2018 Adopted Annual Operating & Capital Improvement Budget

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

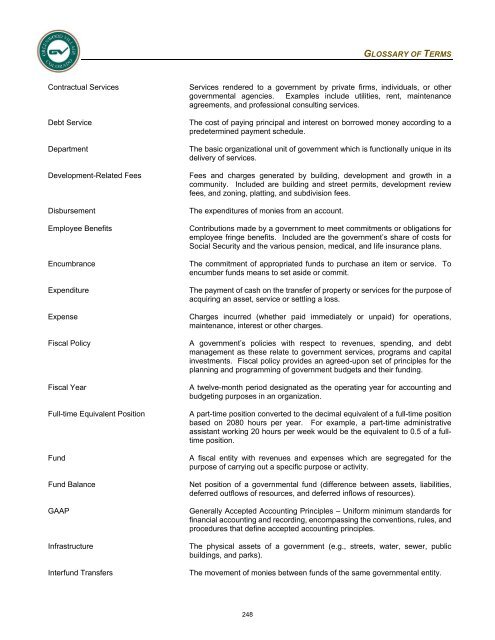

FINANCIAL POLICIES<br />

Procurement Policies<br />

Obtain the highest quality in supplies and contractual services at the least expense to the City.<br />

Discourage uniform bidding and endeavor to obtain as open competition as possible.<br />

Acquire the highest quality product and service for the City.<br />

Utilize vendors which are competent, consistent, reliable, and timely.<br />

Accounting, Auditing & Reporting Policies<br />

The Village’s managerial staff is responsible for establishing and maintaining an internal control structure. This structure<br />

is designed to ensure that Village assets are protected from loss, theft, or misuse.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Provide regular information concerning cash position and investment performance through its accounting system.<br />

Establish and maintain a high degree of accounting competency. Financial accounting and reporting shall be<br />

done in accordance with methods prescribed by the Governmental Accounting Standards Board and the<br />

Government Finance Officers Association, or their equivalents.<br />

Present quarterly and annual reports to City Council summarizing financial activity for all governmental funds.<br />

Maintain financial systems to monitor expenditures, revenues, and performance of all municipal programs on an<br />

ongoing basis.<br />

Provide full disclosure in annual financial statements and bond representations.<br />

Use an independent public accounting firm to perform an annual audit.<br />

Publicly issue a Comprehensive <strong>Annual</strong> Financial Report.<br />

Fund Accounting<br />

Fund accounting is used throughout the Village, for both budgeting and the recording of financial transactions. Under<br />

this system money is segregated into separate accounts, rather than being held in one central account. Each fund has<br />

been established for a specific purpose, and is somewhat like a separate bank account.<br />

Fund Types<br />

The Village currently uses only two types of governmental funds, the General Fund and a <strong>Capital</strong> Projects Fund.<br />

The General Fund includes the majority of Village services. Parks, Trails and Recreation; Community<br />

Development; Police; Public Works; Administrative Services; Finance; Mayor and Council; City Attorney; City<br />

Management; and Municipal Judge are included. Sales tax, use tax, property tax, user fees, fines, permits,<br />

licenses, intergovernmental revenue, investment income, internal transfers, and various other revenues are the<br />

sources of General Fund revenues.<br />

The <strong>Capital</strong> Project Fund is used to account for the financing of long-term capital improvements for the Village.<br />

Interfund Transfers<br />

The City of Greenwood Village’s transfers are considered operating transfers. This represents the transfer from one<br />

fund to another fund for operational purposes without the expectation of any support services in return. Also, this type<br />

of transfer includes the transfer from one fund to another fund for the purpose of capital outlays.<br />

<strong>Budget</strong><br />

A balanced budget is defined as a budget in which expenditures and provisions of contingencies in the budget do not<br />

exceed the total estimated available resources.<br />

244