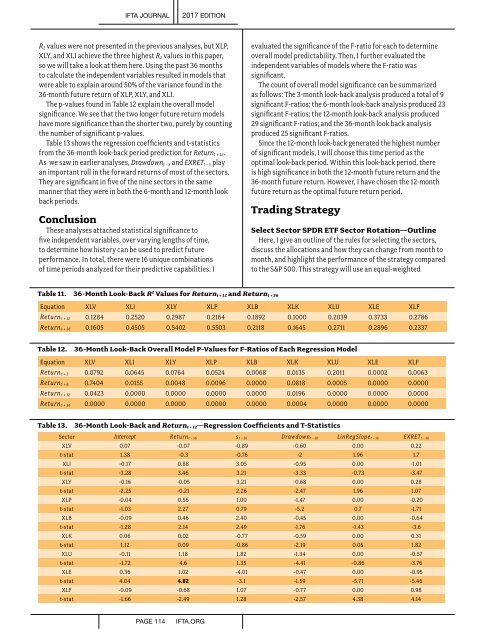

R 2 values were not presented in the previous analyses, but XLP,<br />

XLY, and XLI achieve the three highest R 2 values in this paper,<br />

so we will take a look at them here. Using the past 36 months<br />

to calculate the independent variables resulted in models that<br />

were able to explain around 50% of the variance found in the<br />

36-month future return of XLP, XLY, and XLI.<br />

The p-values found in Table 12 explain the overall model<br />

significance. We see that the two longer future return models<br />

have more significance than the shorter two, purely by counting<br />

the number of significant p-values.<br />

Table 13 shows the regression coefficients and t-statistics<br />

from the 36-month look-back period prediction for Return t + 12 .<br />

As we saw in earlier analyses, Drawdown t − x and EXRET t − x play<br />

an important roll in the forward returns of most of the sectors.<br />

They are significant in five of the nine sectors in the same<br />

manner that they were in both the 6-month and 12-month look<br />

back periods.<br />

Conclusion<br />

These analyses attached statistical significance to<br />

five independent variables, over varying lengths of time,<br />

to determine how history can be used to predict future<br />

performance. In total, there were 16 unique combinations<br />

of time periods analyzed for their predictive capabilities. I<br />

evaluated the significance of the F-ratio for each to determine<br />

overall model predictability. Then, I further evaluated the<br />

independent variables of models where the F-ratio was<br />

significant.<br />

The count of overall model significance can be summarized<br />

as follows: The 3-month look-back analysis produced a total of 9<br />

significant F-ratios; the 6-month look-back analysis produced 23<br />

significant F-ratios; the 12-month look-back analysis produced<br />

29 significant F-ratios; and the 36-month look back analysis<br />

produced 25 significant F-ratios.<br />

Since the 12-month look-back generated the highest number<br />

of significant models, I will choose this time period as the<br />

optimal look-back period. Within this look-back period, there<br />

is high significance in both the 12-month future return and the<br />

36-month future return. However, I have chosen the 12-month<br />

future return as the optimal future return period.<br />

Trading Strategy<br />

Select Sector SPDR ETF Sector Rotation—Outline<br />

Here, I give an outline of the rules for selecting the sectors,<br />

discuss the allocations and how they can change from month to<br />

month, and highlight the performance of the strategy compared<br />

to the S&P 500. This strategy will use an equal-weighted<br />

Table 11. 36-Month Look-Back R 2 Values for Return t + 12 and Return t + 36<br />

Equation XLV XLI XLY XLP XLB XLK XLU XLE XLF<br />

Return t + 12 0.1284 0.2520 0.2987 0.2164 0.1892 0.1000 0.2039 0.3733 0.2786<br />

Return t + 36 0.1605 0.4505 0.5402 0.5503 0.2118 0.1645 0.2711 0.2896 0.2337<br />

Table 12.<br />

36-Month Look-Back Overall Model P-Values for F-Ratios of Each Regression Model<br />

Equation XLV XLI XLY XLP XLB XLK XLU XLE XLF<br />

Return t + 3 0.0792 0.0645 0.0764 0.0524 0.0068 0.0135 0.2011 0.0002 0.0063<br />

Return t + 6 0.7404 0.0155 0.0048 0.0096 0.0000 0.0818 0.0005 0.0000 0.0000<br />

Return t + 12 0.0423 0.0000 0.0000 0.0000 0.0000 0.0196 0.0000 0.0000 0.0000<br />

Return t + 36 0.0000 0.0000 0.0000 0.0000 0.0000 0.0004 0.0000 0.0000 0.0000<br />

Table 13.<br />

36-Month Look-Back and Return t + 12—Regression Coefficients and T-Statistics<br />

Sector Intercept Return t − 36 s t − 36 Drawdown t − 36 LinRegSlope t − 36 EXRET t − 36<br />

XLV 0.07 -0.07 -0.89 -0.60 0.00 0.22<br />

t-stat 1.38 -0.3 -0.76 -2 1.96 1.7<br />

XLI -0.17 0.88 3.05 -0.95 0.00 -1.01<br />

t-stat -3.28 3.46 3.21 -3.33 -0.73 -3.47<br />

XLY -0.16 -0.05 3.21 -0.68 0.00 0.28<br />

t-stat -2.25 -0.21 2.26 -2.47 1.96 1.07<br />

XLP -0.04 0.56 1.00 -1.47 0.00 -0.20<br />

t-stat -1.03 2.27 0.79 -5.2 0.7 -1.71<br />

XLB -0.09 0.46 2.40 -0.45 0.00 -0.64<br />

t-stat -1.28 2.14 2.49 -1.76 -1.43 -3.6<br />

XLK 0.06 0.02 -0.77 -0.59 0.00 0.31<br />

t-stat 1.12 0.09 -0.86 -2.19 0.05 1.82<br />

XLU -0.11 1.18 1.82 -1.34 0.00 -0.57<br />

t-stat -1.72 4.6 1.35 -4.41 -0.86 -3.76<br />

XLE 0.36 1.02 -4.01 -0.47 0.00 -0.95<br />

t-stat 4.04 4.82 -3.1 -1.59 -5.71 -5.46<br />

XLF -0.09 -0.68 1.07 -0.77 0.00 0.98<br />

t-stat -1.66 -2.49 1.28 -2.57 4.38 4.14<br />

PAGE 114<br />

IFTA.ORG