You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

The RSI (14) model generated 54 sets of buy/sell trades for<br />

the May 1942 to January 1966 time period. The model’s batting<br />

average for success against buy and hold was 22.64%, with<br />

an average trade return at 3.73% compared to buy and hold<br />

at 5.71%. Standard deviation for the model based on trading<br />

data was modestly lower at 10.31% compared to 12.87% for buy<br />

and hold. Maximum drawdown from the trades for the model<br />

was at -7.12% compared to buy and hold at -19.29%, while the<br />

maximum return for the model was 42.70% compared to 51.04%<br />

for buy and hold. The model was long 56% of the time during the<br />

1942–1966 time period (Table 14).<br />

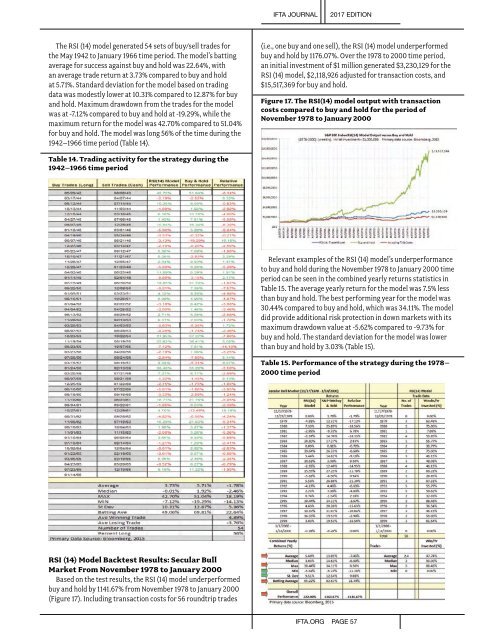

(i.e., one buy and one sell), the RSI (14) model underperformed<br />

buy and hold by 1176.07%. Over the 1978 to 2000 time period,<br />

an initial investment of $1 million generated $3,230,129 for the<br />

RSI (14) model, $2,118,926 adjusted for transaction costs, and<br />

$15,517,369 for buy and hold.<br />

Figure 17. The RSI(14) model output with transaction<br />

costs compared to buy and hold for the period of<br />

November 1978 to January 2000<br />

Table 14. Trading activity for the strategy during the<br />

1942–1966 time period<br />

Relevant examples of the RSI (14) model’s underperformance<br />

to buy and hold during the November 1978 to January 2000 time<br />

period can be seen in the combined yearly returns statistics in<br />

Table 15. The average yearly return for the model was 7.5% less<br />

than buy and hold. The best performing year for the model was<br />

30.44% compared to buy and hold, which was 34.11%. The model<br />

did provide additional risk protection in down markets with its<br />

maximum drawdown value at -5.62% compared to -9.73% for<br />

buy and hold. The standard deviation for the model was lower<br />

than buy and hold by 3.03% (Table 15).<br />

Table 15. Performance of the strategy during the 1978–<br />

2000 time period<br />

RSI (14) Model Backtest Results: Secular Bull<br />

Market From November 1978 to January 2000<br />

Based on the test results, the RSI (14) model underperformed<br />

buy and hold by 1141.67% from November 1978 to January 2000<br />

(Figure 17). Including transaction costs for 56 roundtrip trades<br />

IFTA.ORG PAGE 57