VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

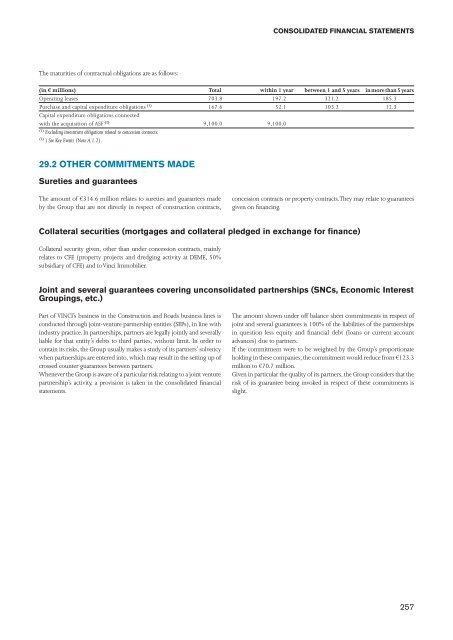

The maturities of contractual obligations are as follows:<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

(in € millions) Total within 1 year between 1 and 5 years in more than 5 years<br />

Operating leases 703.8 197.2 321.2 185.3<br />

Purchase and capital expenditure obligations (1) 167.6 52.1 103.2 12.3<br />

Capital expenditure obligations connected<br />

with the acquisition of ASF (2) 9,100.0 9,100.0<br />

(1) Excluding investment obligations related to concession contracts.<br />

(2) ) See Key Events (Note A.1.2).<br />

29.2 OTHER COMMITMENTS MADE<br />

Sureties and guarantees<br />

The amount of €314.6 million relates to sureties and guarantees made<br />

by the Group that are not directly in respect of construction contracts,<br />

concession contracts or property contracts. They may relate to guarantees<br />

given on financing.<br />

Collateral securities (mortgages and collateral pledged in exchange for finance)<br />

Collateral security given, other than under concession contracts, mainly<br />

relates to CFE (property projects and dredging activity at DEME, 50%<br />

subsidiary of CFE) and to Vinci Immobilier.<br />

Joint and several guarantees covering unconsolidated partnerships (SNCs, Economic Interest<br />

Groupings, etc.)<br />

Part of <strong>VINCI</strong>’s business in the Construction and Roads business lines is<br />

conducted through joint-venture partnership entities (SEPs), in line with<br />

industry practice. In partnerships, partners are legally jointly and severally<br />

liable for that entity’s debts to third parties, without limit. In order to<br />

contain its risks, the Group usually makes a study of its partners’ solvency<br />

when partnerships are entered into, which may result in the setting up of<br />

crossed counter guarantees between partners.<br />

Whenever the Group is aware of a particular risk relating to a joint venture<br />

partnership’s activity, a provision is taken in the consolidated financial<br />

statements.<br />

The amount shown under off balance sheet commitments in respect of<br />

joint and several guarantees is 100% of the liabilities of the partnerships<br />

in question less equity and financial debt (loans or current account<br />

advances) due to partners.<br />

If the commitment were to be weighted by the Group’s proportionate<br />

holding in these companies, the commitment would reduce from €123.3<br />

million to €70.7 million.<br />

Given in particular the quality of its partners, the Group considers that the<br />

risk of its guarantee being invoked in respect of these commitments is<br />

slight.<br />

257