VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

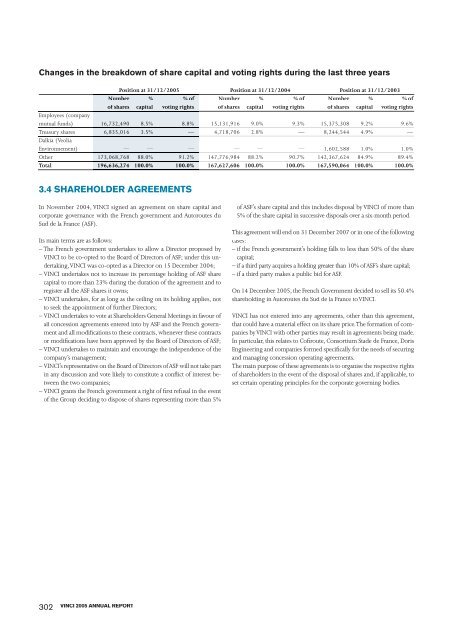

Changes in the breakdown of share capital and voting rights during the last three years<br />

Position at 31/12/<strong>2005</strong> Position at 31/12/2004 Position at 31/12/2003<br />

Number % % of Number % % of Number % % of<br />

of shares capital voting rights of shares capital voting rights of shares capital voting rights<br />

Employees (company<br />

mutual funds) 16,732,490 8.5% 8.8% 15,131,916 9.0% 9.3% 15,375,308 9.2% 9.6%<br />

Treasury shares<br />

Dalkia (Veolia<br />

6,835,016 3.5% — 4,718,706 2.8%<br />

— 8,244,544 4.9%<br />

—<br />

Environnement) — — — — — — 1,602,588 1.0% 1.0%<br />

Other 173,068,768 88.0% 91.2% 147,776,984 88.2% 90.7% 142,367,624 84.9% 89.4%<br />

Total 196,636,274 100.0% 100.0% 167,627,606 100.0% 100.0% 167,590,064 100.0% 100.0%<br />

3.4 SHAREHOLDER AGREEMENTS<br />

In November 2004, <strong>VINCI</strong> signed an agreement on share capital and<br />

corporate governance with the French government and Autoroutes du<br />

Sud de la France (ASF).<br />

Its main terms are as follows:<br />

– The French government undertakes to allow a Director proposed by<br />

<strong>VINCI</strong> to be co-opted to the Board of Directors of ASF; under this undertaking,<br />

<strong>VINCI</strong> was co-opted as a Director on 15 December 2004;<br />

– <strong>VINCI</strong> undertakes not to increase its percentage holding of ASF share<br />

capital to more than 23% during the duration of the agreement and to<br />

register all the ASF shares it owns;<br />

– <strong>VINCI</strong> undertakes, for as long as the ceiling on its holding applies, not<br />

to seek the appointment of further Directors;<br />

– <strong>VINCI</strong> undertakes to vote at Shareholders General Meetings in favour of<br />

all concession agreements entered into by ASF and the French government<br />

and all modifi cations to these contracts, whenever these contracts<br />

or modifi cations have been approved by the Board of Directors of ASF;<br />

– <strong>VINCI</strong> undertakes to maintain and encourage the independence of the<br />

company’s management;<br />

– <strong>VINCI</strong>’s representative on the Board of Directors of ASF will not take part<br />

in any discussion and vote likely to constitute a confl ict of interest between<br />

the two companies;<br />

– <strong>VINCI</strong> grants the French government a right of fi rst refusal in the event<br />

of the Group deciding to dispose of shares representing more than 5%<br />

302<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

of ASF’s share capital and this includes disposal by <strong>VINCI</strong> of more than<br />

5% of the share capital in successive disposals over a six-month period.<br />

This agreement will end on 31 December 2007 or in one of the following<br />

cases:<br />

– if the French government’s holding falls to less than 50% of the share<br />

capital;<br />

– if a third party acquires a holding greater than 10% of ASF’s share capital;<br />

– if a third party makes a public bid for ASF.<br />

On 14 December <strong>2005</strong>, the French Government decided to sell its 50.4%<br />

shareholding in Autoroutes du Sud de la France to <strong>VINCI</strong>.<br />

<strong>VINCI</strong> has not entered into any agreements, other than this agreement,<br />

that could have a material effect on its share price. The formation of companies<br />

by <strong>VINCI</strong> with other parties may result in agreements being made.<br />

In particular, this relates to Cofi route, Consortium Stade de France, Doris<br />

Engineering and companies formed specifi cally for the needs of securing<br />

and managing concession operating agreements.<br />

The main purpose of these agreements is to organise the respective rights<br />

of shareholders in the event of the disposal of shares and, if applicable, to<br />

set certain operating principles for the corporate governing bodies.