Social Impact Investing

Social Impact Investing

Social Impact Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Impact</strong> Investments:<br />

An emerging asset class<br />

Global Research<br />

29 November 2010<br />

3. Financial return expectations<br />

Caveat<br />

We do not present the analysis in<br />

this chapter as representative of<br />

the entire marketplace. The data<br />

set is weighted toward North<br />

American investors and reflects the<br />

population of investors that<br />

participated in the survey. While<br />

the total number of transactions in<br />

the database is significant (and<br />

indeed much higher than we<br />

anticipated given the private nature<br />

of the market), the total number of<br />

participants remains limited. All<br />

conclusions presented below are<br />

made simply based on this data<br />

set, and any extrapolation to the<br />

broader market should be made<br />

with caution.<br />

<strong>Impact</strong> investments span instrument types, sectors, and regions: from equity to debt,<br />

microfinance to healthcare, Developed markets to Emerging markets. Given this<br />

diversity, it is natural that there should be a wide range of expectations for the<br />

financial performance of these assets. In some investors’ eyes, the coupling of the<br />

intent to create positive social impact with the pursuit of financial return is reason to<br />

expect lower returns from impact investments than from traditional investments.<br />

Others believe that financial return need not be sacrificed when social impact is<br />

being delivered and, due to the large underpenetrated market at the BoP, many<br />

impact investments should outperform traditional investments. In this section, we<br />

present some evidence on what impact investors expect of the financial performance<br />

of their assets, what has actually been realized, and how these results compare to<br />

traditional benchmarks.<br />

Analyzing a sample of impact investments<br />

As impact investments are predominantly debt or equity investments into private<br />

companies, we collected the data presented below through a survey. The survey was<br />

executed by The Global <strong>Impact</strong> <strong>Investing</strong> Network (“GIIN”), which collected and<br />

ensured that all data was presented to J.P. Morgan with the names of respondents and<br />

investments removed. Separately, the Calvert Foundation provided a history of its<br />

mostly US-based debt investments, and the International Finance Corporation<br />

(“IFC”) revealed some performance history for its EM private equity investments<br />

which we analyze in Appendix V: Additional returns data 32 . Below we analyze the<br />

broad range of investments covered by the GIIN Survey.<br />

Characterizing the investments reported in the GIIN Survey: 24 respondents<br />

The Survey was sent primarily to the GIIN Investors’ Council, a group of principal<br />

investors and capitalized investment funds that manage impact investments and<br />

participate in industry-building activities. A few additional participants brought the<br />

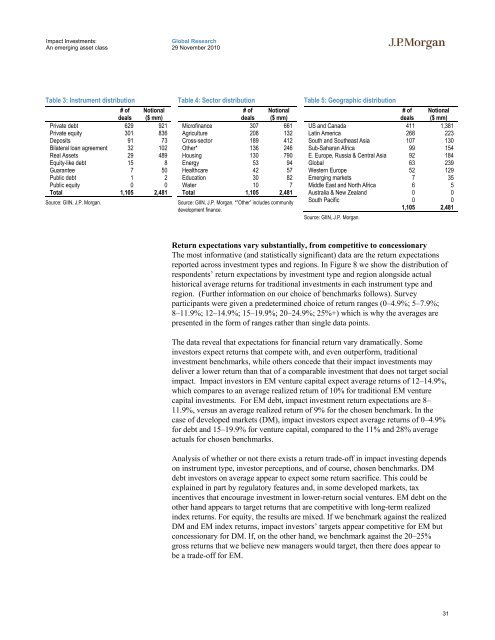

total number of survey respondents to 24 33 . In Table 3 we show the distribution of<br />

reported deals across investment instrument type. Table 4 shows the sector<br />

distribution, and Table 5 shows the regional focus 34 .<br />

In each table, we show both the number of deals and the notional amount represented<br />

by each category. We find that most of the investments reported were made via<br />

private equity or debt instruments. Among the sectors, microfinance is the most<br />

frequently referenced, which is unsurprising as it is one of the most mature of the<br />

impact investment sectors and presents lower barriers to entry 35 to new investors. In<br />

terms of geographic distribution of investments, the US dominated our data set.<br />

32 Since that data set is from a single source and potentially skewed as a result, we do not mix<br />

the results of that analysis with the results of the GIIN Survey.<br />

33 For a full list of survey respondents, see page 82 in the appendix.<br />

34 While we received 984 individual data points, 7 of those data points represented regional<br />

aggregates. In our work, we have accounted for the total number of investments those<br />

aggregates represent as well.<br />

35 Over 90 dedicated microfinance investment vehicles exist and are catalogued on the MIX<br />

Market website (www.mixmarket.org).<br />

30