Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

- TAGS

- coeur

- media.spokesman.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

consisted of $2.0 million <strong>in</strong> federal historic tax credits <strong>and</strong> a $250,000 contribution from<br />

Woodbury County.<br />

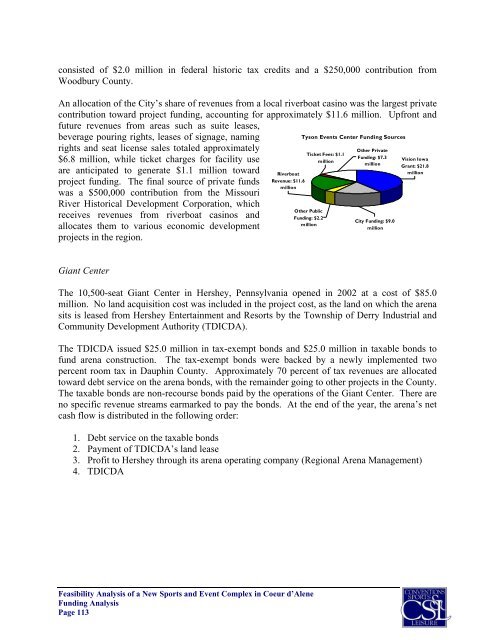

An allocation of the City’s share of revenues from a local riverboat cas<strong>in</strong>o was the largest private<br />

contribution toward project fund<strong>in</strong>g, account<strong>in</strong>g for approximately $11.6 million. Upfront <strong>and</strong><br />

future revenues from areas such as suite leases,<br />

beverage pour<strong>in</strong>g rights, leases of signage, nam<strong>in</strong>g<br />

rights <strong>and</strong> seat license sales totaled approximately<br />

$6.8 million, while ticket charges for facility use<br />

are anticipated to generate $1.1 million toward<br />

project fund<strong>in</strong>g. The f<strong>in</strong>al source of private funds<br />

was a $500,000 contribution from the Missouri<br />

River Historical Development Corporation, which<br />

receives revenues from riverboat cas<strong>in</strong>os <strong>and</strong><br />

allocates them to various economic development<br />

projects <strong>in</strong> the region.<br />

Giant Center<br />

Riverboat<br />

Revenue: $11.6<br />

million<br />

The 10,500-seat Giant Center <strong>in</strong> Hershey, Pennsylvania opened <strong>in</strong> 2002 at a cost of $85.0<br />

million. No l<strong>and</strong> acquisition cost was <strong>in</strong>cluded <strong>in</strong> the project cost, as the l<strong>and</strong> on which the arena<br />

sits is leased from Hershey Enterta<strong>in</strong>ment <strong>and</strong> Resorts <strong>by</strong> the Township of Derry Industrial <strong>and</strong><br />

Community Development Authority (TDICDA).<br />

The TDICDA issued $25.0 million <strong>in</strong> tax-exempt bonds <strong>and</strong> $25.0 million <strong>in</strong> taxable bonds to<br />

fund arena construction. The tax-exempt bonds were backed <strong>by</strong> a newly implemented two<br />

percent room tax <strong>in</strong> Dauph<strong>in</strong> County. Approximately 70 percent of tax revenues are allocated<br />

toward debt service on the arena bonds, with the rema<strong>in</strong>der go<strong>in</strong>g to other projects <strong>in</strong> the County.<br />

The taxable bonds are non-recourse bonds paid <strong>by</strong> the operations of the Giant Center. There are<br />

no specific revenue streams earmarked to pay the bonds. At the end of the year, the arena’s net<br />

cash flow is distributed <strong>in</strong> the follow<strong>in</strong>g order:<br />

1. Debt service on the taxable bonds<br />

2. Payment of TDICDA’s l<strong>and</strong> lease<br />

3. Profit to Hershey through its arena operat<strong>in</strong>g company (Regional Arena Management)<br />

4. TDICDA<br />

Feasibility Analysis of a New <strong>Sports</strong> <strong>and</strong> <strong>Event</strong> <strong>Complex</strong> <strong>in</strong> <strong>Coeur</strong> d’Alene<br />

Fund<strong>in</strong>g Analysis<br />

Page 113<br />

Tyson <strong>Event</strong>s Center Fund<strong>in</strong>g Sources<br />

Ticket Fees: $1.1<br />

million<br />

Other Public<br />

Fund<strong>in</strong>g: $2.2<br />

million<br />

Other Private<br />

Fund<strong>in</strong>g: $7.3<br />

million<br />

City Fund<strong>in</strong>g: $9.0<br />

million<br />

Vision Iowa<br />

Grant: $21.8<br />

million