VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26.2.3 Management of financial covenants<br />

There are no financial covenants for the medium-term credit facilities<br />

(syndicated or individual) mentioned in Notes 25.3.1 b. and c., except<br />

for the acquisition loan of €4.2 billion for which <strong>VINCI</strong> has undertaken<br />

to comply with a minimum ratio between the net financial debt of non-<br />

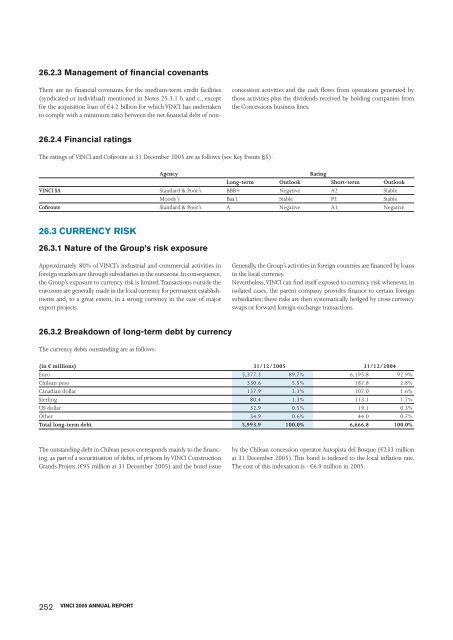

26.2.4 Financial ratings<br />

The ratings of <strong>VINCI</strong> and Cofiroute at 31 December <strong>2005</strong> are as follows (see Key Events §5):<br />

(in € millions) 31/12/<strong>2005</strong> 31/12/2004<br />

Euro 5,377.3 89.7% 6,195.8 92.9%<br />

Chilean peso 330.6 5.5% 187.8 2.8%<br />

Canadian dollar 137.9 2.3% 107.0 1.6%<br />

Sterling 80.4 1.3% 113.1 1.7%<br />

US dollar 32.9 0.5% 19.1 0.3%<br />

Other 34.9 0.6% 44.0 0.7%<br />

Total long-term debt 5,993.9 100.0% 6,666.8 100.0%<br />

252<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

concession activities and the cash flows from operations generated by<br />

those activities plus the dividends received by holding companies from<br />

the Concessions business lines.<br />

Agency Rating<br />

Long-term Outlook Short-term Outlook<br />

<strong>VINCI</strong> SA Standard & Poor’s BBB+ Negative A2 Stable<br />

Moody’s Baa1 Stable P2 Stable<br />

Cofiroute Standard & Poor’s A Negative A1 Negative<br />

26.3 CURRENCY RISK<br />

26.3.1 Nature of the Group’s risk exposure<br />

Approximately 80% of <strong>VINCI</strong>’s industrial and commercial activities in<br />

foreign markets are through subsidiaries in the eurozone. In consequence,<br />

the Group’s exposure to currency risk is limited. Transactions outside the<br />

eurozone are generally made in the local currency for permanent establishments<br />

and, to a great extent, in a strong currency in the case of major<br />

export projects.<br />

26.3.2 Breakdown of long-term debt by currency<br />

The currency debts outstanding are as follows:<br />

The outstanding debt in Chilean pesos corresponds mainly to the financing,<br />

as part of a securitisation of debts, of prisons by <strong>VINCI</strong> Construction<br />

Grands Projets (€95 million at 31 December <strong>2005</strong>) and the bond issue<br />

Generally, the Group’s activities in foreign countries are financed by loans<br />

in the local currency.<br />

Nevertheless, <strong>VINCI</strong> can find itself exposed to currency risk whenever, in<br />

isolated cases, the parent company provides finance to certain foreign<br />

subsidiaries; these risks are then systematically hedged by cross currency<br />

swaps or forward foreign exchange transactions.<br />

by the Chilean concession operator Autopista del Bosque (€233 million<br />

at 31 December <strong>2005</strong>). This bond is indexed to the local inflation rate.<br />

The cost of this indexation is - €6.9 million in <strong>2005</strong>.