VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

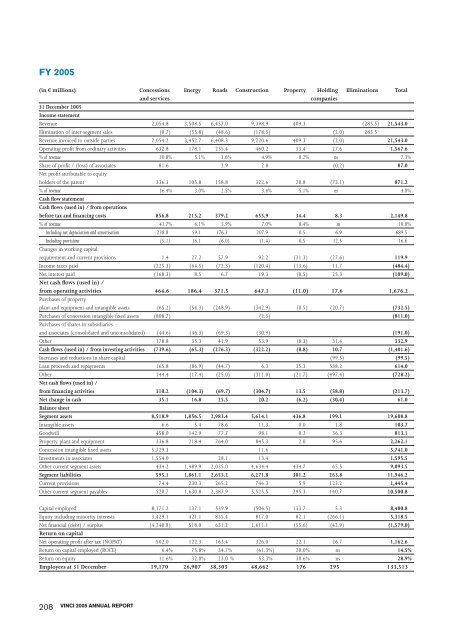

FY <strong>2005</strong><br />

(in € millions) Concessions Energy Roads Construction Property Holding Eliminations Total<br />

and services companies<br />

31 December <strong>2005</strong><br />

Income statement<br />

Revenue 2,054.8 3,508.5 6,457.0 9,398.9 409.3 (285.5) 21,543.0<br />

Elimination of inter-segment sales (0.7) (55.8) (48.6) (178.3) (2.0) 285.5<br />

Revenue invoiced to outside parties 2,054.2 3,452.7 6,408.3 9,220.6 409.3 (2.0) 21,543.0<br />

Operating profit from ordinary activities 632.8 178.1 235.4 460.2 33.4 27.6 1,567.6<br />

% of revenue 30.8% 5.1% 3.6% 4.9% 8.2% ns 7.3%<br />

Share of profit / (loss) of associates 81.6 2.9 2.8 (0.2) 87.0<br />

Net profit attributable to equity<br />

holders of the parent 336.3 105.8 158.8 322.6 20.8 (73.1) 871.2<br />

% of revenue 16.4% 3.0% 2.5% 3.4% 5.1% ns 4.0%<br />

Cash flow statement<br />

Cash flows (used in) / from operations<br />

before tax and financing costs 856.8 215.2 379.2 655.9 34.4 8.3 2,149.8<br />

% of revenue 41.7% 6.1% 5.9% 7.0% 8.4% ns 10.0%<br />

Including net depreciation and amortisation 238.8 59.1 176.3 207.9 0.5 6.9 689.5<br />

Including provisions (5.1) 16.1 (6.0) (1.4) 0.5 12.5 16.6<br />

Changes in working capital<br />

requirement and current provisions 1.4 27.2 57.9 92.2 (31.3) (27.6) 119.9<br />

Income taxes paid (225.3) (64.5) (72.3) (120.4) (13.6) 11.7 (484.4)<br />

Net interest paid (168.3) 8.5 6.7 19.3 (0.5) 25.3 (109.0)<br />

Net cash flows (used in) /<br />

from operating activities 464.6 186.4 371.5 647.1 (11.0) 17.6 1,676.2<br />

Purchases of property.<br />

plant and equipment and intangible assets (65.2) (54.3) (248.9) (342.9) (0.5) (20.7) (732.5)<br />

Purchases of concession intangible fixed assets (808.7) (2.3) (811.0)<br />

Purchases of shares in subsidiaries<br />

and associates (consolidated and unconsolidated) (44.6) (46.3) (69.3) (30.9) (191.0)<br />

Other 178.8 35.3 41.9 53.9 (8.3) 31.4 332.9<br />

Cash flows (used in) / from investing activities (739.6) (65.3) (276.3) (322.2) (8.8) 10.7 (1,401.6)<br />

Increases and reductions in share capital (99.5) (99.5)<br />

Loan proceeds and repayments 165.8 (86.9) (44.7) 6.3 35.3 538.2 614.0<br />

Other 144.4 (17.4) (25.0) (311.0) (21.7) (497.4) (728.2)<br />

Net cash flows (used in) /<br />

from financing activities 310.2 (104.3) (69.7) (304.7) 13.5 (58.8) (213.7)<br />

Net change in cash 35.1 16.8 25.5 20.2 (6.2) (30.4) 61.0<br />

Balance sheet<br />

Segment assets 8,518.9 1,856.5 2,983.4 5,614.1 436.8 199.1 19,608.8<br />

Intangible assets 6.6 5.4 78.6 11.3 0.0 1.8 103.7<br />

Goodwill 458.0 142.9 77.7 98.1 0.2 36.3 813.1<br />

Property. plant and equipment 336.8 218.4 764.0 845.3 2.0 95.6 2,262.1<br />

Concession intangible fixed assets 5,729.3 11.6 5,741.0<br />

Investments in associates 1,554.0 28.1 13.4 1,595.5<br />

Other current segment assets 434.2 1,489.9 2,035.0 4,634.4 434.7 65.5 9,093.5<br />

Segment liabilities 595.1 1,861.1 2,653.2 6,271.8 301.2 263.8 11,946.2<br />

Current provisions 74.4 230.3 265.2 746.3 5.9 123.2 1,445.4<br />

Other current segment payables 520.7 1,630.8 2,387.9 5,525.5 295.3 140.7 10,500.8<br />

Capital employed 8,171.2 137.1 539.9 (506.5) 133.7 5.3 8,480.8<br />

Equity including minority interests 3,429.1 421.1 835.4 817.0 82.1 (266.1) 5,318.5<br />

Net financial (debt) / surplus (4,240.8) 518.0 631.2 1,611.1 (55.6) (42.9) (1,579.0)<br />

Return on capital<br />

Net operating profit after tax (NOPAT) 502.0 122.3 163.4 326.0 22.1 26.7 1,162.6<br />

Return on capital employed (ROCE) 6.4% 75.8% 34.7% (61.3%) 20.0% ns 14.5%<br />

Return on equity 11.6% 32.0% 23.0 % 53.3% 30.6% ns 28.9%<br />

Employees at 31 December 19,170 26,907 38,303 48,662 176 295 133,513<br />

208<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT