- Page 1 and 2:

Draft Red Herring Prospectus Decemb

- Page 3 and 4:

SECTION I DEFINITIONS AND ABBREVIAT

- Page 5 and 6:

Term Description Designated Date Th

- Page 7 and 8:

Term Description Bhandup ( West), M

- Page 9 and 10:

IPO Initial Public Offer ISO Intern

- Page 11 and 12:

FORWARD-LOOKING STATEMENTS This Dra

- Page 13 and 14:

the tax on the additional income of

- Page 15 and 16:

Risk relating to the project 6. The

- Page 17 and 18:

amount(s) due to our lender(s), not

- Page 19 and 20:

utilized portion of the licence. Ad

- Page 21 and 22:

protect us from entire liability fo

- Page 23 and 24:

6. Terrorist attacks and other acts

- Page 25 and 26:

12. Investors are advised to go thr

- Page 27 and 28:

The Indian Architectural float glas

- Page 29 and 30:

BRIEF DETAILS OF THE ISSUE Equity S

- Page 31 and 32:

Share Application Money 2563.61 296

- Page 33 and 34:

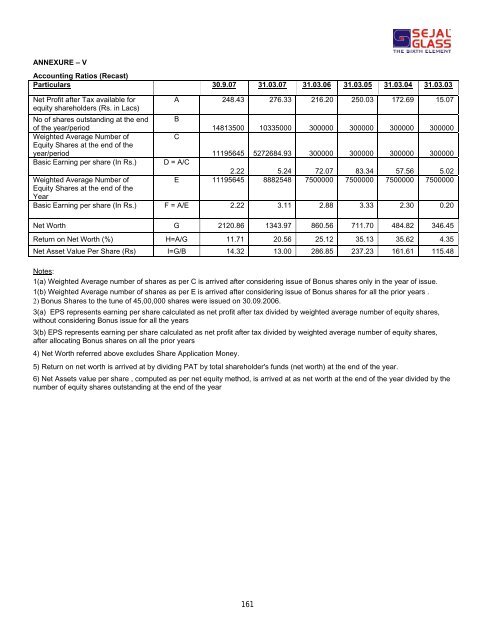

D Net Profit after Tax but before E

- Page 35 and 36:

Issue Management Team Book Running

- Page 37 and 38:

Bank of India Banking Branch M.D.I.

- Page 39 and 40:

Pursuant to recent amendments to th

- Page 41 and 42:

Name and Address of the Underwriter

- Page 43 and 44:

5 Subdivision of Equity shares of R

- Page 45 and 46:

Mr. Mitesh K. Gada* Mr. Shantilal S

- Page 47 and 48:

Capital would be locked-in for a pe

- Page 49 and 50:

Friends, Relatives and Others 36,74

- Page 51 and 52:

3. August 30, 2007 Mr. Nilesh S. Bh

- Page 53 and 54:

Vinod Velji Shah HUF jointly with M

- Page 55 and 56:

9. November 22, 2007 Ms. Diwaliben

- Page 57 and 58:

5 Mr. Kanji V. Gada 6,16,250 3.37 6

- Page 59 and 60:

SECTION V- OBJECTS OF THE ISSUE OBJ

- Page 61 and 62:

a. Plant & Machinery - Imported i.

- Page 63 and 64:

Work-in-progress 0.43 months 430.00

- Page 65 and 66:

We propose to raise Rs. [•] Lacs

- Page 67 and 68:

Authority for the issue The Issue h

- Page 69 and 70:

BASIS FOR ISSUE PRICE The issue pri

- Page 71 and 72:

ii. Lowest - Haldyn Glass Gujarat 5

- Page 73 and 74:

Benefits available to the Company u

- Page 75 and 76:

8. In case of a shareholder being a

- Page 77 and 78:

Benefits available to other Non-Res

- Page 79 and 80:

Benefits available to Mutual Funds

- Page 81 and 82:

Source: Central Statistical Organis

- Page 83 and 84:

� Fused silica glass - Fused sili

- Page 85 and 86:

The Total Float Glass Manufactured

- Page 87 and 88:

increasing demand for hotels/resort

- Page 89 and 90:

• Hygenic - Glass is a non-porous

- Page 91 and 92:

2. High productive and reliable pro

- Page 93 and 94:

We view geographical expansion of o

- Page 95 and 96:

Features 93 Toughened Glass is appr

- Page 97 and 98:

The excellent dampening property of

- Page 99 and 100:

Brief description of the Processes

- Page 101 and 102:

c) Lamination Process Process First

- Page 103 and 104:

101

- Page 105 and 106:

As the batch materials melt into so

- Page 107 and 108:

Apollo Hospital Dhaka, Bangladesh B

- Page 109 and 110:

