sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

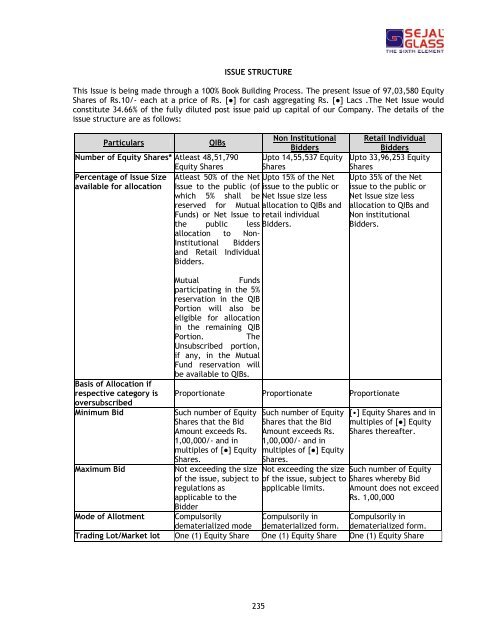

ISSUE STRUCTURE<br />

This Issue is being made through a 100% Book Building Process. The present Issue <strong>of</strong> 97,03,580 Equity<br />

Shares <strong>of</strong> Rs.10/- each at a price <strong>of</strong> Rs. [●] for cash aggregating Rs. [●] Lacs .The Net Issue would<br />

constitute 34.66% <strong>of</strong> the fully diluted post issue paid up capital <strong>of</strong> our Company. The details <strong>of</strong> the<br />

issue structure are as follows:<br />

Particulars QIBs<br />

Non Institutional<br />

Bidders<br />

Retail Individual<br />

Bidders<br />

Number <strong>of</strong> Equity Shares* Atleast 48,51,790 Upto 14,55,537 Equity Upto 33,96,253 Equity<br />

Equity Shares Shares<br />

Shares<br />

Percentage <strong>of</strong> Issue Size Atleast 50% <strong>of</strong> the Net Upto 15% <strong>of</strong> the Net Upto 35% <strong>of</strong> the Net<br />

available for allocation Issue to the public (<strong>of</strong> issue to the public or issue to the public or<br />

which 5% shall be Net Issue size less Net Issue size less<br />

reserved for Mutual allocation to QIBs <strong>and</strong> allocation to QIBs <strong>and</strong><br />

Funds) or Net Issue to retail individual Non institutional<br />

the public less Bidders.<br />

Bidders.<br />

allocation to Non-<br />

Institutional Bidders<br />

<strong>and</strong> Retail Individual<br />

Bidders.<br />

Basis <strong>of</strong> Allocation if<br />

respective category is<br />

oversubscribed<br />

Minimum Bid<br />

Mutual Funds<br />

participating in the 5%<br />

reservation in the QIB<br />

Portion will also be<br />

eligible for allocation<br />

in the remaining QIB<br />

Portion. The<br />

Unsubscribed portion,<br />

if any, in the Mutual<br />

Fund reservation will<br />

be available to QIBs.<br />

Proportionate Proportionate Proportionate<br />

Such number <strong>of</strong> Equity<br />

Shares that the Bid<br />

Amount exceeds Rs.<br />

1,00,000/- <strong>and</strong> in<br />

multiples <strong>of</strong> [●] Equity<br />

Shares.<br />

235<br />

Such number <strong>of</strong> Equity<br />

Shares that the Bid<br />

Amount exceeds Rs.<br />

1,00,000/- <strong>and</strong> in<br />

multiples <strong>of</strong> [●] Equity<br />

Shares.<br />

[•] Equity Shares <strong>and</strong> in<br />

multiples <strong>of</strong> [●] Equity<br />

Shares thereafter.<br />

Maximum Bid<br />

Not exceeding the size Not exceeding the size Such number <strong>of</strong> Equity<br />

<strong>of</strong> the issue, subject to <strong>of</strong> the issue, subject to Shares whereby Bid<br />

regulations as applicable limits. Amount does not exceed<br />

applicable to the<br />

Bidder<br />

Rs. 1,00,000<br />

Mode <strong>of</strong> Allotment Compulsorily<br />

Compulsorily in Compulsorily in<br />

dematerialized mode dematerialized form. dematerialized form.<br />

Trading Lot/Market lot One (1) Equity Share One (1) Equity Share One (1) Equity Share