VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

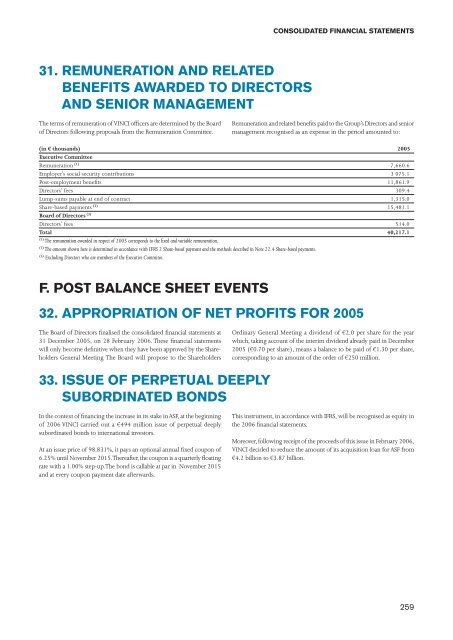

31. REMUNERATION AND RELATED<br />

BENEFITS AWARDED TO DIRECTORS<br />

AND SENIOR MANAGEMENT<br />

The terms of remuneration of <strong>VINCI</strong> officers are determined by the Board<br />

of Directors following proposals from the Remuneration Committee.<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Remuneration and related benefits paid to the Group’s Directors and senior<br />

management recognised as an expense in the period amounted to:<br />

(in € thousands) <strong>2005</strong><br />

Executive Committee<br />

Remuneration (1) 7,660.6<br />

Employer’s social security contributions 3 075.1<br />

Post-employment benefits 11,861.9<br />

Directors’ fees 309.4<br />

Lump-sums payable at end of contract 1,315.0<br />

Share-based payments (2) 15,481.1<br />

Board of Directors (3)<br />

Directors’ fees 514.0<br />

Total 40,217.1<br />

(1) The remuneration awarded in respect of <strong>2005</strong> corresponds to the fixed and variable remuneration.<br />

(2) The amount shown here is determined in accordance with IFRS 2 Share-based payment and the methods described in Note 22.4 Share-based payments.<br />

(3) Excluding Directors who are members of the Executive Commitee.<br />

F. POST BALANCE SHEET EVENTS<br />

32. APPROPRIATION OF NET PROFITS FOR <strong>2005</strong><br />

The Board of Directors finalised the consolidated financial statements at<br />

31 December <strong>2005</strong>, on 28 February 2006. These financial statements<br />

will only become definitive when they have been approved by the Shareholders<br />

General Meeting. The Board will propose to the Shareholders<br />

33. ISSUE OF PERPETUAL DEEPLY<br />

SUBORDINATED BONDS<br />

In the context of financing the increase in its stake in ASF, at the beginning<br />

of 2006 <strong>VINCI</strong> carried out a €494 million issue of perpetual deeply<br />

subordinated bonds to international investors.<br />

At an issue price of 98.831%, it pays an optional <strong>annual</strong> fixed coupon of<br />

6.25% until November 2015. Thereafter, the coupon is a quarterly floating<br />

rate with a 1.00% step-up. The bond is callable at par in November 2015<br />

and at every coupon payment date afterwards.<br />

Ordinary General Meeting a dividend of €2.0 per share for the year<br />

which, taking account of the interim dividend already paid in December<br />

<strong>2005</strong> (€0.70 per share), means a balance to be paid of €1.30 per share,<br />

corresponding to an amount of the order of €250 million.<br />

This instrument, in accordance with IFRS, will be recognised as equity in<br />

the 2006 financial statements.<br />

Moreover, following receipt of the proceeds of this issue in February 2006,<br />

<strong>VINCI</strong> decided to reduce the amount of its acquisition loan for ASF from<br />

€4.2 billion to €3.87 billion.<br />

259