You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IFTA JOURNAL<br />

2017 EDITION<br />

The Relative Strength Index (RSI) as<br />

an Oscillator<br />

The RSI is a technical indicator invented by J. Welles Wilder<br />

and documented in his 1978 book, New Concepts in Technical<br />

Trading Systems. 4 The RSI indicator is one of the most popular<br />

technical analysis indicators available to users and is commonly<br />

found as a default internal indicator to many technical analysis<br />

software packages. The RSI is calculated on the basis of the<br />

speed and direction of a stock or index’s price movement. It<br />

measures the stock or index’s internal strength by comparing<br />

the magnitude of recent gains to recent losses. A common<br />

look-back period for the RSI is 14 trading periods, which then<br />

becomes the popular RSI (14) indicator. The RSI (14) calculation<br />

is found in Equation 1 below, whereby the ratio of the average<br />

gains/average losses over the prior 14 trading periods is known<br />

as the Relative Strength (RS). The RS is calculated into the RSI<br />

(14) as a normalized index (between 0 and 100) through the<br />

second part of Equation 1.<br />

Equation 1. The RSI (14) calculation<br />

The RSI as a Trend Trading Indicator<br />

Although Wilder created the RSI (14) indicator, Andrew<br />

Cardwell is recognized today by many technical analysts as<br />

a leading authority on the RSI (14). Cardwell’s research on<br />

the indicator has “opened the door to new methods of using<br />

oscillators in general for trend following and price projection.” 5<br />

Cardwell employs two moving averages, which smooth the<br />

RSI (14) values: the 9-period simple moving average (SMA) and<br />

the 45-period exponential moving average (EMA). When used<br />

together, these two moving averages help diagnose RSI (14)<br />

trend direction. 6<br />

In RSI: The Complete Guide (2004), John Hayden suggests that<br />

to confirm a bullish RSI (14) trend, the 9-period RSI (14) SMA<br />

must cross above the 45-period RSI (14) EMA. 7 Further, Walter<br />

Baeyens, in RSI: Logic, Signals & Time Frame Correlation (2007),<br />

discusses the importance of using Cardwell’s application of<br />

9-period SMA and 45-period EMA crossovers on both price and<br />

RSI (14) to confirm buy-and-sell signals. 8<br />

The 9-period SMA calculation is defined by Equation 2, and the<br />

45-period EMA is defined by Equation 3.<br />

Equation 2. The RSI (14) nine period simple moving average<br />

calculation<br />

Equation 3. The RSI(14) 45-period exponential moving average<br />

calculation<br />

EMA Today =a∗ [(RSI(14 cp ))−(RSI(14 EMA_ pp ))]+[(RSI(14 EMA_ pp ))]<br />

Where:<br />

a = Acceleration Factor (or, 2 / (No. of period’s EMA + 1) cp =<br />

current period’s RSI (14) close value.EMA pp = previous periods<br />

RSI (14) EMA value.<br />

A Modified Use of the RSI Trend<br />

Trading Indicator<br />

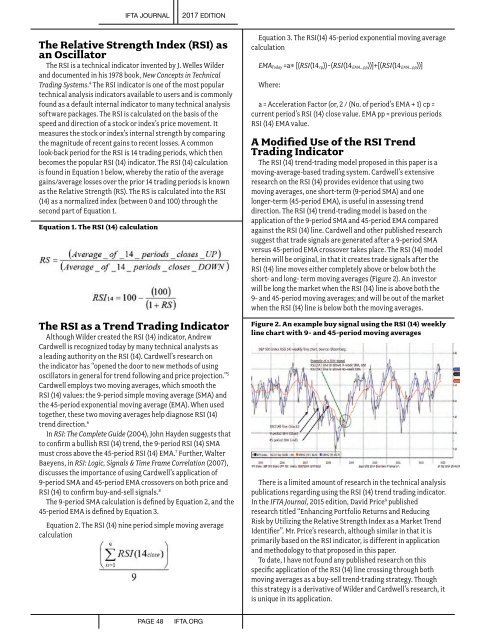

The RSI (14) trend-trading model proposed in this paper is a<br />

moving-average-based trading system. Cardwell’s extensive<br />

research on the RSI (14) provides evidence that using two<br />

moving averages, one short-term (9-period SMA) and one<br />

longer-term (45-period EMA), is useful in assessing trend<br />

direction. The RSI (14) trend-trading model is based on the<br />

application of the 9-period SMA and 45-period EMA compared<br />

against the RSI (14) line. Cardwell and other published research<br />

suggest that trade signals are generated after a 9-period SMA<br />

versus 45-period EMA crossover takes place. The RSI (14) model<br />

herein will be original, in that it creates trade signals after the<br />

RSI (14) line moves either completely above or below both the<br />

short- and long- term moving averages (Figure 2). An investor<br />

will be long the market when the RSI (14) line is above both the<br />

9- and 45-period moving averages; and will be out of the market<br />

when the RSI (14) line is below both the moving averages.<br />

Figure 2. An example buy signal using the RSI (14) weekly<br />

line chart with 9- and 45-period moving averages<br />

There is a limited amount of research in the technical analysis<br />

publications regarding using the RSI (14) trend trading indicator.<br />

In the IFTA Journal, 2015 edition, David Price 9 published<br />

research titled “Enhancing Portfolio Returns and Reducing<br />

Risk by Utilizing the Relative Strength Index as a Market Trend<br />

Identifier”. Mr. Price’s research, although similar in that it is<br />

primarily based on the RSI indicator, is different in application<br />

and methodology to that proposed in this paper.<br />

To date, I have not found any published research on this<br />

specific application of the RSI (14) line crossing through both<br />

moving averages as a buy-sell trend-trading strategy. Though<br />

this strategy is a derivative of Wilder and Cardwell’s research, it<br />

is unique in its application.<br />

PAGE 48<br />

IFTA.ORG