VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

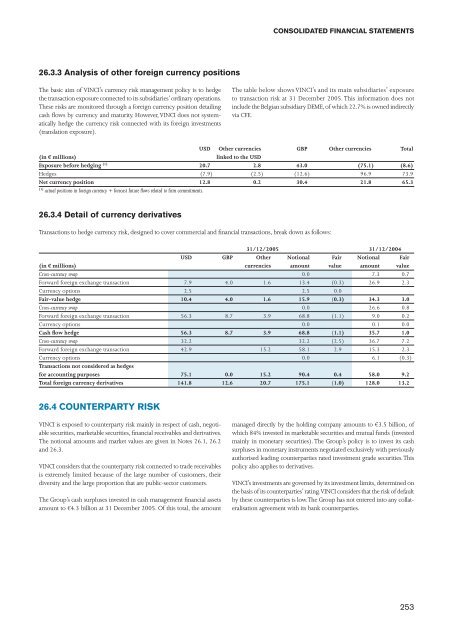

26.3.3 Analysis of other foreign currency positions<br />

The basic aim of <strong>VINCI</strong>’s currency risk management policy is to hedge<br />

the transaction exposure connected to its subsidiaries’ ordinary operations.<br />

These risks are monitored through a foreign currency position detailing<br />

cash flows by currency and maturity. However, <strong>VINCI</strong> does not systematically<br />

hedge the currency risk connected with its foreign investments<br />

(translation exposure).<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

The table below shows <strong>VINCI</strong>’s and its main subsidiaries’ exposure<br />

to transaction risk at 31 December <strong>2005</strong>. This information does not<br />

include the Belgian subsidiary DEME, of which 22.7% is owned indirectly<br />

via CFE.<br />

USD Other currencies GBP Other currencies Total<br />

(in € millions) linked to the USD<br />

Exposure before hedging (1) 20.7 2.8 43.0 (75.1) (8.6)<br />

Hedges (7.9) (2.5) (12.6) 96.9 73.9<br />

Net currency position 12.8 0.2 30.4 21.8 65.3<br />

(1) actual positions in foreign currency + forecast future flows related to firm commitments.<br />

26.3.4 Detail of currency derivatives<br />

Transactions to hedge currency risk, designed to cover commercial and financial transactions, break down as follows:<br />

31/12/<strong>2005</strong> 31/12/2004<br />

USD GBP Other Notional Fair Notional Fair<br />

(in € millions) currencies amount value amount value<br />

Cross-currency swap 0.0 7.3 0.7<br />

Forward foreign exchange transaction 7.9 4.0 1.6 13.4 (0.3) 26.9 2.3<br />

Currency options 2.5 2.5 0.0<br />

Fair-value hedge 10.4 4.0 1.6 15.9 (0.3) 34.3 3.0<br />

Cross-currency swap 0.0 26.6 0.8<br />

Forward foreign exchange transaction 56.3 8.7 3.9 68.8 (1.1) 9.0 0.2<br />

Currency options 0.0 0.1 0.0<br />

Cash flow hedge 56.3 8.7 3.9 68.8 (1.1) 35.7 1.0<br />

Cross-currency swap 32.2 32.2 (2.5) 36.7 7.2<br />

Forward foreign exchange transaction 42.9 15.2 58.1 2.9 15.3 2.3<br />

Currency options 0.0 6.1 (0.3)<br />

Transactions not considered as hedges<br />

for accounting purposes 75.1 0.0 15.2 90.4 0.4 58.0 9.2<br />

Total foreign currency derivatives 141.8 12.6 20.7 175.1 (1.0) 128.0 13.2<br />

26.4 COUNTERPARTY RISK<br />

<strong>VINCI</strong> is exposed to counterparty risk mainly in respect of cash, negotiable<br />

securities, marketable securities, financial receivables and derivatives.<br />

The notional amounts and market values are given in Notes 26.1, 26.2<br />

and 26.3.<br />

<strong>VINCI</strong> considers that the counterparty risk connected to trade receivables<br />

is extremely limited because of the large number of customers, their<br />

diversity and the large proportion that are public-sector customers.<br />

The Group’s cash surpluses invested in cash management financial assets<br />

amount to €4.3 billion at 31 December <strong>2005</strong>. Of this total, the amount<br />

managed directly by the holding company amounts to €3.5 billion, of<br />

which 84% invested in marketable securities and mutual funds (invested<br />

mainly in monetary securities). The Group’s policy is to invest its cash<br />

surpluses in monetary instruments negotiated exclusively with previously<br />

authorised leading counterparties rated investment grade securities. This<br />

policy also applies to derivatives.<br />

<strong>VINCI</strong>’s investments are governed by its investment limits, determined on<br />

the basis of its counterparties’ rating. <strong>VINCI</strong> considers that the risk of default<br />

by these counterparties is low. The Group has not entered into any collateralisation<br />

agreement with its bank counterparties.<br />

253