Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

- TAGS

- coeur

- media.spokesman.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

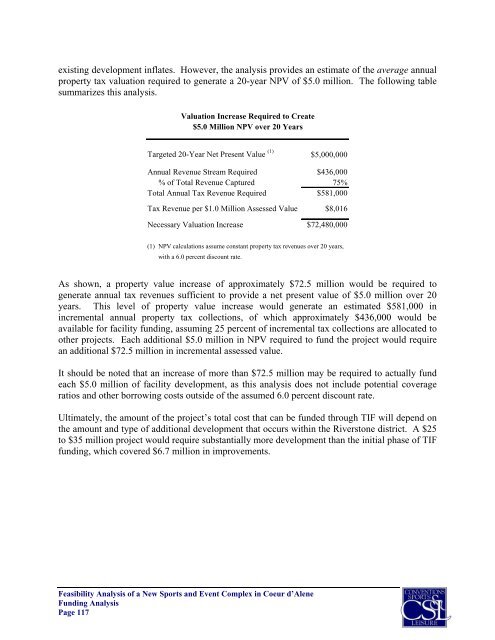

exist<strong>in</strong>g development <strong>in</strong>flates. However, the analysis provides an estimate of the average annual<br />

property tax valuation required to generate a 20-year NPV of $5.0 million. The follow<strong>in</strong>g table<br />

summarizes this analysis.<br />

Valuation Increase Required to Create<br />

$5.0 Million NPV over 20 Years<br />

Targeted 20-Year Net Present Value (1)<br />

As shown, a property value <strong>in</strong>crease of approximately $72.5 million would be required to<br />

generate annual tax revenues sufficient to provide a net present value of $5.0 million over 20<br />

years. This level of property value <strong>in</strong>crease would generate an estimated $581,000 <strong>in</strong><br />

<strong>in</strong>cremental annual property tax collections, of which approximately $436,000 would be<br />

available for facility fund<strong>in</strong>g, assum<strong>in</strong>g 25 percent of <strong>in</strong>cremental tax collections are allocated to<br />

other projects. Each additional $5.0 million <strong>in</strong> NPV required to fund the project would require<br />

an additional $72.5 million <strong>in</strong> <strong>in</strong>cremental assessed value.<br />

It should be noted that an <strong>in</strong>crease of more than $72.5 million may be required to actually fund<br />

each $5.0 million of facility development, as this analysis does not <strong>in</strong>clude potential coverage<br />

ratios <strong>and</strong> other borrow<strong>in</strong>g costs outside of the assumed 6.0 percent discount rate.<br />

Ultimately, the amount of the project’s total cost that can be funded through TIF will depend on<br />

the amount <strong>and</strong> type of additional development that occurs with<strong>in</strong> the Riverstone district. A $25<br />

to $35 million project would require substantially more development than the <strong>in</strong>itial phase of TIF<br />

fund<strong>in</strong>g, which covered $6.7 million <strong>in</strong> improvements.<br />

Feasibility Analysis of a New <strong>Sports</strong> <strong>and</strong> <strong>Event</strong> <strong>Complex</strong> <strong>in</strong> <strong>Coeur</strong> d’Alene<br />

Fund<strong>in</strong>g Analysis<br />

Page 117<br />

$5,000,000<br />

Annual Revenue Stream Required $436,000<br />

% of Total Revenue Captured 75%<br />

Total Annual Tax Revenue Required $581,000<br />

Tax Revenue per $1.0 Million Assessed Value $8,016<br />

Necessary Valuation Increase $72,480,000<br />

(1) NPV calculations assume constant property tax revenues over 20 years,<br />

with a 6.0 percent discount rate.