VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

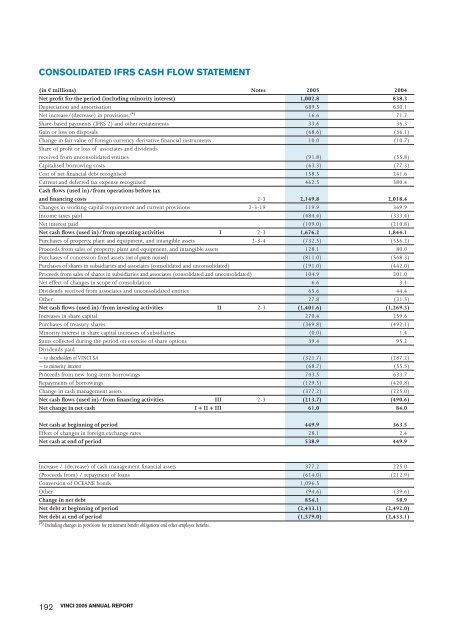

CONSOLIDATED IFRS CASH FLOW STATEMENT<br />

(in € millions) Notes <strong>2005</strong> 2004<br />

Net profit for the period (including minority interest) 1,002.8 838.3<br />

Depreciation and amortisation 689.5 630.1<br />

Net increase/(decrease) in provisions (*) 16.6 71.7<br />

Share-based payments (IFRS 2) and other restatements 33.6 36.3<br />

Gain or loss on disposals (68.6) (36.1)<br />

Change in fair value of foreign currency derivative financial instruments 10.0 (10.7)<br />

Share of profit or loss of associates and dividends<br />

received from unconsolidated entities (91.8) (55.8)<br />

Capitalised borrowing costs (63.3) (77.3)<br />

Cost of net financial debt recognised 158.5 241.6<br />

Current and deferred tax expense recognised 462.5 380.4<br />

Cash flows (used in)/from operations before tax<br />

and financing costs 2-3 2,149.8 2,018.4<br />

Changes in working capital requirement and current provisions 2-3-19 119.9 369.9<br />

Income taxes paid (484.4) (333.4)<br />

Net interest paid (109.0) (210.8)<br />

Net cash flows (used in)/from operating activities I 2-3 1,676.2 1,844.1<br />

Purchases of property, plant and equipment, and intangible assets 2-3-4 (732.5) (556.2)<br />

Proceeds from sales of property, plant and equipment, and intangible assets 128.1 80.0<br />

Purchases of concession fixed assets (net of grants received) (811.0) (568.3)<br />

Purchases of shares in subsidiaries and associates (consolidated and unconsolidated) (191.0) (442.0)<br />

Proceeds from sales of shares in subsidiaries and associates (consolidated and unconsolidated) 104.9 201.0<br />

Net effect of changes in scope of consolidation 6.6 3.1<br />

Dividends received from associates and unconsolidated entities 65.6 44.4<br />

Other 27.8 (31.5)<br />

Net cash flows (used in)/from investing activities II 2-3 (1,401.6) (1,269.5)<br />

Increases in share capital 270.4 259.6<br />

Purchases of treasury shares (369.8) (492.1)<br />

Minority interest in share capital increases of subsidiaries (0.0) 1.4<br />

Sums collected during the period on exercise of share options 39.4 95.2<br />

Dividends paid<br />

– to shareholders of <strong>VINCI</strong> SA (321.7) (287.2)<br />

– to minority interest (68.7) (55.5)<br />

Proceeds from new long-term borrowings 743.5 633.7<br />

Repayments of borrowings (129.5) (420.8)<br />

Change in cash management assets (377.2) (225.0)<br />

Net cash flows (used in)/from financing activities III 2-3 (213.7) (490.6)<br />

Net change in net cash I + II + III 61.0 84.0<br />

Net cash at beginning of period 449.9 363.5<br />

Effect of changes in foreign exchange rates 28.1 2.4<br />

Net cash at end of period 538.9 449.9<br />

Increase / (decrease) of cash management financial assets 377.2 225.0<br />

(Proceeds from) / repayment of loans (614.0) (212.9)<br />

Conversion of OCEANE bonds 1,096.5<br />

Other (94.6) (39.6)<br />

Change in net debt 854.1 58.9<br />

Net debt at beginning of period (2,433.1) (2,492.0)<br />

Net debt at end of period (1,579.0) (2,433.1)<br />

(*) Including changes in provisions for retirement benefit obligations and other employee benefits.<br />

192<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT