Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

- TAGS

- coeur

- media.spokesman.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Hotel/Motel Tax<br />

As discussed previously, hotel taxes <strong>in</strong> <strong>Coeur</strong> d’Alene are limited to a two percent tax assessed<br />

<strong>by</strong> the State. It is possible that additional hotel taxes could be implemented through the<br />

formation of an Auditorium District <strong>and</strong>/or an <strong>in</strong>crease to the State’s population thresholds<br />

regard<strong>in</strong>g Resort City Tax eligibility. While these options may entail political <strong>and</strong>/or legislative<br />

challenges, it is useful to underst<strong>and</strong> the fund<strong>in</strong>g potential of a hotel tax should one be<br />

implemented <strong>in</strong> the future.<br />

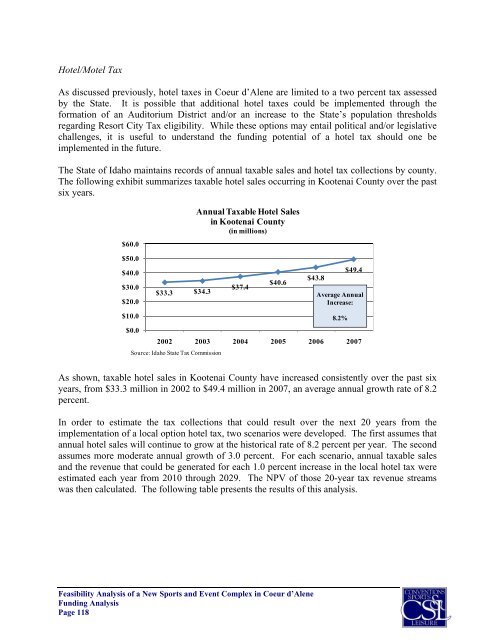

The State of Idaho ma<strong>in</strong>ta<strong>in</strong>s records of annual taxable sales <strong>and</strong> hotel tax collections <strong>by</strong> county.<br />

The follow<strong>in</strong>g exhibit summarizes taxable hotel sales occurr<strong>in</strong>g <strong>in</strong> Kootenai County over the past<br />

six years.<br />

$60.0<br />

$50.0<br />

$40.0<br />

$30.0<br />

$20.0<br />

$10.0<br />

$0.0<br />

$33.3<br />

Annual Taxable Hotel Sales<br />

<strong>in</strong> Kootenai County<br />

(<strong>in</strong> millions)<br />

$34.3<br />

$37.4<br />

As shown, taxable hotel sales <strong>in</strong> Kootenai County have <strong>in</strong>creased consistently over the past six<br />

years, from $33.3 million <strong>in</strong> 2002 to $49.4 million <strong>in</strong> 2007, an average annual growth rate of 8.2<br />

percent.<br />

In order to estimate the tax collections that could result over the next 20 years from the<br />

implementation of a local option hotel tax, two scenarios were developed. The first assumes that<br />

annual hotel sales will cont<strong>in</strong>ue to grow at the historical rate of 8.2 percent per year. The second<br />

assumes more moderate annual growth of 3.0 percent. For each scenario, annual taxable sales<br />

<strong>and</strong> the revenue that could be generated for each 1.0 percent <strong>in</strong>crease <strong>in</strong> the local hotel tax were<br />

estimated each year from 2010 through 2029. The NPV of those 20-year tax revenue streams<br />

was then calculated. The follow<strong>in</strong>g table presents the results of this analysis.<br />

$40.6<br />

Feasibility Analysis of a New <strong>Sports</strong> <strong>and</strong> <strong>Event</strong> <strong>Complex</strong> <strong>in</strong> <strong>Coeur</strong> d’Alene<br />

Fund<strong>in</strong>g Analysis<br />

Page 118<br />

$43.8<br />

$49.4<br />

Average Annual<br />

Increase:<br />

8.2%<br />

2002 2003 2004 2005 2006 2007<br />

Source: Idaho State Tax Commission