Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

Presented by: Proposed Sports and Event Complex in Coeur d ...

- TAGS

- coeur

- media.spokesman.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TIF<br />

The proposed event facility site is located with<strong>in</strong> the Urban Improvement District that was<br />

established for the use of TIF funds for the <strong>in</strong>itial phase of Riverstone development. Therefore,<br />

the project could capture TIF funds without establish<strong>in</strong>g a new district or modify<strong>in</strong>g the exist<strong>in</strong>g<br />

district.<br />

In the past, TIF projects <strong>in</strong> Idaho were not able to capture the portion of property taxes that<br />

would have been allocated to the local school district. However, recent legislative changes<br />

removed that restriction, allow<strong>in</strong>g TIF projects to capture all <strong>in</strong>cremental property taxes. As<br />

noted previously, the project would be eligible to leverage 100 percent of <strong>in</strong>cremental property<br />

taxes generated <strong>by</strong> development with<strong>in</strong> the District. However, based on the structure of the TIF<br />

used to fund the <strong>in</strong>itial phase of Riverstone development, it is assumed that 75 percent of<br />

<strong>in</strong>cremental tax collections would be dedicated to the proposed facility project, with the<br />

rema<strong>in</strong><strong>in</strong>g 25 percent allocated to other projects <strong>in</strong> the community.<br />

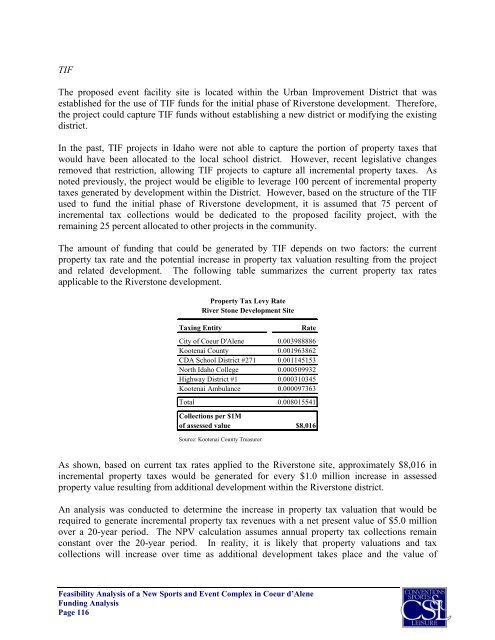

The amount of fund<strong>in</strong>g that could be generated <strong>by</strong> TIF depends on two factors: the current<br />

property tax rate <strong>and</strong> the potential <strong>in</strong>crease <strong>in</strong> property tax valuation result<strong>in</strong>g from the project<br />

<strong>and</strong> related development. The follow<strong>in</strong>g table summarizes the current property tax rates<br />

applicable to the Riverstone development.<br />

Property Tax Levy Rate<br />

River Stone Development Site<br />

Tax<strong>in</strong>g Entity Rate<br />

City of <strong>Coeur</strong> D'Alene 0.003988886<br />

Kootenai County 0.001963862<br />

CDA School District #271 0.001145153<br />

North Idaho College 0.000509932<br />

Highway District #1 0.000310345<br />

Kootenai Ambulance 0.000097363<br />

Total 0.008015541<br />

Collections per $1M<br />

of assessed value $8,016<br />

Source: Kootenai County Treasurer<br />

As shown, based on current tax rates applied to the Riverstone site, approximately $8,016 <strong>in</strong><br />

<strong>in</strong>cremental property taxes would be generated for every $1.0 million <strong>in</strong>crease <strong>in</strong> assessed<br />

property value result<strong>in</strong>g from additional development with<strong>in</strong> the Riverstone district.<br />

An analysis was conducted to determ<strong>in</strong>e the <strong>in</strong>crease <strong>in</strong> property tax valuation that would be<br />

required to generate <strong>in</strong>cremental property tax revenues with a net present value of $5.0 million<br />

over a 20-year period. The NPV calculation assumes annual property tax collections rema<strong>in</strong><br />

constant over the 20-year period. In reality, it is likely that property valuations <strong>and</strong> tax<br />

collections will <strong>in</strong>crease over time as additional development takes place <strong>and</strong> the value of<br />

Feasibility Analysis of a New <strong>Sports</strong> <strong>and</strong> <strong>Event</strong> <strong>Complex</strong> <strong>in</strong> <strong>Coeur</strong> d’Alene<br />

Fund<strong>in</strong>g Analysis<br />

Page 116