Availability of Nitrogen and Hydrog

- Page 111 and 112: With the knowledge and experience o

- Page 113 and 114: Further our company proposes to imp

- Page 115 and 116: Sr. No Name of the trademark regist

- Page 117 and 118: 7. Sale deed dated July 14, 2004 be

- Page 119 and 120: 3. Standard fire and Special perils

- Page 121 and 122: May 21, 2007. Premium Amount Rs. 6,

- Page 123 and 124: KEY INDUSTRY REGULATIONS AND POLICI

- Page 125 and 126: Changes in the Registered Office of

- Page 127 and 128: 2. Non-Compete Agreement between ou

- Page 129 and 130: Sr. No. Name, Age, Designation, Fat

- Page 131 and 132: Sr. No. Name, Age, Designation, Fat

- Page 133 and 134: Compensation to Managing Director/W

- Page 135 and 136: Mr. Mitesh K. Gada, Whole-Time Dire

- Page 137 and 138: Leave travel concession for self an

- Page 139 and 140: emuneration payable to the said Dir

- Page 141 and 142: • To look into the reasons for su

- Page 143 and 144: extent of remuneration and/or reimb

- Page 145 and 146: ORGANISATION CHART OF OUR COMPANY 1

- Page 147 and 148: Sr. No Name, Age and Designatio n S

- Page 149 and 150: OUR PROMOTER AND THEIR BACKGROUND T

- Page 151 and 152: MR. SHANTILAL S. GADA Identificatio

- Page 153 and 154: CURRENCY OF PRESENTATION All refere

- Page 155 and 156: 1 st December, 2007 The Board of Di

- Page 157 and 158: STATEMENT OF ASSETS AND LIABILITIES

- Page 159 and 160: NOTES TO RESTATED PROFIT AND LOSS A

- Page 161: the provision for deferred tax, tim

- Page 165 and 166: LOANS AND ADVANCES (UNSECURED, CONS

- Page 167 and 168: Annexure XII (Rs. in lacs) Details

- Page 169 and 170: f Bank of India g Axis Bank 4 Vehic

- Page 171 and 172: ANNEXURE - XIV RELATED PARTY TRANSA

- Page 173 and 174: Travelling Expenses Insurance Premi

- Page 175 and 176: Unsecured Loan received/refund Unse

- Page 177 and 178: FDR refunded 2.50 Interest paid on

- Page 179 and 180: 17 Kanji Gada FDR received FDR refu

- Page 181 and 182: 26 Shantilal Gada Interest paid on

- Page 183 and 184: CAPITALIZATION STATEMENT ANNEXURE X

- Page 185 and 186: 1. The company has generally been r

- Page 187 and 188: FINANCIAL INFORMATION OF GROUP COMP

- Page 189 and 190: 2. Sejal International Limited Seja

- Page 191 and 192: Shareholding Pattern: The Sharehold

- Page 193 and 194: 27 Mr. Hasmukh B. Shah 5000 0.09 28

- Page 195 and 196: 5. Sejal Finance Limited. Sejal Fin

- Page 197 and 198: 2. Mitesh Textiles Mitesh Textiles

- Page 199 and 200: Companies with which the Promoters

- Page 201 and 202: FACTORS AFFECTING OUR RESULTS OF OP

- Page 203 and 204: % to Turnover 65.72% 69.06% 63.03%

- Page 205 and 206: Fiscal 2005 Vs 2006 Income Income f

- Page 207 and 208: Related Party Transactions For deta

- Page 209 and 210: SECTION VIII - LEGAL AND REGULATORY

- Page 211 and 212: A complaint bearing Complaint No. 6

- Page 213 and 214:

Sejal Glass House has not filed any

- Page 215 and 216:

STATUTORY APPROVALS AND LICENSES Ex

- Page 217 and 218:

6. Occupancy Certificate bearing no

- Page 219 and 220:

Sr. No. Details License No. 1. EPCG

- Page 221 and 222:

4. Application bearing no. 1371940

- Page 223 and 224:

OR (b)(ii) There shall be compulsor

- Page 225 and 226:

FROM ALL THE STOCK EXCHANGES MENTIO

- Page 227 and 228:

Further, each Bidder where required

- Page 229 and 230:

Expert Opinion Except as stated oth

- Page 231 and 232:

This being an initial public offeri

- Page 233 and 234:

Principal Terms and Conditions of t

- Page 235 and 236:

� to register himself or herself

- Page 237 and 238:

ISSUE STRUCTURE This Issue is being

- Page 239 and 240:

In case the Bid-Cum-Application For

- Page 241 and 242:

2. Hindu Undivided Families or HUFs

- Page 243 and 244:

please refer the section titled “

- Page 245 and 246:

published in two national newspaper

- Page 247 and 248:

Escrow Collection Banks shall trans

- Page 249 and 250:

Build Up of the Book and Revision o

- Page 251 and 252:

(j) In terms of SEBI Guidelines, QI

- Page 253 and 254:

c) Ensure that the details about De

- Page 255 and 256:

IT IS MANDATORY FOR ALL THE BIDDERS

- Page 257 and 258:

1. On the Bid-cum-Application Form

- Page 259 and 260:

Submission of Bid-cum-Application F

- Page 261 and 262:

Grounds for Technical Rejections Bi

- Page 263 and 264:

) The Bidder must necessarily fill

- Page 265 and 266:

Save and except refunds effected th

- Page 267 and 268:

(iii) Under-subscription below 5% o

- Page 269 and 270:

if any, for encashing such cheques,

- Page 271 and 272:

RESTRICTIONS ON FOREIGN OWNERSHIP O

- Page 273 and 274:

SECTION X- DESCRIPTION OF EQUITY SH

- Page 275 and 276:

MODIFICATION OF RIGHTS Title of Art

- Page 277 and 278:

Title of Article Article Number and

- Page 279 and 280:

Title of Article Article Number and

- Page 281 and 282:

Title of Article Article Number and

- Page 283 and 284:

Title of Article Article Number and

- Page 285 and 286:

TRANSFER AND TRANSMISSION OF SHARES

- Page 287 and 288:

Title of Article Article Number and

- Page 289 and 290:

Title of Article Article Number and

- Page 291 and 292:

Title of Article Article Number and

- Page 293 and 294:

Title of Article Article Number and

- Page 295 and 296:

Title of Article Article Number and

- Page 297 and 298:

Title of Article Article Number and

- Page 299 and 300:

Title of Article Article Number and

- Page 301 and 302:

Title of Article Article Number and

- Page 303 and 304:

Title of Article Article Number and

- Page 305 and 306:

SECTION XI -OTHER INFORMATION MATER

- Page 307:

23. SEBI observation letter no. [