VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

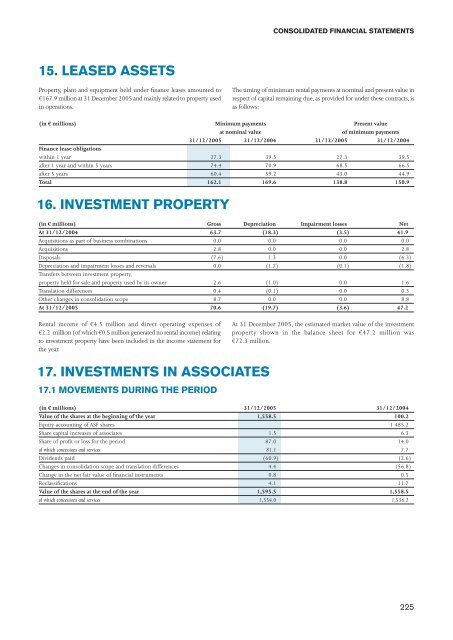

15. LEASED ASSETS<br />

Property, plant and equipment held under finance leases amounted to<br />

€167.9 million at 31 December <strong>2005</strong> and mainly related to property used<br />

in operations.<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

The timing of minimum rental payments at nominal and present value in<br />

respect of capital remaining due, as provided for under these contracts, is<br />

as follows:<br />

(in € millions) Minimum payments Present value<br />

at nominal value of minimum payments<br />

31/12/<strong>2005</strong> 31/12/2004 31/12/<strong>2005</strong> 31/12/2004<br />

Finance lease obligations<br />

within 1 year 27.3 39.5 27.3 39.5<br />

after 1 year and within 5 years 74.4 70.9 68.5 66.5<br />

after 5 years 60.4 59.2 43.0 44.9<br />

Total 162.1 169.6 138.8 150.9<br />

16. INVESTMENT PROPERTY<br />

(in € millions) Gross Depreciation Impairment losses Net<br />

At 31/12/2004 63.7 (18.3) (3.5) 41.9<br />

Acquisitions as part of business combinations 0.0 0.0 0.0 0.0<br />

Acquisitions 2.8 0.0 0.0 2.8<br />

Disposals (7.6) 1.3 0.0 (6.3)<br />

Depreciation and impairment losses and reversals 0.0 (1.7) (0.1) (1.8)<br />

Transfers between investment property,<br />

property held for sale and property used by its owner 2.6 (1.0) 0.0 1.6<br />

Translation differences 0.4 (0.1) 0.0 0.3<br />

Other changes in consolidation scope 8.7 0.0 0.0 8.8<br />

At 31/12/<strong>2005</strong> 70.6 (19.7) (3.6) 47.2<br />

Rental income of €4.5 million and direct operating expenses of<br />

€2.2 million (of which €0.5 million generated no rental income) relating<br />

to investment property have been included in the income statement for<br />

the year.<br />

17. INVESTMENTS IN ASSOCIATES<br />

17.1 MOVEMENTS DURING THE PERIOD<br />

At 31 December <strong>2005</strong>, the estimated market value of the investment<br />

property shown in the balance sheet for €47.2 million was<br />

€72.3 million.<br />

(in € millions) 31/12/<strong>2005</strong> 31/12/2004<br />

Value of the shares at the beginning of the year 1,558.5 100.2<br />

Equity accounting of ASF shares 1 485.2<br />

Share capital increases of associates 1.5 6.3<br />

Share of profit or loss for the period 87.0 14.0<br />

of which concessions and services 81.1 7.7<br />

Dividends paid (60.9) (2.6)<br />

Changes in consolidation scope and translation differences 4.4 (56.8)<br />

Change in the net fair value of financial instruments 0.8 0.5<br />

Reclassifications 4.1 11.7<br />

Value of the shares at the end of the year 1,595.5 1,558.5<br />

of which concessions and services 1,554.0 1,536.2<br />

225