sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the provision for deferred tax, timing differences due to depreciation adjustment only<br />

have been considered.<br />

Foreign currency assets <strong>and</strong> liabilities have not been restated for the purpose <strong>of</strong> these<br />

interim financial statements as the respective adjustments are made only at the end <strong>of</strong><br />

the financial year.<br />

(2) Segment Information - Activity wise <strong>and</strong> Geography wise<br />

The management has identified that the company has activity wise Primary business segments<br />

I.e. Manufacturing Activity <strong>and</strong> Retail Trading activity. The Trading segment primarily has<br />

domestic revenue.<br />

(3) In the opinion <strong>of</strong> the <strong>Board</strong> the current assets, Loans <strong>and</strong> advances are approximately<br />

<strong>of</strong> the value stated <strong>and</strong> are realizable in the ordinary course <strong>of</strong> business <strong>and</strong> the provision for<br />

all known liabilities is adequately made.<br />

(4) All Insurance Claims, lodged by the Company are accounted for, unless the<br />

management is uncertain about the acceptability <strong>of</strong> the same by the insurance authorities.<br />

(5) A Survey U/S 133A <strong>of</strong> the Income Tax Act, 1961 was conducted in August 2007 at all the<br />

premises <strong>of</strong> the Company as well as all the group concerns at their respective locations. The<br />

Chairman Shri Amrut Gada declared an additional income <strong>of</strong> Rs.5.00 Crore to the Income Tax<br />

Authorities on account <strong>of</strong> all the group concerns. He has however, confirmed to the <strong>Board</strong> <strong>of</strong><br />

Directors that the declaration <strong>of</strong> income has been made in his personal capacity to buy peace<br />

<strong>of</strong> mind <strong>and</strong> that the resultant Income Tax Liability shall be borne by him in his individual<br />

capacity <strong>and</strong> that the company has no liability in this behalf. A letter to this effect has also<br />

been submitted to the Income Tax Department by him. The <strong>Board</strong> <strong>of</strong> Directors have taken due<br />

note <strong>of</strong> the above.<br />

(6) The previous year's figures have been regrouped <strong>and</strong> rearranged, wherever necessary.<br />

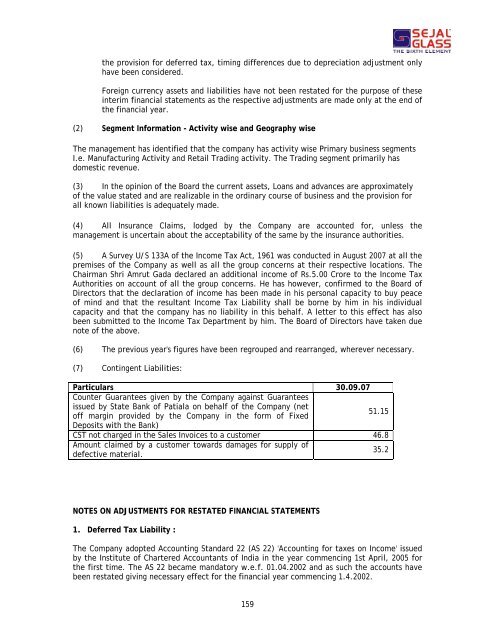

(7) Contingent Liabilities:<br />

Particulars 30.09.07<br />

Counter Guarantees given by the Company against Guarantees<br />

issued by State Bank <strong>of</strong> Patiala on behalf <strong>of</strong> the Company (net<br />

51.15<br />

<strong>of</strong>f margin provided by the Company in the form <strong>of</strong> Fixed<br />

Deposits with the Bank)<br />

CST not charged in the Sales Invoices to a customer 46.8<br />

Amount claimed by a customer towards damages for supply <strong>of</strong><br />

defective material.<br />

NOTES ON ADJUSTMENTS FOR RESTATED FINANCIAL STATEMENTS<br />

1. Deferred Tax Liability :<br />

The Company adopted Accounting St<strong>and</strong>ard 22 (AS 22) 'Accounting for taxes on Income' issued<br />

by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India in the year commencing 1st April, 2005 for<br />

the first time. The AS 22 became m<strong>and</strong>atory w.e.f. 01.04.2002 <strong>and</strong> as such the accounts have<br />

been restated giving necessary effect for the financial year commencing 1.4.2002.<br />

159<br />

35.2