sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

May 21, 2007. Premium<br />

Amount Rs.<br />

6,760.66<br />

Restrictive Covenants<br />

Pursuant to our Secured Loans<br />

119<br />

<strong>and</strong> personal accident<br />

cover. Car Insured-<br />

Mahindra Bolero.<br />

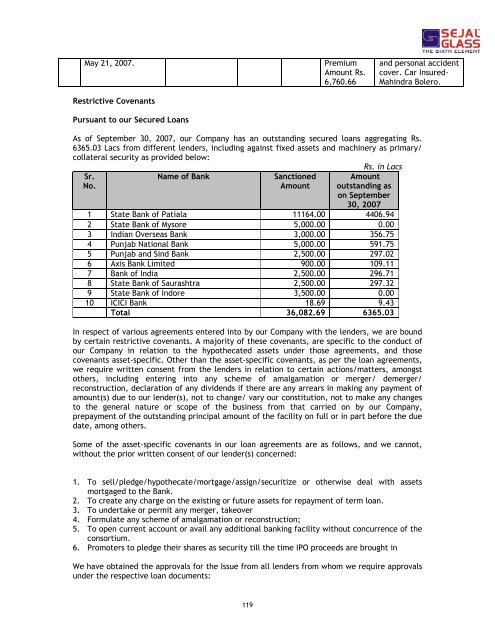

As <strong>of</strong> September 30, 2007, our Company has an outst<strong>and</strong>ing secured loans aggregating Rs.<br />

6365.03 Lacs from different lenders, including against fixed assets <strong>and</strong> machinery as primary/<br />

collateral security as provided below:<br />

Sr.<br />

No.<br />

Name <strong>of</strong> Bank Sanctioned<br />

Amount<br />

Rs. in Lacs<br />

Amount<br />

outst<strong>and</strong>ing as<br />

on September<br />

30, 2007<br />

1 State Bank <strong>of</strong> Patiala 11164.00 4406.94<br />

2 State Bank <strong>of</strong> Mysore 5,000.00 0.00<br />

3 Indian Overseas Bank 3,000.00 356.75<br />

4 Punjab National Bank 5,000.00 591.75<br />

5 Punjab <strong>and</strong> Sind Bank 2,500.00 297.02<br />

6 Axis Bank Limited 900.00 109.11<br />

7 Bank <strong>of</strong> India 2,500.00 296.71<br />

8 State Bank <strong>of</strong> Saurashtra 2,500.00 297.32<br />

9 State Bank <strong>of</strong> Indore 3,500.00 0.00<br />

10 ICICI Bank 18.69 9.43<br />

Total 36,082.69 6365.03<br />

In respect <strong>of</strong> various agreements entered into by our Company with the lenders, we are bound<br />

by certain restrictive covenants. A majority <strong>of</strong> these covenants, are specific to the conduct <strong>of</strong><br />

our Company in relation to the hypothecated assets under those agreements, <strong>and</strong> those<br />

covenants asset-specific. Other than the asset-specific covenants, as per the loan agreements,<br />

we require written consent from the lenders in relation to certain actions/matters, amongst<br />

others, including entering into any scheme <strong>of</strong> amalgamation or merger/ demerger/<br />

reconstruction, declaration <strong>of</strong> any dividends if there are any arrears in making any payment <strong>of</strong><br />

amount(s) due to our lender(s), not to change/ vary our constitution, not to make any changes<br />

to the general nature or scope <strong>of</strong> the business from that carried on by our Company,<br />

prepayment <strong>of</strong> the outst<strong>and</strong>ing principal amount <strong>of</strong> the facility on full or in part before the due<br />

date, among others.<br />

Some <strong>of</strong> the asset-specific covenants in our loan agreements are as follows, <strong>and</strong> we cannot,<br />

without the prior written consent <strong>of</strong> our lender(s) concerned:<br />

1. To sell/pledge/hypothecate/mortgage/assign/securitize or otherwise deal with assets<br />

mortgaged to the Bank.<br />

2. To create any charge on the existing or future assets for repayment <strong>of</strong> term loan.<br />

3. To undertake or permit any merger, takeover<br />

4. Formulate any scheme <strong>of</strong> amalgamation or reconstruction;<br />

5. To open current account or avail any additional banking facility without concurrence <strong>of</strong> the<br />

consortium.<br />

6. Promoters to pledge their shares as security till the time IPO proceeds are brought in<br />

We have obtained the approvals for the Issue from all lenders from whom we require approvals<br />

under the respective loan documents: