Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

- TAGS

- coeur

- media.spokesman.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Estimated Fund<strong>in</strong>g Supported Per 1% Increase<br />

<strong>in</strong> Local Hotel Tax Rate:<br />

Scenario 1: 8.2% Annual Scenario 2: 3.0% Annual<br />

Revenue Growth Revenue Growth<br />

Estimated Revenue Estimated Revenue<br />

Taxable From 1% Taxable From 1%<br />

Sales (1) Tax Increase Sales (1) Tax Increase<br />

2008 $53,456,000 $50,888,000<br />

2009 57,839,000 52,414,000<br />

2010 62,581,000 $626,000 53,987,000 $540,000<br />

2011 67,712,000 677,000 55,606,000 556,000<br />

2012 73,264,000 733,000 57,275,000 573,000<br />

2013 79,270,000 793,000 58,993,000 590,000<br />

2014 85,770,000 858,000 60,763,000 608,000<br />

2015 92,802,000 928,000 62,586,000 626,000<br />

2016 100,410,000 1,004,000 64,463,000 645,000<br />

2017 108,643,000 1,086,000 66,397,000 664,000<br />

2018 117,550,000 1,176,000 68,389,000 684,000<br />

2019 127,188,000 1,272,000 70,441,000 704,000<br />

2020 137,616,000 1,376,000 72,554,000 726,000<br />

2021 148,898,000 1,489,000 74,730,000 747,000<br />

2022 161,106,000 1,611,000 76,972,000 770,000<br />

2023 174,315,000 1,743,000 79,281,000 793,000<br />

2024 188,607,000 1,886,000 81,660,000 817,000<br />

2025 204,070,000 2,041,000 84,110,000 841,000<br />

2026 220,802,000 2,208,000 86,633,000 866,000<br />

2027 238,905,000 2,389,000 89,232,000 892,000<br />

2028 258,492,000 2,585,000 91,909,000 919,000<br />

2029 279,685,000 2,797,000 94,666,000 947,000<br />

NPV: 2010 - 2029 (2)<br />

$14,452,000 $7,862,000<br />

(1) Based on actual 2007 sales, <strong>in</strong>flated <strong>by</strong> 8.2 or 3.0 percent<br />

(2) Assumes 6.0 percent discount rate<br />

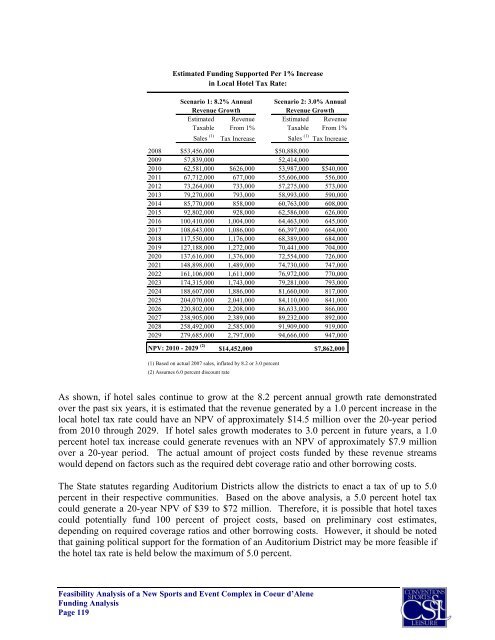

As shown, if hotel sales cont<strong>in</strong>ue to grow at the 8.2 percent annual growth rate demonstrated<br />

over the past six years, it is estimated that the revenue generated <strong>by</strong> a 1.0 percent <strong>in</strong>crease <strong>in</strong> the<br />

local hotel tax rate could have an NPV of approximately $14.5 million over the 20-year period<br />

from 2010 through 2029. If hotel sales growth moderates to 3.0 percent <strong>in</strong> future years, a 1.0<br />

percent hotel tax <strong>in</strong>crease could generate revenues with an NPV of approximately $7.9 million<br />

over a 20-year period. The actual amount of project costs funded <strong>by</strong> these revenue streams<br />

would depend on factors such as the required debt coverage ratio <strong>and</strong> other borrow<strong>in</strong>g costs.<br />

The State statutes regard<strong>in</strong>g Auditorium Districts allow the districts to enact a tax of up to 5.0<br />

percent <strong>in</strong> their respective communities. Based on the above analysis, a 5.0 percent hotel tax<br />

could generate a 20-year NPV of $39 to $72 million. Therefore, it is possible that hotel taxes<br />

could potentially fund 100 percent of project costs, based on prelim<strong>in</strong>ary cost estimates,<br />

depend<strong>in</strong>g on required coverage ratios <strong>and</strong> other borrow<strong>in</strong>g costs. However, it should be noted<br />

that ga<strong>in</strong><strong>in</strong>g political support for the formation of an Auditorium District may be more feasible if<br />

the hotel tax rate is held below the maximum of 5.0 percent.<br />

Feasibility Analysis of a New <strong>Sports</strong> <strong>and</strong> <strong>Event</strong> <strong>Complex</strong> <strong>in</strong> <strong>Coeur</strong> d’Alene<br />

Fund<strong>in</strong>g Analysis<br />

Page 119